PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636189

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636189

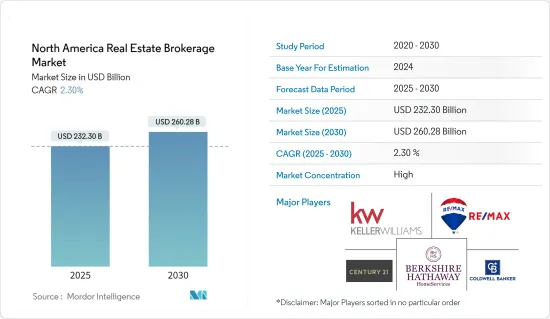

North America Real Estate Brokerage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Real Estate Brokerage Market size is estimated at USD 232.30 billion in 2025, and is expected to reach USD 260.28 billion by 2030, at a CAGR of 2.3% during the forecast period (2025-2030).

Key Highlights

- The North American real estate brokerage market is mainly driven by urbanization and the increasing demand for residential real estate.

- The region's expanding population is fueling the need for housing and infrastructure, propelling the real estate market. With the population on the rise, the demand for various infrastructures, including residential, commercial, and office spaces, is witnessing a notable surge.

- This surge presents a lucrative opportunity for real estate developers and investors. Understanding these demographic shifts empowers real estate stakeholders to make strategic decisions on investments, property types, and customized offerings to cater to the local demand. According to the Census Bureau, the US population is forecasted to peak at nearly 370 million by 2080 before gradually declining to around 366 million by 2100.

- The United States ranks as the world's third most populous nation, trailing only China and India, as per the Census Bureau's Population Clock. Indonesia and Pakistan complete the top five. Consequently, as urbanization intensifies, the brokerage market is poised for significant growth.

- In weaker multifamily markets, prices are anticipated to drop by up to 6%. However, with a significant reduction in new developments and the lengthy construction lead times, a robust recovery could materialize by late 2025. Industrial prices are likely to hold steady. Notably, new federal grants totaling USD 3.3 billion are catalyzing infrastructure enhancements, particularly in the Midwest, East Coast, and Gulf Coast states, bolstering the industrial and logistics sectors.

- Office prices are on the brink of stabilizing, even though a 7-10% decline is projected for 2024. Following this, it is anticipated that there will be a notable performance divergence between prime and secondary assets. While the retail sector is witnessing a scarcity in strip retail supply, which is fostering optimism, concerns loom over declining savings and escalating credit card debt, potentially curbing consumer spending.

North America Real Estate Brokerage Market Trends

Industrial Rental Growth Faces Challenges Amidst Changing Dynamics

In 2023, the industrial rental growth trajectory was projected to face challenges due to the completion of several big-box properties. Smaller properties, typically under 100,000 square feet, were poised for heightened demand, with robust single-digit rental growth projections.

While the broader trend leans toward the favor of smaller industrial properties, there are notable exceptions, especially in select sub-markets with larger industrial offerings. Take, for instance, areas within a 15-minute drive of Port Houston. These locales have seen a surge in demand, thanks to the redirection of traffic from the West Coast to the East and Gulf Coasts. There are over 80 industrial properties exceeding 100,000 square feet in this vicinity, yet only one is currently available for lease. Moreover, the scarcity of immediately available space is poised to bolster the industrial development in Baytown, Texas, close to the terminal.

As the ground freight infrastructure receives a boost in support, markets with intermodal terminals are expected to witness a surge in demand. This is especially true for those strategically positioned along newly established freight rail lines and emerging trade corridors near land borders. Despite ongoing labor negotiations at ports along the East and Gulf Coasts, the broader trend of reshoring, moving away from China, is expected to find its optimal support through the East Coast ports.

US Home Prices Hit Record High Despite Rising Mortgage Rates

In April 2024, the S&P CoreLogic Case-Shiller Home Price Index revealed a 6.3% annual gain, slightly lower than March's 6.5% but still marking a new peak. While some experts speculate a potential Fed rate cut might boost the housing market, the actual timing and probability of such a move remain uncertain.

However, the story is different for new homes. As mortgage rates climbed, with some surpassing 7% in May, sales of newly constructed single-family homes in the United States suffered. Data from the US Census Bureau and HUD showed an 11.7% drop from April and a substantial 16.5% decline from 2022.

But there is a silver lining for buyers. The dip in sales has led to new home inventories reaching levels not seen since early 2008, giving buyers more leverage. Sellers of existing homes are responding by offering concessions, like covering closing costs and chipping in for repairs.

Moreover, for those considering new builds, the median price for a new home in May 2024 fell by USD 500 to USD 417,400, almost USD 2,000 below the median price of existing homes.

North America Real Estate Brokerage Industry Overview

The North American real estate brokerage market is vibrant, characterized by a diverse array of players vying for market dominance. Leading the pack are stalwarts such as Keller Williams Realty, RE/MAX, Coldwell Banker Real Estate, Berkshire Hathaway HomeServices, and Century 21 Real Estate. These industry giants predominantly function through extensive agent networks and office setups, catering to both residential and commercial property transactions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing Urbanization Driving the Market

- 4.2.1.2 Regulatory Environment Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Market Saturation Restraining the Market

- 4.2.2.2 Intrest Rate Fluctuations Restraining the Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Government Regulations, Trade Agreements, and Initiatives

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Residential

- 5.1.2 Non-Residential

- 5.2 By Service

- 5.2.1 Sales

- 5.2.2 Rental

- 5.3 By Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Keller Williams Realty

- 6.2.2 RE/MAX

- 6.2.3 Coldwell Banker Real Estate

- 6.2.4 Berkshire Hathaway HomeServices

- 6.2.5 Century 21 Real Estate

- 6.2.6 Sotheby's International Realty

- 6.2.7 ERA Real Estate

- 6.2.8 Corcoran Group

- 6.2.9 Compass

- 6.2.10 Douglas Elliman Real Estate*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX