Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635381

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635381

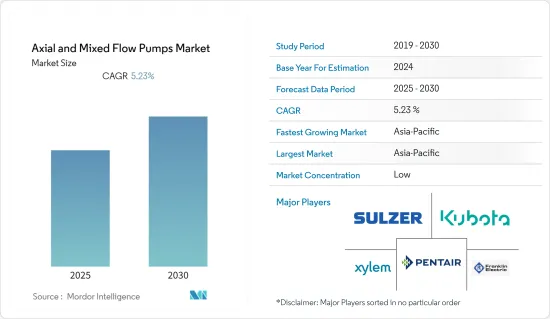

Axial and Mixed Flow Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Axial and Mixed Flow Pumps Market is expected to register a CAGR of 5.23% during the forecast period.

Key Highlights

- Axial and mixed flow pumps are used in sewage treatment plants, irrigation, and flood control. These pumps are used in agriculture to pump water from reservoirs to fields and to remove unwanted or excess water from areas. Furthermore, it can be used in municipal water treatment to help drive water or fluids to different conveyor systems or reservoirs. These factors are expected to propel the axial, and mixed flow pumps market forward.

- Furthermore, advantages such as high low rate with minimal pressure requirement, enhanced discharge rate with the relatively low velocity of head, and they can be adjusted to run effectively and efficiently with minimal aerodynamic loss are contributing to the growth of global axial flow pumps. All of these factors combine to increase the demand for axial flow pumps, thereby boosting the global market growth.

- For instance, in March 2021, Xylem announced that it was making waves in the world of water. The Xylem Water Solutions India Pvt Ltd, a wholly-owned subsidiary of Xylem Inc, has expanded rapidly in India. The company offers innovative products and solutions across the entire water cycle - from extraction to purification and storage to distribution and wastewater management - allowing customers to transport, treat, test, and efficiently use water in public utility, residential and commercial building services, as well as industrial and agricultural settings.

- Moreover, the use of axial flow pumps in agricultural sectors such as irrigation, fisheries, and drainage is a key market trend in the global market. Furthermore, rising population has increased demand for crop production, where axial flow pumps are widely used for irrigation.

- The axial and mixed flow pump market has been negatively influenced due to the COVID-19 pandemic, owing to its dependence on chemical, petrochemical, fisheries, and other sectors. According to a report published by the National Bureau of Statistics of China, the chemical industry witnessed a 20% decline in production in March 2020, which is expected further increase by the end of 2021.

Axial & Mixed Flow Pumps Market Trends

Rising Demand for Energy Fuel

- The axial and mixed flow pumps market is expected to grow as people become more environmentally conscious and governments are willing to invest in water and wastewater treatment. Furthermore, the rising demand for energy fuel is a growing trend in this market. Demand for crude oil in domestic transportation and international logistics is increasing, which is expected to stimulate onshore and offshore fuel exploration.

- India is the world's third-largest consumer of both energy and oil. India's oil refining capacity was 259.3 MMT (million metric tonnes) as of May 1, 2021, making it Asia's second-largest refiner. By 2040, India plans to increase this capacity to 667 MTPA (million tonnes per annum).

- Also, by 2040, India's energy demand is expected to double to 1,123 Mtoe (million tonnes of oil equivalent). The increased demand for fuel is expected to drive product adoption across a wide range of end-user industries, including oil and gas, power, water, and wastewater treatment.

- According to the International Energy Agency, investment in coal is expected to increase by 10% by 2021 as a growing number of countries race to secure alternative fuel sources to improve energy security, which the Ukraine war has reduced.

- Further, according to China's central government, the country aims to have 50,000 fuel-cell vehicles on the road by 2025 and produce 100,000-200,000 tonnes of hydrogen annually from renewable sources by the same year. This will further drive the market growth.

Asia Pacific is Expected to Hold Significant Market Share

- The axial and mixed flow pumps market would be primarily driven by a robust investment environment, particularly in water treatment facilities. With major exploration activities underway in both onshore and offshore formats, primarily in the unconventional oil and gas sector, Asia Pacific is bound to have a significant slice of the global axial flow pump market pie. This raises the demand slope for axial flow pumps.

- Furthermore, the region accounted for a sizable portion of manufacturing and construction industries in 2021 and is expected to grow further in the coming years. While it is profitable for manufacturers in terms of market share, it is also distinguished by low labor costs and increasing government support. China and India, in particular, successfully shift the manufacturing industry to themselves.

- For instance, according to IBEF, in September 2021, the government approved the PLI scheme worth Rs. 26,058 crores (USD 3.53 billion) for the auto and drone industries to boost India's manufacturing capabilities. These initiatives further drive the studied market in the region.

- Moreover, On November 19, 2021, Prime Minister Mr. Narendra Modi laid the foundation stone for the Uttar Pradesh Defence Industrial Corridor project worth Rs. 400 crores (USD 53.73 million) in Jhansi, which further boosted the studied market.

- Other reasons for the region's growth include technological advancements and innovations that greatly empower the region's foothold for industrialization. It is expected to drive demand for the Axial and Mixed Flow Pump Market during the forecast period. For instance, According to the India Brand Equity Foundation, in February 2022, India's technology spending increased by 8.7 % in 2022. This is the fastest rate of growth in the Asia Pacific region. In 2021, India's tech leaders spent 7% more on hardware than in 2020.

Axial & Mixed Flow Pumps Industry Overview

The global axial and mixed flow pump market is competitive in nature because of the presence of major players like Xylem Inc., Franklin Electric, Ebara Corporation, Sulzer Ltd., and Pentair Plc, among others. Major companies are developing advanced technologies and launching new products to stay competitive in the market.

- November 2021- Sulzer announced a High-flow axial pump for a loop reactor to Calysseo's facility in Chongqing, China, to aid in producing an innovative bio-protein for the Asian aquafeed industry. Sulzer adjusted the pump design for clean-in-place (CIP) and to withstand corrosion and erosion, as the broth contains entrained gases and solids.

- August 2021- AMI Global, a provider of industrial IoT solutions, has announced a collaboration with Peerless Pump Company, a wholly-owned subsidiary of the Grundfos Group that specializes in the design and manufacture of UL-listed and FM-approved fire pump systems. With the launch of Peerless FireConnect, the partnership brings IoT connectivity and condition monitoring to fire pump systems worldwide.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91591

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Innovative Oil & Gas Industry

- 5.1.2 Rising Demand for Energy Fuel

- 5.2 Market Restraints

- 5.2.1 Axial flow pumps are not suitable for handling highly viscous fluids

6 SEGMENTATION

- 6.1 By Flow Type

- 6.1.1 Axial

- 6.1.2 Radial

- 6.1.3 Mixed

- 6.2 By Number of Stages

- 6.2.1 Single Stage

- 6.2.2 Multi Stage

- 6.3 By End-user Industry

- 6.3.1 Oil & Gas

- 6.3.2 Chemicals

- 6.3.3 Food & Beverage

- 6.3.4 Water & Wastewater

- 6.3.5 Pharmaceuticals

- 6.3.6 Power Generation

- 6.3.7 Construction

- 6.3.8 Metal & Mining

- 6.3.9 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 Italy

- 6.4.2.4 France

- 6.4.2.5 Russia

- 6.4.2.6 Rest of the Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 Australia & New Zealand

- 6.4.3.6 Rest of the Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Chile

- 6.4.4.4 Rest of the Latin America

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 Turkey

- 6.4.5.4 Rest of the Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Xylem, Inc.

- 7.1.2 Franklin Electric

- 7.1.3 Sulzer Ltd.

- 7.1.4 Kubota Corporation

- 7.1.5 Pentair plc

- 7.1.6 Torishima Pump Manufacturing Co Ltd

- 7.1.7 Ebara Corporation

- 7.1.8 Weir Group PLC

- 7.1.9 Hayward Tyler

- 7.1.10 Peerless Pump Company

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.