Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635461

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635461

United States Energy Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

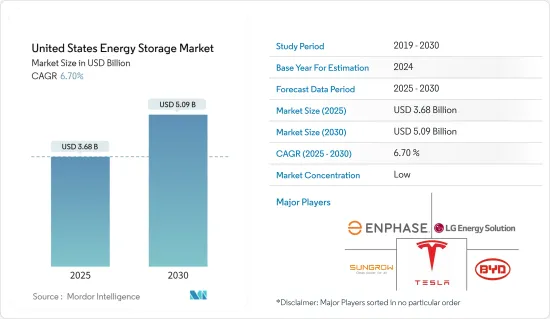

The United States Energy Storage Market size is estimated at USD 3.68 billion in 2025, and is expected to reach USD 5.09 billion by 2030, at a CAGR of 6.7% during the forecast period (2025-2030).

Key Highlights

- In the long term, factors such as increasing installations of renewable energy and declining prices for lithium-ion batteries are expected to drive the market during the forecast period.

- The scarcity of raw materials used for battery manufacturing is likely to hinder the market's growth during the forecast period.

- Researchers in the United States have been at the forefront of researching and developing alternate battery chemistries, which are safer and more efficient than current battery chemistries, thus creating several opportunities for the market in the future.

United States Energy Storage Market Trends

The Residential Segment is Expected to Dominate the Market

- In the recent past, the energy storage system (ESS) in the United States experienced significant growth, especially in the residential sector, along with the rising investments in renewable energy infrastructure across the region. Electricity consumption in residential buildings is estimated to increase during the forecast period due to increasing annual disposable incomes and the rising work-from-home trend across the United States. Energy storage systems provide continuous power supply at homes during power outages at peak hours.

- Various incentive programs across the United States are in place to support the residential energy storage market. California's Self-Generation Incentive Program (SGIP) supports the residential storage sector and offers incentives for new and existing distributed energy resources. Moreover, the residential energy storage segment is likely to proliferate because of increasing technological advancements in energy storage technology, which is leading to a decline in battery prices and widespread deployment of renewable power sources.

- Residential solar installations in New Jersey are likely to witness significant growth due to favorable incentive programs like Solar Renewable Energy Credits (SREC) and the declining cost of solar panels, which was introduced by the government of New Jersey. The shifting trend toward solar enables homeowners to save money on electricity bills. This, in turn, is likely to increase the deployment of residential energy storage systems.

- Moreover, in February 2023, California's net metering policy, also called NEM 3.0, incentivized residential consumers to sell the excess generated electricity from their rooftop power plants and store the electricity to use it at a time when prices of grid electricity become high. Similarly, commercial consumers are also expected to gain benefits from NEM 3.0.

- Furthermore, in May 2023, LG Energy Solution (LGES) launched a residential battery energy storage system in the United States to cater to the demand for electricity storage. The company's backup solution, Prime, contains a battery, inverter, and an auto-backup device with a capacity of about 19.2 kWh to 32 kWh to store, use, and export electricity.

- Therefore, owing to such points, the residential segment is expected to dominate the US energy storage market during the forecast period.

Rising Renewable Energy Generation is Expected to Drive the Market

- In the last decade, the installed renewable energy capacity and generation have been rising steadily in the United States. Renewable resources, such as solar and wind, generate power intermittently and at various levels, and storing this energy to be used during high demand is of vital importance.

- Due to this, modern energy-storing systems (ESS) are becoming an indispensable part of renewable energy projects. The rapid growth in the renewable energy sector is expected to be one of the strongest drivers for the growth of the ESS market in the United States.

- As of 2023, the United States had approximately 387.54 GW of renewable installed capacity from 160 GW in 2012. The increasing usage of renewable energy has made it easy for the energy storage concept to penetrate the market at such a fast rate.

- Traditionally, the most widely-used energy storage technology utilized in the United States has been pumped storage systems. As of 2023, the United States had more than 24 GW of storage from pumped hydropower and another 1.5 GW in batteries in the residential, commercial, and utility sectors. However, due to their geographical limitations, large land footprint, and falling battery costs, this technology is expected to see limited growth in demand during the forecast period.

- Moreover, the future outlook for energy storage systems in the United States is promising, driven by the growing need for grid stability and energy security, particularly in the context of increasing renewable energy deployment. Also, with the development of new and affordable lithium-ion batteries, the number of residential, commercial, and industrial solar rooftop PV systems coupled with ESS has increased significantly.

- Owing to the above points, rising renewable energy generation is expected to drive the market in the near future.

United States Energy Storage Industry Overview

The US energy storage market is moderately fragmented. Some of the key players in the market are Tesla Inc., BYD Co. Ltd, LG Energy Solution Ltd, Enphase Energy, and Sungrow Power Supply Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92093

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Energy Storage Systems Installed Capacity and Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increase in Adoption of Renewable Energy

- 4.5.1.2 Declining Cost of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Presence of Other Energy Storage Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Batteries

- 5.1.2 Other Energy Storage System Technologies

- 5.2 Phase

- 5.2.1 Single Phase

- 5.2.2 Three Phase

- 5.3 End User

- 5.3.1 Residential

- 5.3.2 Commercial and Industrial

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Tesla Inc.

- 6.3.2 Sungrow Power Supply Co. Ltd

- 6.3.3 BYD Co. Ltd

- 6.3.4 Sonnen GmbH

- 6.3.5 LG Energy Solution Ltd

- 6.3.6 Enphase Energy

- 6.3.7 Voith GmbH & Co. KGaA

- 6.3.8 Andritz AG

- 6.3.9 Siemens Energy AG

- 6.3.10 Fluence Energy

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Lithium-ion Batteries

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.