Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635397

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635397

Latin America Positive Displacement Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

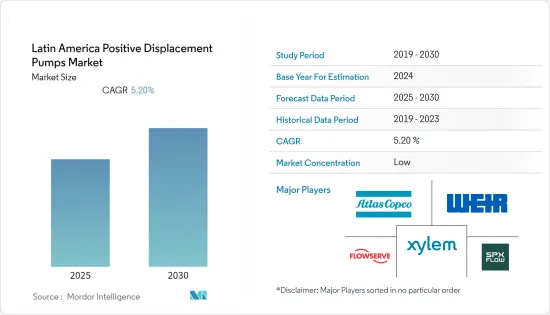

The Latin America Positive Displacement Pumps Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- Latin America has an abundance of natural resources. As a result, the extractive industry is critical to the economies of the countries. Although the oil and gas industry is the major end-user, sales are also driven by other industries including as power generation, water and wastewater, construction, chemical processes, food and beverage, pharmaceuticals, and metals and mining.

- The COVID-19 pandemic has had a significant effect on the production of oil, gas, and electricity in Latin America. Positive displacement pumps are in less demand throughout the region as a result of supply chain interruptions and delays in project construction activity. Also, It was expected that positive displacement pump market pump sales will likely resume after the end of COVID-19 pandemic. Further rising industrialization, increased construction projects, and increased mining activity in the region are the primary drivers boosting demand for positive displacement pumps in Latin America.

- The rising need to treat wastewater created by the industrial sector, along with declining groundwater levels, will drive market demand for positive displacement pumps in the future. Positive displacement pumps have high viscosity, solids handling capability, efficiency, and accurate repeatable measurement, all of which contribute to market growth.

- Additionally, The rapid development of civic water utility infrastructure in emerging regions such as Latin America has led to increased demand for positive displacement pumps. The demand for sewage treatment has increased massively in both public and industrial sectors with increased number of pumping units installed base. Technologies such as desalination and ZLD (zero-liquid discharge) is expected to boost the market for positive displacement pumps market in civic and industrial sectors.

Latin America Positive Displacement Pumps Market Trends

Oil and Gas Industry drives Positive Displacement Pumps Market

- As one of the largest end-user, the oil and gas industry drives positive displacement pump sales. Following a devastating drop in the region's economy as a result of the COVID-19 outbreak, reforms in each country's legal frameworks and regulations are critical to reviving pump sales. Positive displacement pump manufacturers have an appealing market outlook due to regional attention to the development of oil and gas resources as well as the general requirement for basic chemicals.

- Moreover, positive displacement pumps are widely used in the oil and gas industries of nations such as Venezuela, Brazil, and Mexico. These pumps are utilized for both exploratory and refining purposes. Furthermore, investments in the oil and gas sector, such as shale gas exploration and liquefied natural gas, are likely to drive demand for positive displacement pumps in Latin American regions.

- Further, mining activity in Latin American countries such as Peru and Chile has increased the demand for positive displacement pumps, particularly for the repair and maintenance of existing pumps. Chile and Peru are likely to present a combined opportunity for capital expenditure. As a result, these factors are likely to promote market growth throughout the forecast period.

- Despite the slowing trend in material price supply and demand, the oil and gas industry is likely to have enormous demand for positive displacement pumps over the projection period. This is due to ongoing investments in shale gas around the world. The increasing emphasis on establishing micro-liquefied natural gas terminals, which has resulted in reduced investment value for oil producers, has resulted in rising demand for positive displacement pumps.

Brazil is the Most Lucrative Country in the Latin America Positive Displacement Pump Market

- Brazil is the leading revenue-producing nation in the Latin American positive displacement pump market because of an increase in businesses that has decreased the amount of potable water and increased groundwater contamination. Additionally, the use of positive displacement pumps has expanded as a result of low disposable water levels and groundwater adulteration, which would accelerate market expansion even more.

- According to World Integrated Trade Solution, in Latin America, positive displacement pump exports from Brazil were primarily destined for Bolivia, Chile, and Paraguay. Following these countries are the United States, Argentina, and Germany. The US and Germany recorded the most noticeable rates of growth in terms of shipments among the major destination nations, while the other leaders experienced more modest rates of growth.

- Netzsch Pumps & Systems, Brazil, delivered its millionth pump from its subsidiary in Exton, USA, in June 2020. The pump was created at the company's headquarters in Waldkraiburg, Germany, and is a Nemo progressive cavity pump for high-density solids. The components were designed and constructed in the Netzsch facility in Brazil, and the pump was then assembled, tested, and transported to the United States.

- Additionally, according to Indexbox, Brazil saw a rise in foreign imports of positive displacement pumps and hand pumps in 2020. Imports increased dramatically during this time period. The rate of growth was fastest in 2009, when imports rose. Imports peaked in 2020 and are expected to grow steadily in the short term.

Latin America Positive Displacement Pumps Industry Overview

Latin America positive displacement pumps market is fairly fragmented market. Some of the key players in the market include Flowserve Corp., Atlas Copco, Xylem Inc., etc.

- March 2021 - Abel Pumps, a producer of highly engineered reciprocating positive displacement pumps for a range of end sectors, including mining, marine, power, water, wastewater, and other general industries, was acquired by IDEX Corporation.

- January 2021 - Atlas Copco Portable Energy has expanded its dewatering range with the introduction of over thirty new heavy-duty, high-capacity pumps. A novel piston positive displacement pump that may run dry without destroying internal components has been introduced. It is best suited for wellpoint applications with modest water volume and depth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91648

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study assumptions and market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness -Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Continuous Demand from the Oil & Gas Industry

- 5.1.2 Huge Scarcity in the Disposable Water Level and Groundwater Adulteration will Drive the Market

- 5.2 Market Challenges

- 5.2.1 Market Saturation in Conventional End-user Industries

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Reciprocating Pumps

- 6.1.1.1 Diaphragm

- 6.1.1.2 Piston

- 6.1.1.3 Plunger

- 6.1.2 Rotary Pumps

- 6.1.2.1 Gear

- 6.1.2.2 Lobe

- 6.1.2.3 Screw

- 6.1.2.4 Vane

- 6.1.2.5 Peristaltic

- 6.1.2.6 Progressive Cavity

- 6.1.1 Reciprocating Pumps

- 6.2 End-User

- 6.2.1 Oil & Gas

- 6.2.2 Chemicals

- 6.2.3 Food & Beverages

- 6.2.4 Water & Wastewater

- 6.2.5 Pharmaceuticals

- 6.2.6 Power

- 6.2.7 Others

- 6.3 Geography

- 6.3.1 Brazil

- 6.3.2 Colombia

- 6.3.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atlas Copco

- 7.1.2 The Weir Group PLC

- 7.1.3 Flowserve Corporation

- 7.1.4 Xylem Inc.

- 7.1.5 SPX FLOW, Inc

- 7.1.6 Colfax

- 7.1.7 IDEX

- 7.1.8 Abel Pumps

- 7.1.9 Dover Corporation

- 7.1.10 Tsurumi Pump

- 7.1.11 Pentair Plc

- 7.1.12 Alfa Laval AB

8 INVESTMENT ANALYSIS

9 FUTURE MARKET OUTLOOK

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.