Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636112

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636112

South America High Voltage Switchgear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

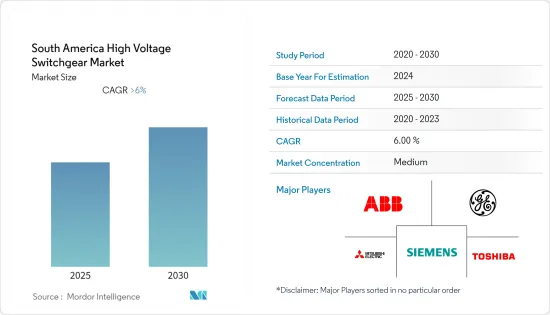

The South America High Voltage Switchgear Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels. Over the medium term, increasing electricity generation and consumption, along with network expansions to accommodate the infrastructure development projects and integration of renewables into the grid, which, in turn, is expected to drive the high-voltage switchgear market during the forecast period.

- On the other hand, stringent environmental and safety regulations related to the high-voltage switchgear market are restraining factors. Nevertheless, the government has prioritized the power sector by making considerable investments in the sector to provide power to remote areas in the country. Brazil dominates the high-voltage switchgear market, with the major demand from the expansion of transmission and distribution networks fueled by the rising investment in alternative energy sources.

South America High Voltage Switchgear Market Trends

Gas-Insulated Switchgear to Witness a Significant Growth

- Gas-insulated high voltage switchgear (GIS) is close-packed metal-enclosed switchgear comprises of high voltage components, such as circuit breakers and disconnectors, and offers numerous advantages, such as less field construction work, flexible designs, minimal maintenance, and good reliability and safety.

- In March 2022, GE Renewable Energy's Grid Solutions unveiled the world's first 420 kV, 63 kA g3 gas-insulated substation (GIS) circuit-breaker1 prototype. The g3 circuit breaker was presented to a group of leading transmission utilities.

- GIS is a kind of metal-enclosed switchgear, and it occupies much less space. Gas-tight metal enclosures enclose all the equipment, and SF6 is used as insulation between the earthed metal enclosures and live parts of the equipment. GIS can be used in city buildings, roofs and offshore platforms, and industrial and hydropower plants where spaces are limited.

- The demand for high-voltage direct current (HVDC) transmission systems is expected to supplement further the integration of large-scale renewables located far away from the demand centers in the South American power grid. Therefore, with increasing urbanization and industrialization across developing economies, the demand for gas-insulated switchgear is expected to grow significantly during the forecast period.

Brazil to Dominate the Market

- Rapid industrialization and urbanization have led to an increase in electricity demand. This, in turn, has fueled the need for the expansion of T&D infrastructure across the region and thereby driving the high-voltage switchgear market.

- Electrobras, the largest Brazilian electricity generation company, produced about 170 million MWh accumulated until 4Q2022 and the installed capacity reached 42,559 MW in 4Q2022 and is expected to increase further during the forecast period. As a result, there is a need for the expansion of the existing power transmission network, which is expected to drive the demand for high-voltage switchgear in the country.

- In September 2022, the implementation of the 4th machine at AHE Curua-Una (Eletrobras Eletronorte) was completed, adding 12.5 MW of installed capacity in Eletrobras' commercial operation.

- The completion of Electrobras projects such as the Angra 3 Plant (Eletrobras Eletronuclear), the Santa Cruz natural gas thermal plant (Eletrobras Furnas), the Coxilha Negra wind farm (CGT Eletrosul), and CGH Cachoeira Branca (CGT Eletrosul) will add approximately 1GW to Eletrobras installed capacity which is expected to drive the demand of high voltage switchgear market.

- Therefore, owing to the above points, the increasing renewable energy installations and investments in the country are expected to drive the Brazil high-voltage switchgear market during the forecast period.

South America High Voltage Switchgear Industry Overview

The South American high voltage switchgear market is moderately fragmented. Some of the major players in the market (in no particular order) include ABB Ltd., Schneider Electric SE, General Electric Company, Toshiba International Corporation, and Mitsubishi Electric Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 5000058

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Air-insulated

- 5.1.2 Gas-insulated

- 5.1.3 Other Types

- 5.2 End User

- 5.2.1 Transmission & Distribution Utilities

- 5.2.2 Commercial & Residential

- 5.2.3 Industrial

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Colombia

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Schneider Electric SE

- 6.3.3 General Electric Company

- 6.3.4 Toshiba International Corporation

- 6.3.5 Mitsubishi Electric Corporation

- 6.3.6 Siemens AG

- 6.3.7 Larson & Turbo Limited

- 6.3.8 Bharat Heavy Electricals Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.