PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636140

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636140

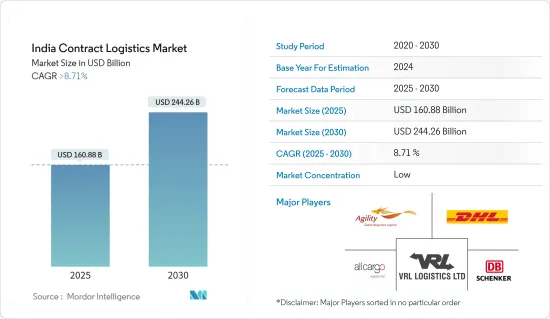

India Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Contract Logistics Market size is estimated at USD 160.88 billion in 2025, and is expected to reach USD 244.26 billion by 2030, at a CAGR of greater than 8.71% during the forecast period (2025-2030).

Key Highlights

- As the Indian economy continues its upward trajectory, the demand for contract logistics is witnessing a notable surge. E-commerce is reshaping the landscape, and as customers prioritize their core competencies, there's an increasing demand for tailored solutions and cost efficiency. This evolving landscape is pushing players to adapt beyond their traditional boundaries. Over the past decade, the Indian contract logistics scene has undergone significant transformations, primarily fueled by the nation's economic ascent. The allure of this burgeoning market has even drawn the attention of foreign players.

- For instance, in August 2023, CMA CGM's subsidiary, CEVA Logistics, made headlines by acquiring a 96 percent stake in Mumbai's Stellar Value Chain Solutions. This strategic move underscores the growing prominence of contract logistics, especially with omnichannel fulfillment services spanning diverse sectors such as e-commerce, automotive, food products, consumer goods, fashion, retail, healthcare, and pharmaceuticals. Stellar, now a pivotal player, boasts an expansive footprint with 7.7 million square feet of space distributed across over 70 facilities in 21 cities throughout India.

- Urbanization, economic development, and a burgeoning middle class have fueled domestic consumption in India. This surge spans everyday fast-moving consumer goods, personal automobiles, household essentials, and even luxury items, all propelling the growth of contract logistics within the retail sector.

- Moreover, e-commerce stands as a cornerstone in bolstering the country's contract logistics sector. Trends like the rise of mobile commerce, innovative payment methods, e-commerce's reach into rural territories, and the adoption of artificial intelligence and automation are reshaping online sales dynamics. These shifts not only bolster online sales but also amplify the growth of the contract logistics sector. Furthermore, cutting-edge interventions such as big data analytics, intelligent material handling equipment, and advanced tracking mobile apps are revolutionizing India's contract logistics landscape.

India Contract Logistics Market Trends

India's Insourced Logistics: Riding the Wave of E-Commerce and Digital Transformation

Driven by the surging demand for supply chain agility, digital innovation, and the e-commerce boom, India's insourced logistics sector is on the brink of significant expansion. While predominantly dominated by large corporations, mid-sized enterprises are making their foray into the sector, due to technology reducing traditional entry barriers. The e-commerce surge has prompted numerous businesses to cultivate in-house logistics capabilities, ensuring quicker deliveries and enhanced control over customer experiences. As the logistics sector evolves, it's responding to the burgeoning demand for services, largely spurred by the rapid advancements in e-commerce. Key drivers for India's e-commerce logistics market include increased internet penetration, the rise of last-mile delivery, a growing preference for online shopping-amplified by attractive discounts-and the broadening scope of online grocery logistics.

Forecasts suggest the Indian e-commerce industry will soar to USD 325 billion by 2030. In 2024, third-party logistics providers are set to handle around 17 billion shipments over the next seven years. With approximately 936.16 million internet subscribers in India, about 350 million are seasoned online users actively participating in transactions. In December 2023, Indian e-commerce titan Flipkart is gearing up to secure USD 1 billion in a fresh funding round, with its parent entity, Walmart, expected to infuse USD 600 million. Further bolstering this round, in May 2024, Google LLC is channeling USD 350 million into Flipkart. This funding, predominantly led by Walmart Inc.-Flipkart's majority stakeholder-aims to amplify Flipkart's operations and modernize its digital framework for a broader Indian customer base. Additionally, both entities are strategizing to enhance Flipkart's integration with Google's cloud platform.

As e-commerce garners global momentum, the role of contract logistics has become paramount for retailers. The emphasis on cohesive online and omnichannel strategies highlights the critical nature of contract logistics. By overseeing inventory management, packaging, transportation, reporting, forecasting, and warehousing, contract logistics plays a pivotal role in enhancing online order fulfillment for retailers.

