Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636180

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636180

Global Lithium-ion Battery Separator For Electric Vehicle Application - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

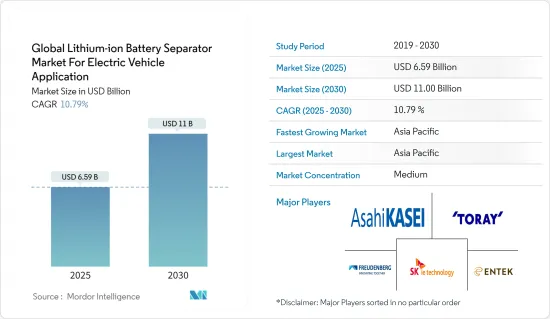

The Global Lithium-ion Battery Separator Market For Electric Vehicle Application Industry is expected to grow from USD 6.59 billion in 2025 to USD 11.00 billion by 2030, at a CAGR of 10.79% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising growth in electric vehicle sales and declining cost of lithium-ion batteries are expected to be among the most significant drivers for the global lithium-ion battery separator market for electric vehicle applications during the forecast period.

- On the other hand, there are complex supply chain constraints for manufacturing battery separators that pose a threat to the global lithium-ion battery separator market for electric vehicle applications during the forecast period.

- Nevertheless, continued efforts are being made to develop enhanced battery separator materials. This factor is expected to create several opportunities for the global lithium-ion battery separator market for electric vehicle applications in the future.

- The Asia-Pacific region is expected to witness significant growth and is likely to register the highest CAGR during the forecast period. This is due to the presence of a significant battery and associated equipment and materials manufacturing industry in the region.

Global Lithium-ion Battery Separator Market Trends

Polyethylene to Witness Growth

- Polyethylene (PE) has emerged as a dominant material for lithium-ion battery separators in electric vehicle applications. This is mainly due to its excellent chemical stability, mechanical strength, and ability to be manufactured into thin, porous membranes. The global market for Polyethylene separators in electric vehicle batteries has seen substantial growth in recent years, driven by the rapid expansion of the electric vehicle industry and increasing demand for high-performance, safe, and cost-effective energy storage solutions.

- Polyethylene separators, particularly those made from high-density polyethylene (HDPE) and ultra-high molecular weight polyethylene (UHMWPE), offer a compelling combination of properties that make them well-suited for use in the demanding environment of electric vehicle batteries. These materials provide good thermal stability, which is crucial for preventing thermal runaway in battery systems, while also offering excellent chemical resistance to the electrolytes and electrode materials used in lithium-ion cells.

- As global electric vehicle demand escalates, the demand for batteries in electric vehicle applications is set to surge, consequently boosting the need for polyethylene in battery separator materials. This increase is driven by the growing production of electric and hybrid vehicles, which require efficient and durable battery components. Additionally, advancements in battery technology are further propelling the demand for high-quality polyethylene separators.

- According to the International Energy Agency (IEA), electric vehicle sales have witnessed a significant surge in recent years owing to the growing awareness of adopting sustainable transportation solutions amongst the public and various financial incentives offered by regional governments to meet their decarbonization targets. Between 2023 and 2022, electric vehicle sales witnessed an uptick of 30.13%, whereas the annual average growth rate between 2019 and 2023 was over 100%, signifying the growing traction for electric vehicles.

- In recent years, manufacturers have adopted the latest manufacturing techniques, developed new material compositions, and developed new material chemistries with other materials. These advancements have not only improved the functional properties of Polyethylene separators but have also contributed to reducing manufacturing costs, making them an increasingly attractive option for electric vehicle manufacturers looking to optimize battery performance while managing production expenses.

- For instance, in January 2024, Scientists at the Institute of Modern Physics (IMP) of the Chinese Academy of Sciences (CAS) and the Advanced Energy Science and Technology Guangdong Laboratory have developed high-temperature-resistant polyethylene terephthalate (PET) separators for lithium-ion batteries. The separator, a pivotal component of lithium-ion batteries, is instrumental in safeguarding battery safety. It not only insulates the cathode and anode to prevent short-circuiting but also facilitates the transport of lithium ions.

