PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636152

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636152

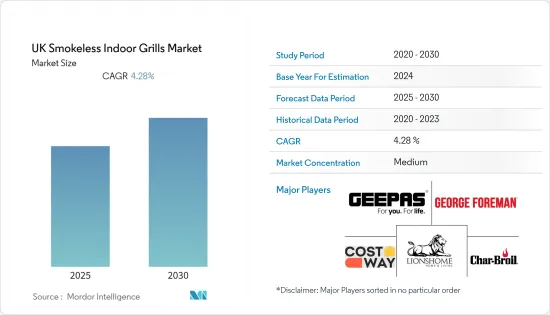

UK Smokeless Indoor Grills - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UK Smokeless Indoor Grills Market is expected to register a CAGR of 4.28% during the forecast period.

With the advent of COVID-19, the revenue of the grills market in the UK observed a significant rise as people were spending more time in their homes and engaging in cooking activities; during the same period, the price of the equipment observed an increase with disruption in the market. Electric smokeless grills, with their compact size, are more portable with their non-sticky surface, making them easy to clean. The Russia-Ukraine war had created a surge in energy prices in the UK, having its spillover effect on demand for grills with people searching for cost-efficient products in the market.

The use of gas and coal-based energy appliances causes indoor air pollution, risking the health of people employed in restaurants, cafes, and other commercial kitchens. To remove this issue, smokeless indoor grills emerge as an efficient option for hotel chains as well as domestic kitchens. With the market size expansion of the UK restaurant industry after the pandemic, demand for smokeless indoor grills is expected to increase.

UK Smokeless Indoor Grills Market Trends

Restaurant Industry And Domestic Kitchen Driving Demand

With the environmental concern, hotel and restaurant chains in the UK are making efforts towards reducing their carbon footprint. 97% of the charcoal used in UK barbecues is made from non-sustainable hardwood sources with an emission higher carbon footprint, making traditional rills a major source of emission. These concerns are leading to households and the restaurant industry adopting smokeless indoor grills equipped with infrared heating and air filtration systems.

The size of the restaurant industry in the UK has observed a significant increase over the years, and the overall BBQ & alfresco eating & entertaining market in the UK last year increased. With the increasing price of outside food, "Homegastronomy" is an emerging trend in the UK with the creation of restaurant-quality dishes at home leading to rising demand for tastes better cooked on the grill than the oven.

Rising Expenditure On Kitchen Appliance Driving The Market

The mean value of average disposable income per household has observed continuous growth over the last decade in the UK, rising to USD 49,274 last year and making people raise their domestic consumption expenditure. Market revenue of grills and roasters observed a sharp growth during the pandemic, rising to a value of more than 20 million USD during the period. With the rising price of meat in the country, the price/cost of barbeque in restaurants is observing a continuous rise, making it preferable for households to perform barbeque at home.

Smokeless indoor grills are more efficient to operate, with electricity being a cheaper and more reliable fuel, leading to a rising number of households in the UK adopting smokeless grills with an increasing expenditure. Electric barbeque is easy to install, and the grill can be made ready for use in a few seconds, making it perfect for use in an indoor kitchen.

UK Smokeless Indoor Grills Industry Overview

As the transition towards smokeless indoor grills is still at a slow rate, the market for these grills is fragmented in the UK. People still prefer to have the smoky flavor of coal-based grills in their barbeque meat. As the world is transitioning towards cleaner energy and raising awareness for health issues from the use of coal grills, smokeless indoor grill is expected to have positive growth over the coming years. With the features of temperature control and easy to switch on and off, smokeless grills are more favorable for indoor kitchens. A few of the players existing in the UK smokeless indoor grill market are Geepas, LionsHome, Cost Way, George Foreman, and Char-Broil.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Advancement of Smokeless Grilling, Infrared heating, others driving the market

- 4.2.2 Rising E-commerce driving sales of smokeless indoor grills

- 4.3 Market Restraints

- 4.3.1 Coal based grills having a significant share in the market

- 4.3.2 Rising price of electronic appliances with supply chain disruptions in market

- 4.4 Market Opportunities

- 4.4.1 Rising number of restaurants and household food preparation

- 4.4.2 Increase in Kitchen appliance expenditure with rising disposable Income

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in United Kingdom Smokeless Indoor Grill Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Indoor electric grill without smoke

- 5.1.2 Smokeless Infrared Indoor grill

- 5.1.3 Stovetop smokeless grill

- 5.1.4 Other Types

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Direct Sale

- 5.3.2 Hypermarket/Supermarket

- 5.3.3 Speciality Store

- 5.3.4 Online

- 5.3.5 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Geepas

- 6.2.2 LionsHome

- 6.2.3 CostWay

- 6.2.4 George Foreman

- 6.2.5 Char-Broil

- 6.2.6 Weber

- 6.2.7 Napoleon

- 6.2.8 Tepro

- 6.2.9 Cadac

- 6.2.10 BeefEater*

7 FUTURE MARKET TRENDS

8 DISCLAIMER AND ABOUT US