Growth in the Manufacturing and Automotive Sector Driving the Contract Logistics Market

Fueled by the 'Make in India' initiative, the contract logistics market is witnessing robust growth, largely due to the rapid expansion of the manufacturing industry. Manufacturers are increasingly emphasizing core competencies, seeking cost efficiencies, and integrating advanced technologies into their supply chain activities.

Simultaneously, the manufacturing sector has pioneered the trend of outsourcing supply chain management. This shift is bolstered by the evolution of service providers into pivotal partners, delivering comprehensive solutions that encompass documentation, tracking, warehousing, and legal compliance. Furthermore, the automobile sector is amplifying the demand for multi-modal logistics.

On the other hand, In 2023-24, India saw a 3 percent rise in auto component imports, totaling USD 20.9 billion, up from USD 20.3 billion in 2022-23. Asia dominated the import landscape, contributing 66 percent, trailed by Europe at 26 percent and North America at 8 percent. Notably, imports from Asia experienced a 3 percent uptick. Major import categories encompassed engine components, body & chassis, suspension & braking, and drive transmission & steering. Thus, the growing automobile export imports are expected to drive contract logistics services across the country.

India Contract Logistics Industry Overview

The Contract Logistics market in India is fiercely competitive, fragmented in nature with the presence of many international and too many small domestic companies.

Key players in the contract logistics market are taking initiatives to gain maximum benefit from the opportunities in India. Some of the major players in the contract logistics market include Deutsche Post DHL, DB Schenker, Kuehne + Nagel International AG, Allcargo, among others. The contract logistics sector in India is on a constant growth curve. This growth has brought with it a new set of industry challenges, from running more efficient networks and expanding product and service portfolios to gaining control over unpredictable costs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Insights in Technological Trends

- 4.3 Brief on Government Regulations and Initiatives

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Insights on Freight Transportation Costs /Freight Rates

- 4.6 Insights on E-Commerce Industry in the Region (Domestic and Cross-Border)

- 4.7 Insights on Contract Logistics in the Context of After-Sales/Reverse Logistics

- 4.8 Insights on the impact of Implementation of GST in the Logistics Sector

- 4.9 Brief on Different Services Provided by Contract Logistics Players (Integrated Warehousing & Transportation, Supply Chain Services, and Other Value-Added Services)

- 4.10 Insights into Key Special Economic Zones (SEZS) and Manufacturing Hubs

- 4.11 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Marjet Drivers

- 5.1.1 Growth in Ecommerce

- 5.1.2 Government intiatives are boosting the market

- 5.2 Market Restriants

- 5.2.1 Skilled Labor Shortages

- 5.2.2 High Intiatial Investments

- 5.3 Market Oppurtunities

- 5.3.1 Technological Innovations

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Insourced

- 6.1.2 Outsourced

- 6.2 By End User

- 6.2.1 Manufacturing and Automotive

- 6.2.2 Consumer Goods & Retail

- 6.2.3 High - Tech

- 6.2.4 Healthcare and Pharmaceutical

- 6.2.5 Other End Users (Energy, Construction, Aerospace, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 International Players

- 7.2.1.1 Kuehne + Nagel Private Limited

- 7.2.1.2 Hellmann Worldwide Logistics India Private Limited

- 7.2.1.3 Agility Logistics

- 7.2.1.4 CH Robinson Worldwide Freight India Private Limited

- 7.2.1.5 DSV Panalpina

- 7.2.1.6 Nippon Express (India) Private Limited

- 7.2.1.7 FedEx Corporation

- 7.2.1.8 Expeditors International (India) Private Limited *

- 7.2.2 Domestic Players

- 7.2.2.1 All Cargo Logistics Limited

- 7.2.2.2 VRL Logistics Ltd

- 7.2.2.3 Adani Logistics Company

- 7.2.2.4 Aegis Logistics Ltd

- 7.2.2.5 Transport Corporation of India

- 7.2.2.6 Gati Litmited

- 7.2.2.7 Delhivery Private Limited

- 7.2.2.8 Future Supply Chain Solutions Ltd

- 7.2.2.9 TVS Supply Chain Solutions *

- 7.2.1 International Players

- 7.3 Other Companies (Mahindra Logistics, Safexpress Pvt Ltd, Snowman Logistics, GS Logistics, Nitco Logistics, Gateway Distriparks Limited*)

8 FUTURE OUTLOOK OF THE MARKET

9 APPENDIX

- 9.1 GDP Distribution, by Activity and Region

- 9.2 Insight into Capital Flows (investments by sector)

- 9.3 Insight into Key Export Destinations

- 9.4 Insight into Key Import Origin Countries