PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636083

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1636083

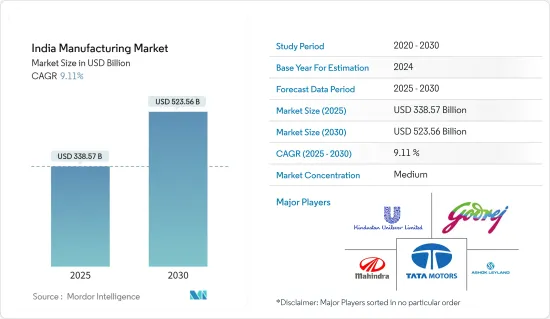

India Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India Manufacturing Market size is estimated at USD 338.57 billion in 2025, and is expected to reach USD 523.56 billion by 2030, at a CAGR of 9.11% during the forecast period (2025-2030).

Key Highlights

- India's manufacturing market underwent various phases of development during the pandemic, contributing approximately 16-17% to the GDP and employing nearly 20% of the country's workforce. It has become an attractive destination for foreign investments, with numerous mobile phone, luxury, and automobile brands establishing or considering manufacturing facilities in the country. The implementation of the Goods and Services Tax (GST) unified India into a single market with a GDP of USD 2.5 trillion and a population of 1.32 billion, attracting significant investor interest.

- According to the Indian Cellular and Electronics Association (ICEA), India has the potential to ramp up its cumulative manufacturing capacity for laptops and tablets to USD 100 billion by 2025 through strategic policy interventions. Among the government's initiatives, SAMARTH Udyog Bharat 4.0, led by the Ministry for Heavy Industries & Public Enterprises, aims to enhance the manufacturing market's competitiveness, particularly in terms of capital goods. The focus on developing industrial corridors and smart cities underscores the government's commitment to fostering holistic national development.

- India is steadily advancing toward Industry 4.0 through initiatives such as the National Manufacturing Policy, which targets a 25% share of manufacturing in GDP by 2025, and the Production Linked Incentive (PLI) scheme. The PLI scheme aims to elevate the core manufacturing sector to global standards. The gradual transition to automated and process-driven manufacturing in India is anticipated to enhance efficiency and bolster production capabilities.

India Manufacturing Market Trends

Growing Government Spending is Expected to Boost the Market's Growth

Manufacturing has emerged as one of India's high-growth markets. The government launched the 'Make in India' program to place the country on the map as a manufacturing hub and give global recognition to the economy. For instance, Wistron Corp. collaborated with India's Optiemus Electronics to manufacture products such as laptops and smartphones, significantly boosting the 'Make in India' initiative and electronics manufacturing in the country.

The government has taken several initiatives to promote a healthy environment for the growth of the market. In the Union Budget, the government allocated INR 2,403 crores (USD 315 million) to the promotion of electronics and IT hardware manufacturing. The PLI for semiconductor manufacturing was set at INR 760 billion (USD 9.71 billion) to make India one of the major global producers of this crucial component.

India's manufacturing market is experiencing rapid growth, driven by the expanding population. Increased investments and initiatives like 'Make in India' have positioned the country as a global manufacturing hub. In FY 2023, the manufacturing market saw an annual production growth rate of 4.7%.

Although the gross value added by the manufacturing sector has been steadily increasing, it still lags behind the services sector. However, with the potential of a vast consumer base, global giants like Siemens, HTC, and Toshiba have either established or are in the process of establishing manufacturing facilities in the region. Apple has also initiated operations in India, diversifying its production away from China.

Micro, small, and medium enterprises (MSMEs) play a crucial role in India's transition from an agriculture-based economy to an industrialized one. The contribution of MSMEs to India's GDP has remained stable in recent years, highlighting their importance in driving economic growth and job creation.

Growth of the Automotive Industry is Driving the Market

India holds a prominent position in the global heavy vehicles market, as it is the largest producer of tractors, the second-largest manufacturer of buses, and the third-largest producer of heavy trucks globally. In FY 2022, India's automobile production amounted to 22.93 million vehicles, indicating a robust domestic demand and significant export potential.

In November 2023, total passenger vehicle sales amounted to 334,130 units, marking a slight increase of 3.7% compared to November 2022. This surge represented the highest sales recorded for passenger vehicles in November. In FY 2023, India's automobile exports totaled 4,761,487 units, further demonstrating the country's strong presence in the global automotive market.

Two-wheelers are the dominant vehicle type manufactured in India, constituting the majority of automobiles sold domestically. This category includes motorcycles, scooters, and mopeds. The future growth trajectory of this sector is anticipated to be driven by electric scooters and motorcycles, with many major manufacturers venturing into electric vehicle production.

For instance, in January 2023, Mahindra and Mahindra Ltd, a leading automotive company in India, announced the approval of their investment of INR 10,000 crores (USD 1,226.74 million) for electric vehicles under the government of Maharashtra's industrial promotion scheme for electric vehicles.

India Manufacturing Industry Overview

The Indian manufacturing market is fragmented, with a mix of global and local players. Some of the major players present in the market include Tata Motors Ltd, Mahindra & Mahindra Limited, Ashok Leyland, Hindustan Unilever Limited, and Godrej Group. Major companies in the market adopt product launches, partnerships, business expansions, and acquisitions as key developmental strategies to offer better products and services to customers. For instance, in December 2022, Tata Passenger Electric Mobility, a subsidiary of Tata Motors, completed the acquisition of Ford India's vehicle manufacturing plant in Sanand for INR 725.7 crores (USD 89.01 million). This acquisition was expected to provide an additional state-of-the-art manufacturing capacity of 300,000 units per annum, scalable to 420,000 units per annum.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Insights into Government Initiatives

- 4.3 Insights into Recent Significant Investments and Developments the Industry

- 4.4 Insights into Manufacturing Clusters in India

- 4.5 Insights into History of Manufacturing Industry in India

- 4.6 Impact of the COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The government has introduced several initiatives under the banner of "Make in India"

- 5.1.2 India boasts a sizable pool of skilled labor, facilitating the establishment of manufacturing facilities for companies in various sectors

- 5.2 Market Restraints/Challenges

- 5.2.1 Fluctuating economic conditions

- 5.2.2 Infrastructure limitation

- 5.2.3 Supply chain disruptions

- 5.3 Market Opportunities

- 5.3.1 Government Support for MSMEs

- 5.3.2 Growing Domestic Demand

- 5.3.3 Export Potential

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Ownership

- 6.1.1 Public Sector

- 6.1.2 Private Sector

- 6.1.3 Joint Sector

- 6.1.4 Cooperative Sector

- 6.2 By Raw Materials Used

- 6.2.1 Agro Based Industries

- 6.2.2 Mineral Based Industries

- 6.3 End-user Industries

- 6.3.1 Automotive

- 6.3.2 Manufacturing

- 6.3.3 Textile and Apparel

- 6.3.4 Consumer electronics

- 6.3.5 Construction

- 6.3.6 Food and Beverages

- 6.3.7 Other End-use Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Tata Motors Ltd

- 7.2.2 Mahindra & Mahindra Limited

- 7.2.3 Ashok Leyland

- 7.2.4 Hindustan Unilever Limited

- 7.2.5 Godrej group

- 7.2.6 Maruti Suzuki Limited

- 7.2.7 Tata Steel Limited

- 7.2.8 Larsent & Toubro Limited

- 7.2.9 Apollo Tyres

- 7.2.10 Moser Baer*

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX