Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635353

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635353

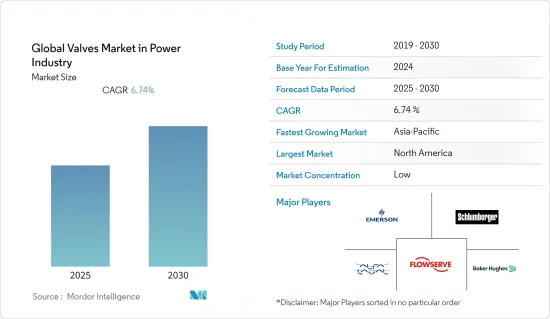

Global Valves in Power Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Global Valves Market in Power Industry is expected to register a CAGR of 6.74% during the forecast period.

Key Highlights

- Power consumption is increasing due to climate change and the need to develop better, renewable, and less damaging resources to create electricity. Due to this, manufacturers of industrial valves for the power plant sector look for process machinery that can improve the effectiveness of electricity production.

- Further, the growing strategic developments such as acquisitions, collaborations, and so on are set to bolster the growth rate. For instance, in April 2022, Vexve Armatury Group acquired Armatury Group GmbH, a distributor of ARMATURY Group valves in the Austrian and German markets for the power, gas, and metallurgy sectors. Through the acquisition, Vexve Armatury Group's position is strengthened, particularly in the DACH region (Germany, Austria, Switzerland).

- COVID-19 has created supply chain disruptions and has significantly impacted energy production during the lockdowns. However, the impact has been short-term.

- Along with additional expenses, valve replacement adds up. Equipment needs to be taken apart and then put back together. The personnel and materials required to manage valve inventory control have a cost. Additionally, there can be a fee for the environmental damage caused by the disposal of old valves. All of this is on top of the additional costs for customers caused by employee overtime and the revenue lost due to the facility having to shut down, even momentarily. This acts as a restraint on the market.

Power Sector in Valves Market Trends

Growing Power Sector is Expected to Cater the Market Growth

- A different set of flow control requirements are needed for each kind of power generation application. That so, a power plant's particular pipeline system may contain a wide variety of valves. Industrial valves for power plants also need to play diverse roles depending on the operations occurring in a specific area of the pipe system.

- Moreover, due to the diversity of renewable energy plants, different valves are needed for different processes, such as low temperature, low-pressure raw material at one end of the process and high temperature, high-pressure steam at the other. It's not unusual for these plants to use various valve types to carry out particular activities, depending on the exact duties involved.

- In nuclear power plants, control valves are frequently employed to control fluid flux, and the principal circuit of one nuclear power plant contains more than 1500 control valves. They enable the flux to be directed to a precise amount of steam or water, ensuring the nuclear power plant's energy efficiency. Nuclear power reactors generate around 10% of the world's electricity. A total of 55 more reactors, or roughly 15% of the current capacity, are now being built.

- Further, the growing government aid in developing nuclear power plants is set to boost the market growth rate. For instance, in November 2021, the US government announced The Bipartisan Infrastructure Law that includes over USD 62 billion for the US Department of Energy (DOE) to assist in the country's transition to a clean energy economy, which provides for utilizing nuclear energy, the country's greatest single source of clean power. The law includes around USD 2.5 billion to enable the demonstration of two advanced American reactors by 2028 and USD 6 billion to launch a Civil Nuclear Credit program.

North America is Analyzed to Major Share in the Market

- North America is expected to hold the major share in the market owing to the significant presence of the power generation plants. Moreover, The United States has the most operational nuclear reactors. The 92 operating nuclear reactors in the USA have a net combined capacity of 94.7 GWe. With a total net capacity of 13.6 GWe, Canada has 19 nuclear reactors that are currently in operation. Nuclear power plants produced 14.6% and 19.7% of the nation's electricity in 2020 in the US and Canada, respectively (Source: World Nuclear Association).

- Further, the growing collaborations in integrating advanced technologies in the valves in power generation are analyzed to boost the market growth rate during the forecast period. For instance, in May 2021, The Nuclear Division of Curtiss-Wright stated that it had reached a contract with Exelon Generation Company LLC to license the firm's valve program performance data. Curtiss-Wright will use the performance data in collaboration with Exelon Generation to improve the efficiency of its StressWave ultrasonic leak detection technology and encourage the adoption of best practices in valve assessment, analysis, and performance throughout the U.S. nuclear fleet and the power generation sector.

- Asia-Pacific is analyzed to grow at a significant rate during the forecast period. The significant demand from the power sector is a driving factor for the market. For instance, in 2021, China generated 8.11 trillion kilowatt-hours (KWh), an increase of 8.1 percent from the previous year. Power generation in 2021 increased by 11% from 2019, making the average rise over the last two years 5.4%. In December, China's wind, solar, and nuclear energy production increased year over year by 30.1%, 18.8%, and 5.7%, respectively (Source: National Bureau of Statistics (NBS)).

- Moreover, the growing product innovations to meet the demand in the power generation sector further contribute to the market's need. In May 2022, The ARMATURY Group announced that the company had manufactured three butterfly valves with DNs ranging from 1,800 to 2,000 for the Philippine hydroelectric power facility. As shut-off valves, butterfly valves L32.71 PN 10 and PN 6 will completely open or close the passage of the working medium through the pipeline.

Power Sector in Valves Industry Overview

The Global Valves Market in Power Industry is fragmented and is analyzed to be highly competitive. The companies are leveraging strategic collaborative initiatives to increase market share and profitability. Manufacturers should be able to improve their product ranges and get a larger market share through mergers and acquisitions. Major firms include Emerson Electric Co., Schlumberger Limited, Alfa Laval Corporate AB, Flowserve Corporation, and Crane Co., among others.

- December 2021- Severn Group, a multinational company of dedicated high-end valve engineering and manufacturing companies that includes Severn and LB Bentley, has acquired ValvTechnologies, a pioneer in the design and manufacture of metal-seated, zero-leakage isolation valve products for demanding applications. The agreement is a milestone toward Severn Group's goal of being the leading global expert in severe service valves for the industrial and energy industries. Along with Severn and LB Bentley, ValvTechnologies will remain operationally independent while gaining access to a larger pool of resources and knowledge as a larger group member.

- June 2021- Neles Corp has inked an asset acquisition agreement to buy Flowrox's valve and pump operations. The companies develop and produce valve and pump solutions for the mining, minerals processing, metallurgy, construction, energy, environmental, and chemical industries. These solutions include pinch valves, knife gate valves, and peristatic pumps.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91508

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Power Sector in the Global Economy

- 5.1.2 Adoption of Smart Valves in the Power Industry

- 5.2 Market Restraints

- 5.2.1 Lack of Standardized Policies and High Replacement Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ball

- 6.1.2 Butterfly

- 6.1.3 Gate/Globe/Check

- 6.1.4 Plug

- 6.1.5 Control

- 6.1.6 Other Types

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Co.

- 7.1.2 Schlumberger Limited

- 7.1.3 Alfa Laval Corporate AB

- 7.1.4 Flowserve Corporation

- 7.1.5 Crane Co.

- 7.1.6 Baker Hughes

- 7.1.7 Valmet Oyj

- 7.1.8 KITZ Corporation

- 7.1.9 IMI Critical Engineering

- 7.1.10 L&T Valves Limited

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.