Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635422

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635422

United States Building Automation Controls - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

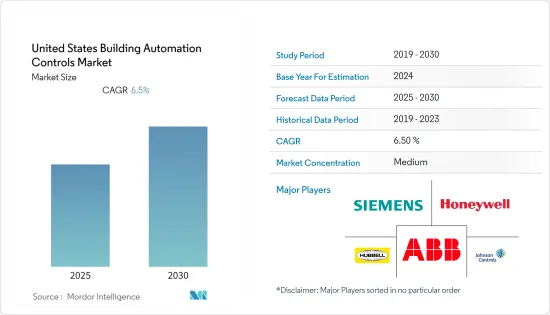

The United States Building Automation Controls Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- According to the New York State Energy Research and Development Authority, enabling real-time energy management systems and smart technologies could reduce costs by an average of 15% and increase the bottom line by creating an environment that encourages employee productivity and reduces energy waste, according to the New York State Energy Research and Development Authority (NYSERDA).

- Building managers and security experts are becoming more aware of the risk of smart building security as buildings become more integrated with IT and networking technology. Institutions in the financial services sector and other sectors should place a priority on smart building security since they are potentially lucrative targets for hackers. Because of these changes, the need for intelligent security system solutions will increase.

- Moreover, smart building IoT is gaining popularity in the commercial spaces as it provides user-friendly automation and application of intelligence for tasks, such as timer-controlled heating to an entire building by automatically regulating HVAC systems. IoT facility management service provides efficient physical security for a smart building by using cameras, movement detectors, and digital identification factors, such as biometrics identification systems.

- According to US facility managers, there is also a strong interest in upgrades and innovative building environments. Yet respondent input shows a major gap in the technologies currently deployed in the buildings. More than half of those surveyed says that the buildings they manage do not have proper air quality solutions (57%), integrated lighting that improves occupant productivity (66%), contactless building entry (67%), or an app that provides real-time information on building health (73%). Such a factor is expected to encourage the adoption of automation solutions post-pandemic.

- Despite the benefits that smart buildings offer, the building automation systems industry has always faced a tremendous challenge due to the way manufacturers deploy and install their systems. Significant building control systems are closed protocols that do not allow third-party systems to be installed in the ecosystems. Commercial building owners are challenged when it comes to choosing a sole manufacturer to be tied down to, as this lack of flexibility in installed systems could lead to high routine maintenance costs and delayed service.

US Building Automation Controls Market Trends

Fire Protection Systems are one of the Factor Driving the Market

- Integrating fire and safety systems with automated buildings is essential for preventing or minimizing loss during a fire threat. A fire safety system provides a high level of coordination, which is required between the active fire system, building-wide communications, and interactive smoke control systems in case of a fire. This method reduces the quantity of damage that a fire might inflict.

- According to the national fire protection association 2021 report, in 2020, local fire departments responded to an estimated 1.4 million fires in the united states. These fires resulted in the deaths of 3,500 civilians and the injury of 15,200 civilians. Property damage was projected to be worth USD 21.9 billion. In 2020, a fire department in the united states responded to a fire every 23 seconds on average. Every 89 seconds, a home structure fire was reported, every three hours and 24 minutes, a home fire death was reported, and every 46 minutes, a home fire injury was reported.

- With the improvements in the sensors' capabilities and communication channel technology, IoT devices present in industries and residential spaces have made the adoption of new-tech solutions possible. Therefore, the market is experiencing the demand for fire safety systems that can integrate with the new as well as legacy systems.

- Owing to safety policies and regulations applicable to the industry, despite market maturity, the industry continues to introduce new product offerings that have contributed to product turnover and attracted new demand. In many cities, it is a statutory requirement to carry out fire evacuation drills at least twice a year in all residential and commercial spaces. Further, the awareness toward the adoption of equipment to meet the safety standards, regulations, and fire safety systems is demanded in several process industries, such as oil and gas, power generation, water and wastewater, food manufacturing, metal and mining, paper and pulp, and textile manufacturing and processing.

