Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636183

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636183

Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

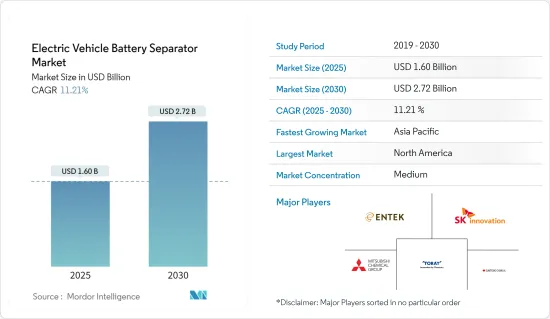

The Electric Vehicle Battery Separator Market size is estimated at USD 1.60 billion in 2025, and is expected to reach USD 2.72 billion by 2030, at a CAGR of 11.21% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the supply chain gap in battery materials created by the monopolies of some countries, such as ingredient shortages or distribution bottlenecks, is expected to restrain market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

- North America is expected to have significant growth in the market during the forecast period, with most of the demand coming from countries like the United States, Canada, etc.

Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment is Expected to Dominate the Market

- A battery separator, a porous membrane, plays a crucial role in lithium-ion batteries. It prevents electrical short circuits by isolating the cathode and anode, ensuring only lithium ions can pass through.

- In recent years, lithium-ion batteries have emerged as the most commonly used battery technology in electric vehicles. This is due to several advantages associated with them, such as high energy density, relatively long cycle life, and efficiency.

- According to the International Energy Agency, demand for EV batteries reached more than 750 GWh in 2023, up 40% relative to 2022. The majority of these batteries are lithium-ion technology. As lithium-ion battery application in electric vehicles increases, the demand for battery separators for lithium-ion battery technology is expected to increase simultaneously.

- Additionally, the decreasing price of lithium-ion batteries is expected to drive the use of this technology in electric vehicles, which, in turn, will boost the demand for the use of battery separators of lithium-ion technology. In 2023, the price of lithium-ion battery packs suffered a 14% drop compared to the previous year to USD139/kWh.

- Further, as research and development continue to develop more stable and efficient battery separators for electric vehicles, the demand for lithium-ion technology battery separators is expected to increase.

- For instance, in February 2024, Scientists at Incheon National University devised a method to enhance the stability and characteristics of lithium-ion battery separators. They achieve this by incorporating a layer of silicon dioxide along with other functional molecules. Such developments will improve the functionality of lithium-ion separators in electric vehicle applications.

- Thus, owing to the increasing demand for lithium-ion batteries and the technological development of battery separators used in electric vehicles, this segment is expected to have a major share of the market.

North America is Expected to Dominate the Market

- The North American electric vehicle market is majorly driven by the five major players, accounting for more than 70% of the market in 2023. These prominent players include Tesla, Toyota Group, Ford Group, Hyundai, and Honda. Tesla is the highest seller of electric vehicles in North American countries. As the demand for electric vehicles increases, the use of batteries in these vehicles will also increase, thereby driving the electric vehicle battery separator market.

- The demand for electric vehicles is increasing continuously in North America. According to the Energy Information Administration, the combined sales of hybrid vehicles, plug-in hybrid electric vehicles, and battery electric vehicles (BEV) in the United States rose to 16.3% of total new light-duty vehicle (LDV) sales in 2023, which was 12.9% in the previous year.

- Further, supportive government policies are also affecting the demand for electric vehicle batteries, thereby affecting the demand for the electric vehicle battery cathode market. Governments across North America have been rolling out policies and incentives to spur EV adoption. These initiatives encompass tax credits, grants, rebates, and investments in charging infrastructure. Such support has bolstered consumer interest in EVs, thereby driving the demand for battery separators.

- With the support of the government, electric vehicle manufacturers are investing in opening local factories for battery separators in the region, thereby easing the supply chain. For instance, in April 2024, Honda Motor Co. Ltd agreed with Asahi Kasei Corporation to produce battery separators for automotive batteries in Canada.

- Thus, owing to the growing number of electric vehicles and increasing local manufacturing of electric vehicle battery separators, the region is expected to dominate the market in the forecast period.

Electric Vehicle Battery Separator Industry Overview

The electric vehicle battery separator market is moderately fragmented. Some of the major players in the market (in no particular order) include Entek International, SK Innovation Co. Ltd, Mitsubishi Chemical Group Corporation, Toray Industries Inc., and Sumitomo Chemical Co. Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002592

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-acid

- 5.1.3 Other Battery Type

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 Qatar

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Entek International

- 6.3.2 SK Innovation Co. Ltd

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Hitachi Chemical Company Ltd

- 6.3.5 Toray Industries Inc.

- 6.3.6 Sumitomo Chemical Co. Ltd

- 6.3.7 UBE Corp

- 6.3.8 Teijin Ltd

- 6.3.9 Yunnan Enjie New Materials Co. Ltd

- 6.3.10 Cangzhou Mingzhu Plastic Co. Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Battery Chemistries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.