- Therefore, as per the points mentioned above, the polyethylene separator material is expected to witness growth during the forecast period.

Asia Pacific to Dominate the Market

- The Asia-Pacific region has emerged as the dominant force in the global lithium-ion battery separator market for electric vehicle applications, with its influence extending far beyond its geographical boundaries. This dominance is rooted in a variety of factors, including the region's robust manufacturing capabilities, significant government support, extensive research and development initiatives, and the presence of major players across the entire electric vehicle supply chain.

- Countries like China, Japan, South Korea, and, to a growing extent, India have positioned themselves at the forefront of this rapidly evolving industry, leveraging their existing strengths in electronics, automotive manufacturing, and advanced materials to create a formidable ecosystem for battery separator production. The region's rapid growth in this market is not only a result of its manufacturing prowess but also stems from its strategic foresight in recognizing the pivotal role that electric vehicles will play in the future of global transportation.

- For instance, the International Energy Agency has witnessed significant growth in electric vehicle sales in recent years. Between 2022 and 2022, the growth in electric vehicle sales increased by more than 24%, whereas between 2019 and 2023, the annual average growth rate was close to 100%. This signifies the growing traction for electric vehicles, which in turn developed favorable market conditions for the lithium-ion battery separator market.

- This recognition has led to substantial investments in capacity expansion, technological innovation, and the development of a highly skilled workforce specializing in battery and separator technologies. This unique combination of factors has established the Asia-Pacific as the current leader in lithium-ion battery separator production for electric vehicles. Still, it has also positioned itself to maintain this leadership well into the future, even as other regions seek to develop their capabilities in this critical technology sector.

- For instance, in October 2023, Asahi Kasei is set to invest in new equipment to bolster its production capacity for Hipore lithium-ion battery (LIB) separators. The company plans to set up fresh coating lines at its current LIB separator plants in the United States, Japan, and South Korea. Operations are slated to commence in stages, starting in the first half of fiscal year 2026. This strategic move will enable Asahi Kasei to cater to the battery needs of approximately 1.7 million electric vehicles.

- Asahi Kasei's investment underscores its commitment to advancing battery technology and meeting the growing demand for electric vehicles. By enhancing its production capabilities, the company aims to strengthen its position in the global lithium-ion market. The new coating lines will incorporate state-of-the-art technology to ensure high-quality and efficient production processes. This expansion aligns with Asahi Kasei's long-term strategy to support the transition to sustainable energy solutions.

- Therefore, as mentioned above, the Asia-Pacific region is expected to dominate the market during the forecast period.

Global Lithium-ion Battery Separator Industry Overview

The global lithium-ion battery separator market for electric vehicle applications is semi-fragmented. Some of the key players in this market (in no particular order) are Asahi Kasei Corporation, Toray Battery Separator Film Co. Ltd, Freudenberg Performance Materials, SK ie Technology Corporation Ltd, and Entek International.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50002589

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Electric Vehicle Sales

- 4.5.1.2 Decreasing Lithium-ion Battery Price

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Polyethylene

- 5.1.2 Polypropylene

- 5.1.3 Composite

- 5.1.4 Other Materials

- 5.2 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Russia

- 5.2.2.8 Turkey

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 South Korea

- 5.2.3.6 Malaysia

- 5.2.3.7 Thailand

- 5.2.3.8 Indonesia

- 5.2.3.9 Vietnam

- 5.2.3.10 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 Nigeria

- 5.2.4.4 Egypt

- 5.2.4.5 Qatar

- 5.2.4.6 South Africa

- 5.2.4.7 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Colombia

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Asahi Kasei Corporation

- 6.3.2 Toray Battery Separator Film Co. Ltd

- 6.3.3 Freudenberg Performance Materials

- 6.3.4 SK ie Technology Corporation Ltd

- 6.3.5 Entek International

- 6.3.6 Sumitomo Chemical Co. Ltd

- 6.3.7 Ube Maxell Co. Ltd

- 6.3.8 W-Scope Corporation

- 6.3.9 Daramic

- 6.3.10 Amer SIL

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Enhanced Separator Materials

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.