Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636129

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636129

Europe DC Distribution Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

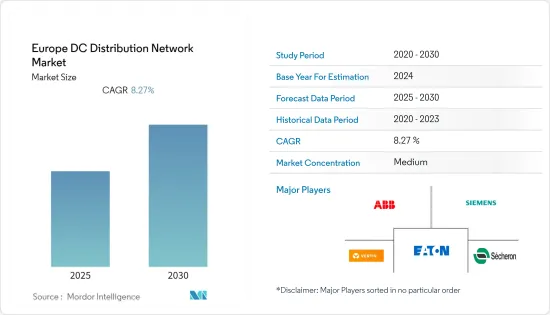

The Europe DC Distribution Network Market is expected to register a CAGR of 8.27% during the forecast period.

Key Highlights

- Over the long term, factors such as growth in the renewable energy sector and its compatibility with battery storage devices and advantages over AC distribution, like power sharing between systems with different frequencies, are expected to drive the market in Europe during the forecast period.

- On the flip side, high initial cost and a lot of complexity compared to generic distribution networks are the factors expected to hinder the growth of the market studied.

- The DC distribution network is considered an important element with regard to the future aspects of smart grids. Also, solar power is estimated to supply one-third of the world's energy demand by 2060, thereby proliferating the DC distribution market in the future, as solar energy generates a direct current.

- Germany is expected to witness significant demand in the European DC distribution network market during the forecast period.

Europe DC Distribution Network Market Trends

Low and Medium Voltage Segment to Dominate the Market

- Low and Medium Voltage DC distribution network (up to 750 Volt DC) operates on voltage levels that can be used directly utilized without any further voltage reduction. It is also known as low tension (LT) or secondary distribution networks. The low and Medium voltage distribution network carries electrical power from the distribution transformer to the consumer's energy meter.

- A typical low and medium-voltage distribution network requires several devices that distribute, convert voltages, and protect electrical circuits within the electrical system. The voltage level of low-voltage and medium-voltage distribution networks is typically equal to the primary voltage of electrical appliances. The LV distribution network is a 3-phase 4-wire distribution network.

- One of the primary end-user industries utilizing a low and medium DC distribution network is the electric vehicle (EV) charging infrastructure, as EVs only accept DC power, and the low and medium DC distribution network helps in bypassing the AC conversion process to DC altogether, the charge can go directly into the battery.

- The data center end user is expected to be one of the most rapidly expanding segments during the forecast period. Data centers are the primary component used in cloud storage applications, which are a critical component of the digitalized operations of every task, including smart grid and smart transportation. Compared to AC distribution networks, low and medium-voltage DC distribution networks are utilized in modern data centers to convert the AC power obtained from utilities into DC power. Compared to AC distribution networks, low and medium-voltage DC distribution networks are utilized in modern data centers to convert the AC power obtained from utilities into DC power and require less space and equipment installation.

- As of January 2022, Germany and the United Kingdom were the second and third largest market in terms of data centers (with 487 and 456 units), behind the United States. Furthermore, the United Kingdom is home to around 288 Colocation data centers, which is expected to witness significant growth in the future, creating substantial opportunities for DC distribution networks. France, the third largest data center country behind the United Kingdom and Germany, is also expected to offer significant market opportunities in the coming years. Therefore, the increasing adoption of big data and IoT technology across various industries has led to high regional data generation. Thus, the growing data centers will likely increase the low and medium DC distribution network during the forecast period.

- Therefore, based on the factors mentioned above, low and medium voltage segment is expected to dominate the North America DC distribution network market during the forecast period.

Germany to Witness Significant Growth

- Germany is one of the most prominent countries in terms of solar energy installed capacity in 2022. As of 2022, the country's solar energy installed capacity totaled 66.55 GW, i.e., an increase of about 12.28% compared to the previous year's value (59.27 GW).

- Germany, with a target of 98 GW of solar installed capacity and 85% of the electricity through renewable by 2050, is likely to see a significant development for the distributed power generation.

- In Germany, the public grid is available throughout the country, and access to the grid is regulated and generally not prohibitively expensive, so electricity microgrids without a connection to the main grid traditionally are not common in Germany. However, 'connected microgrids' are becoming more important owing to the ever-growing number of distributed generation plants.

- Furthermore, in Germany, there have been grid design tests where parts of the electricity grid can be isolated from the general grid and operated stand-alone, such as in blackouts. Increasing shift towards decentralized electricity generation in the country is expected to provide significant opportunity for the DC distribution network market.

- Therefore, based on the above-mentioned factors, Germany is expected to witness significant demand in the Europe DC distribution network market during the forecast period.

Europe DC Distribution Network Industry Overview

The Europe DC distribution network market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include ABB Ltd., Siemens AG, Vertiv Group Corp., Eaton Corporation PLC, and Secheron SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000225

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Voltage

- 5.1.1 High Voltage

- 5.1.2 Low and Medium Voltage

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Siemens AG

- 6.3.3 Vertiv Group Corporation

- 6.3.4 Eaton Corporation Plc

- 6.3.5 Secheron SA

- 6.3.6 Schneider Electric SE

- 6.3.7 Robert Bosch GmbH

- 6.3.8 Alpha Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.