- In December 2021, Texas Fire Alarm(TFA), a full-service fire protection provider, was acquired by the National Fire & Safety, end-to-end fire protection and life safety solutions platform and a portfolio business of Highview Capital. TFA specializes in warehouse/distribution, industrial, commercial, and multi-family fire alarm, fire sprinkler, extinguisher, and kitchen hood system service. TFA's staff includes NICET-certified engineers and highly qualified technicians. TFA's full-service fire protection services include TFA's central monitoring station's 24-hour emergency monitoring. Such acquisitions will enable the company to develop the products according to the requirements of customers and increase the market share in the studies region.

Commercial

- According to the US Department of Energy, the buildings sector accounted for about 76% of the electricity used, resulting in a considerable amount of associated greenhouse gas (GHG) emissions, thereby making it necessary to reduce the energy consumption in buildings to comply with national energy and environmental challenges and decrease costs to building owners and tenants. By 2030, building energy use could be cut more than 20% using technologies known to be cost-effective today and by more than 35% if the research goals are met. Much higher savings are technically possible.

- The Energy Policy Act of the United States offers businesses tax deductions for the costs of improving the energy efficiency of commercial buildings. A tax deduction of up to USD 1.80 per square foot is available for buildings that save at least 50% of the heating and cooling energy of a system or building that meets ASHRAE Standard 90.1-2001 or 90.1-2007. Such tax benefits are expected to increase the use of energy management systems.

- The investments in commercial buildings are massive in the United States. According to Construct Connect and Oxford Economics, in 2022, the value of commercial construction by retail will account for USD 19.64 billion, USD 14.96 billion for hotels, USD 12.05 billion for government, and USD 9.66 billion for sports stadiums.

- Recently, in July 2021, 75F, one of the prominent providers of IoT-based building automation technologies, specialized in optimizing IAQ and energy efficiency in commercial spaces, announced an investment from Siemens AG. The latest influx in 75F's Series A funding round brings the Minneapolis-based company's total funding to USD 28 million.

- In August 2021, Illinois-based Intermatic Incorporated announced the launch of its new ARISTA Advanced Lighting Control System, a customizable smart lighting solution that supports commercial and municipal buildings up to 10,000 square feet. The system allows installers of all technology backgrounds to integrate impressive, code-compliant functionality in a wide range of lighting control applications.

US Building Automation Controls Industry Overview

The United States Building Automation market is moderately consolidated, with the presence of a few major companies. The companies are continuously investing in making strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are:

- January 2022- Stay-Lite Lighting, nationwide lighting and electrical maintenance service provider was acquired by Orion Energy Systems, Inc., a provider of energy-efficient LED lighting, control, and IoT systems, including turnkey project implementation, program management, and system maintenance. The acquisition enables Orion Maintenance Services to develop faster, which provides lighting and electrical services to customers.

- November 2021 - AI Fire has acquired BCI Technologies. BCI Technologies installs, repairs, and services specialized security systems for businesses and commercial facilities. The Academy Fireteam of AI Fire will open its first district office in Dallas, Texas, due to the acquisition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91745

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitute Products

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Assessment Of The Impact Of Covid-19 On The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Favorable local regulations driving adoption of security & fire protection systems

- 5.1.2 Rising demand for energy efficient buildings in the region

- 5.1.3 Technological advancements in the field of IoT & wireless infrastructure

- 5.2 Market Challenges

- 5.2.1 Absence of Technology Alignment and High Acquisition and Implementation Costs

6 TECHNOLOGY SNAPSHOT

- 6.1 Analysis of major communication protocols (KNX, NON-KNX)

- 6.2 Major advancements in the field of Building Automation and Control Systems

- 6.3 Analysis of new & retrofit installations

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Lighting Controls

- 7.1.2 HVAC Systems

- 7.1.3 Security and Access Control

- 7.1.4 Fire Protection Systems

- 7.1.5 Software(BEMS)

- 7.1.6 Services(Professional)

- 7.2 By End User

- 7.2.1 Residential

- 7.2.2 Commercial

- 7.2.3 Industrial

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Honeywell International, Inc

- 8.1.2 Siemens AG

- 8.1.3 ABB Limited

- 8.1.4 Johnson Controls International

- 8.1.5 Hubell

- 8.1.6 Delta Controls

- 8.1.7 Robert Bosch

- 8.1.8 Schneider Electric

- 8.1.9 United Technologies Corporation

- 8.1.10 Lutron Electronics

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.