PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636103

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636103

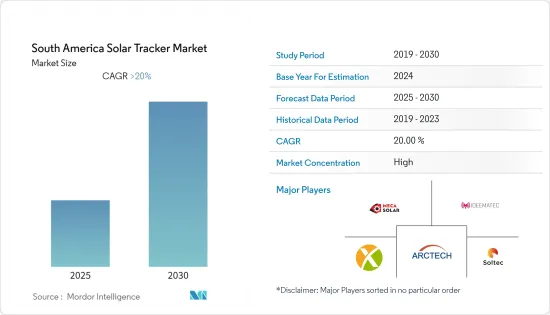

South America Solar Tracker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The South America Solar Tracker Market is expected to register a CAGR of greater than 20% during the forecast period.

The market was moderately affected by the COVID-19 pandemic due to falling energy demand, which led to several projects being delayed. However, the market has rebounded strongly and is expected to grow steadily during the forecast period.

Key Highlights

- Over the long term, rising demand for cheap, clean energy to achieve environmental targets and cater to the region's growing energy demands, combined with supportive government policies, is expected to drive the market during the forecast period.

- On the flip side, the growth of the residential and commercial segments in the South American solar PV market, which are almost exclusively rooftop-mounted systems with no trackers, is expected to restrain the market during the forecast period.

- Nevertheless, the commercialization of the usage of artificial intelligence and the Internet of Things to track the sun's movement and maximize power output is expected to be a significant growth opportunity for the market during the forecast period.

- Brazil is expected to be the largest market during the forecast period, with the majority of the demand coming from solar photovoltaic energy.

South America Solar Tracker Market Trends

Single-Axis segment to dominate the market

- Typically, a solar tracking system moves reflecting surfaces or the solar panel's face to track the sun. Solar trackers can produce up to 40% more energy from the sun compared to conventional panels. Due to more advanced and effective sun-trapping technology, solar trackers are being employed in both household and commercial-grade solar panels.

- Single-axis trackers typically follow the sun's direction and travel from east to west. Single-axis trackers only use one angle as the rotational axis. More than 30% more electricity can be produced with this kind of tracker. These trackers offer a quick, easy, and affordable approach to enhancing the performance of solar installations.

- Moreover, due to their relatively low cost and less sophisticated construction than dual-axis trackers, single-axis solar trackers are generally accepted on the global market. Single-axis solar trackers are offered in several different configurations, depending on their tilt and alignment direction.

- Increasing the electricity capacity for ongoing and upcoming projects is challenging for governments and energy firms. The 20%-30% capacity increase on single-axis solar trackers can be very helpful. This, in turn, is anticipated to generate sizable prospects for businesses engaged in the production of single-axis solar tracking systems during the forecast period.

- In 2021, the total solar PV installed capacity in South America accounted for 32.66 GW. With an annual growth rate of around 58% as compared to the previous year, the generation is expected to grow. Using the single-axis solar trackers can increase the generation capacity further, thus creating an opportunity for the single-axis solar trackers segment in the forecast period.

- Hence, owing to the above points, the single-axis solar trackers segment will likely see significant market growth during the forecast period.

Brazil expected to be the largest geographical segment

- Brazil is one of the fastest-growing solar PV markets globally, and as the demand for cheap renewable power increases across the country rapidly, the country's solar PV market is also expected to expand rapidly during the forecast period.

- According to the International Renewable Energy Agency (IRENA), as of 2022, solar PV installed capacity reached 24.07 GW and became the 3rd largest source of Brazilian electricity.

- To drive the country's solar sector by securing the solar supply chain, the country witnessed large investments in the solar manufacturing sector, with significant investments in the solar PV module manufacturing facilities, such as BYD's new solar PV module factory in Brazil, announced in September 2022.

- Additionally, significant investments are being made in the R&D of solar equipment, such as solar trackers. In August 2022, Nextracker partnered with FIT (Flex Instituto de Tecnologia) to launch South America's largest solar tracker R&D facility, the Brazil Center for Solar Excellence (CFSE). The facility is expected to encompass R&D across the full lifecycle of solar tracker systems, including structural, mechanical, and electrical design, construction, operation, and maintenance.

- Due to such growth in the utility solar segment in the country, the demand for solar trackers has also increased. For instance, in November 2022, Trina Solar received a contract for 520 MW of its Vanguard 1P smart trackers, optimized with SuperTrack artificial intelligence, for Brazil's Santa Luzia solar parks. Similarly, in July 2022, Arctech signed an agreement with Mori Energia for the supply of solar PV trackers for the 168 MW Skyline project in Brazil.

- Such developments demonstrate the rapid growth of the Brazilian utility solar segment, which is expected to drive the growth of the solar tracker market during the forecast period.

South America Solar Tracker Industry Overview

The South American solar tracker market is consolidated. Some of the major players (in no particular order) include Arctech Solar Holding Co. Ltd., MecaSolar, Ideematec Deutschland GmbH, Soltec Power Holdings SA, and Nextracker Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 By Axis Type

- 5.1.1 Single-Axis

- 5.1.2 Dual-Axis

- 5.2 By Country

- 5.2.1 Brazil

- 5.2.2 Chile

- 5.2.3 Argentina

- 5.2.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Soltec Power Holdings SA

- 6.3.2 Arctech Solar Holding Co. Ltd.

- 6.3.3 MecaSolar

- 6.3.4 Ideematec Deutschland GmbH

- 6.3.5 Nextracker Inc.

- 6.3.6 DCE Solar

- 6.3.7 Valmont Industries Inc.

- 6.3.8 PV Hardware

- 6.3.9 Solar Flexrack

- 6.3.10 Array Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS