PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635538

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635538

GCC Finished Vehicle Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

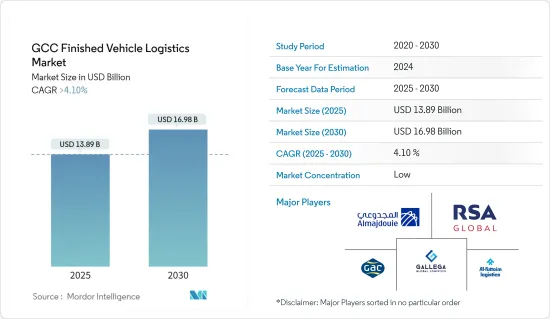

The GCC Finished Vehicle Logistics Market size is estimated at USD 13.89 billion in 2025, and is expected to reach USD 16.98 billion by 2030, at a CAGR of greater than 4.1% during the forecast period (2025-2030).

Key Highlights

- In GCC countries, rising vehicle registrations, organized transportation and warehousing activities, increased investments, and the expansion of automobile manufacturing plants, alongside the growth of intermodal freight transportation, are propelling the growth of the finished vehicles logistics market.

- Furthermore, the integration of blockchain technology into finished vehicle logistics systems stands out as a pivotal development, poised to fuel market expansion in the years ahead. Many companies are leveraging this technology to streamline operations and achieve cost savings in vehicle logistics. Blockchain's adoption in the finished vehicle logistics sector enhances transparency and efficiency in transportation. It not only boosts the visibility and predictability of logistics operations but also hastens the movement of goods. Several market players are harnessing this technology for real-time tracking of each vehicle unit and automating transaction management.

- Nonetheless, challenges such as vehicle damage during transit, a shortage of truck drivers, and the high costs tied to finished vehicle logistics pose hurdles to the growth of the GCC finished vehicles logistics market.

GCC Finished Vehicle Logistics Market Trends

Government Investments In Road Infrastructure is Driving the market

According to the Ministry of Transport and Logistics Services (MTLS), Saudi Arabia's road network stretches over 73,000 km. Of this, 49,000 km consists of single-lane roads, which the Kingdom plans to upgrade to two-lane roads, while motorways make up 5,000 km. Additionally, Saudi Arabia boasts 144,000 km of functional dirt roads.

The Kingdom is leveraging its road network not just to bolster logistics growth but also to enhance passenger transport. In February 2023, the government inked investment contracts to roll out a nationwide bus network. This network aims to link over 200 locations through 76 distinct routes. Designed to serve intercity needs, the bus services target an annual ridership of 6 million passengers. Furthermore, the initiative aligns with national sustainability goals by aiming to curtail car journeys. Economically, this venture is projected to inject approximately SAR 3.2 billion (USD 853 million) into the annual GDP.

In April 2023, the government revealed tendering for several motorway projects: Jeddah-Makkah (64 km), Yanbu-Jubail (447 km), Asir-Jazan (136 km), and Jeddah-Jazan (570 km). These projects are part of the National Center for Privatization (NCP) efforts, focusing on privatization and public-private partnerships (PPP). The MTLS is overseeing the tendering process. Once completed, these projects are set to bolster the Kingdom's high-capacity, high-speed road transport capabilities significantly. Overall, these initiatives underscore Saudi Arabia's commitment to enhancing its transportation infrastructure and logistics, driving economic growth, and achieving sustainability goals.

Saudi Arabia is dominating the region

Saudi Arabia's automotive industry, with imports surpassing one million vehicles annually, ranks among the world's top 20 vehicle import markets and stands as the largest in the Arab World. The consistent growth of Saudi Arabia's automotive sector is primarily attributed to the government's dedication to enhancing the automotive value chain and increasing local content, all part of a broader initiative to rejuvenate the manufacturing landscape.

As the nation pushes forward with its ambitions, it targets an annual production of 300,000 cars by 2030, alongside 3-4 original equipment manufacturers (OEMs) aiming to produce over 400,000 passenger vehicles. Notably, Saudi Arabia currently dominates the GCC, accounting for more than half of its car sales. By 2030, the county aims to produce 300,000 cars annually and has 3-4 original equipment manufacturers (OEMs) producing over 400,000 passenger vehicles. Ceer, the Saudi EV brand, is poised to inject USD 8 billion into the nation's GDP by 2034. The Saudi automotive aftermarket, valued at USD 4.2 billion, constitutes 40% of the entire GCC aftermarket industry. Initiatives like the National Automotive and Vehicles Academy (NAVA) and the Automotive Manufacturers Association (AMA) are specifically designed to nurture local capabilities, particularly in the emerging EV sector, accelerating overall sector development.

As the Saudi automotive industry continues its rapid ascent, the appetite for aftermarket products and services-ranging from spare parts and accessories to maintenance-will inevitably surge. Currently, the cumulative value of the Saudi automotive aftermarket stands at an impressive USD 4.2 billion, making up roughly 40% of the entire GCC aftermarket landscape. With these strategic advancements, the Finished Vehicle Market in Saudi Arabia is poised for significant growth, solidifying its position as a key player in the global automotive industry.

GCC Finished Vehicle Logistics Industry Overview

GCC Finished Vehicle Logistics Market has become increasingly competitive and fragmented with a large number of local and regional players and a few global players. Some of the major players in the GCC region include Gallega Global Logistics, RSA Global, Almajdouie Logistics, Al-Futtaim Logistics, Gulf Agency Company Ltd., and many more. Major companies in the market have adopted new technology adoption, partnerships, business expansions, and acquisitions as their key developmental strategies to offer better services to customers in the industry. For instance, PPG Member, Almajdouie Logistics (MLC) and GEFCO Group have announced the formation of 50-50 joint ventures in automotive logistics. They have partnered to provide finished vehicle logistics services to Almajdouie Auto (MMC), the importer of Hyundai in Saudi Arabia.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Insights into Logistics Technological Advancements

- 4.3 Insights into Inbound, Outbound Services, and Other Services (Vehicle Recall)

- 4.4 Insights into Areas such as Reverse Logistics Services, Contract Logistics, and Third Party Logistics Market

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Government Regulations and Initiatives

- 4.7 Trends in Intermodal Transportation in GCC

- 4.8 Insights on the Effect of Geopolitical Events on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Automotive Industry is driving the market

- 5.1.2 Rising demand for Electric Vehicles

- 5.2 Market Restraints/Challenges

- 5.2.1 Rising Cost and Driver Shortage

- 5.2.2 The Rise in Fuel cost

- 5.3 Market Opportunities

- 5.3.1 Green transport Solutions

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Activity

- 6.1.1 Transportation

- 6.1.1.1 Roadways

- 6.1.1.2 Railways

- 6.1.1.3 Maritime

- 6.1.1.4 Airways

- 6.1.2 Warehousing

- 6.1.3 Other Value-added Services

- 6.1.1 Transportation

- 6.2 By Country

- 6.2.1 United Arab Emirates

- 6.2.2 Saudi Arabia

- 6.2.3 Rest of GCC

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Gallega Global Logistics

- 7.2.2 RSA Global

- 7.2.3 Almajdouie Logistics

- 7.2.4 Al-Futtaim Logistics

- 7.2.5 Gulf Agency Company Ltd.

- 7.2.6 CEVA Logistics

- 7.2.7 DHL

- 7.2.8 Kuehne + Nagel International AG

- 7.2.9 Yusen Logistics Co., Ltd.

- 7.2.10 GEFCO*

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 9.2 Economic Statistics - Transport and Storage Sector Contribution to the Economy

- 9.3 External Trade Statistics - Export and Import, by Product

- 9.4 Insight into Key Export Destinations

- 9.5 Insight into Key Import Origin Countries