PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635347

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635347

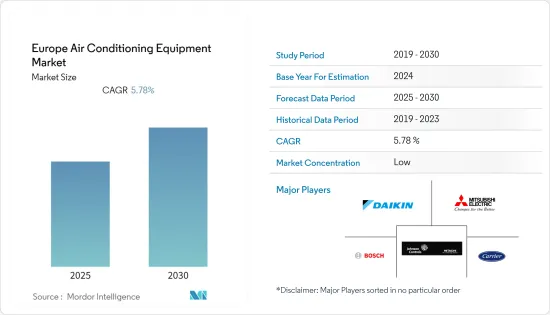

Europe Air Conditioning Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Air Conditioning Equipment Market is expected to register a CAGR of 5.78% during the forecast period.

Key Highlights

- In line with European commitments toward an increase in energy efficiency, the United Kingdom and France developed a massive regulatory framework and binding targets for the industrial, transport, and building sectors over the past decade.

- For instance, Smart Buildings Alliance (SBA), an association in France, aims to promote the smart building industry in smart cities. The alliance has combined 170 organizations from different trades related to the construction industry (industrial companies, service companies, builders, developers, design offices, architects, developers, and innovative start-ups).

- The growing product innovations are further bolstering the adoption rate of the equipment. For instance, In February 2021, Carrier Global Corporation announced the launch of its new BluEdge service platform for Carrier and CIAT heating, ventilating, and air conditioning (HVAC) equipment in Europe. Carrier Global Corporation is a prominent global provider of healthy, safe, and sustainable building and cold chain solutions. The multi-tiered BluEdge service platform was created to accommodate specific customer needs and maintain equipment performance over the course of a product's lifecycle.

- The COVID-19 second wave has also impacted the supply chain for air conditioning equipment. The cost of air conditioning grew in 2021 due to supply limitations since the cost of raw materials to make HVAC equipment, such as steel, plastic, and aluminum, increased. Due to the high demand from other industries, such as smartphone and Electron Vehicle producers, the market also experienced a shortage of semiconductor supplies.

Europe Air Conditioning Equipment Market Trends

Industrial is Expected to Grow at a Signficant Rate

- Refrigeration is increasingly becoming one of the driving forces behind the smooth operations of essential industries worldwide and the adoption of process chillers in industrial settings. The industrial refrigeration sector comprises various processes, including chilling and low-temperature freezers. Its widespread applications have made it a large-scale industry.

- For instance, German manufacturer, Efficient Energy, introduced a new chiller with a 120kW (34.1TR) cooling capacity, suitable for industrial cooling and using only water (R718) as a refrigerant. As per the company, the new eChiller120 is up to 82% more energy-efficient than conventional chiller systems. The eChiller120 model is suitable for process and machine cooling applications, like laser heads, rollers, and cooling basins. It can also be used for technical air conditioning of data centers and server rooms. The eChiller is best equipped to produce chilled-water temperatures between 16°C (61°F) and 22°C (72°F).

- To create safe and healthy indoor settings, there is an increasing need for fresh air supply in commercial and industrial facilities. In February 2022, Daikin launched a new direct expansion coil module, model number EKVDX-A, compatible with Daikin's upgraded VAM-J8 decentralized ventilation unit and enabled the supply of fresh air while minimizing the heat load impact of fresh air on comfort air-conditioning systems. This innovative Daikin direct expansion coil module provides fresh and hygienic air in commercial and industrial settings.

- Further, in October 2021, Daikin announced Fusion25, the strategic management plan based on the social backdrop where pressing concerns such as global warming, energy scarcity, and the need for clean indoor air are prevalent. Regarding heating, ventilation, air conditioning, and refrigeration (HVAC-R), Daikin Europe wants to be a complete solutions provider throughout Europe, the Middle East, and Africa in the next five years (EMEA). The growth speed is aggressive, with a forecasted turnover of 5.7 billion Euros by the fiscal year 2025. Investments are being made to enhance its R&D Centers in Europe, increase production, sales, and service capabilities, and finance the growth of its business model's digitization.

United Kingdom is Analyzed to Register Significant Growth Rate

- In recent years, the UK ventilation and air conditioning market has benefited from growing health, safety, and energy efficiency legislation, revised building regulations, and environmental legislation. The UK government has also been actively participating in reducing the effects of climate change. This is expected to impact the adoption of HVAC equipment.

- By 2050, the government promises to have cut the UK's greenhouse gas emissions to zero. As a result of climate change's warming effects and the requirement to create a healthy indoor environment that fosters productivity at work, there is a difficulty that the demand for cooling in buildings during the summer is anticipated to increase. It is important to consider the best possible mix of passive and active cooling strategies to fulfill this rising demand cost-effectively and at net zero. The wider prospects and ramifications must be taken into account. For instance, using reversible heat pumps for cooling could increase the penetration of low-carbon space heating into the existing building stock.

- Adding to this, the growing collaborations in the country further contribute to the market growth rate. For instance, In November 2021, Balfour Beatty Kilpatrick and EJ Parker Technical Services have been contracted to deliver the Heating, Ventilation, and Air Conditioning (HVAC), a framework arrangement worth GBP150 to GBP250 million throughout the program. The HVAC package is the first of many contracts the partners will issue over the ensuing months as a part of a powerful framework lasting the following 18 years.

- In June 2022, Smith Brothers Stores announced a collaboration with Midea, a prominent international producer of HVAC products, for nationwide distribution. This agreement, which began in June 2022, has been carefully planned with consideration for consumer feedback to ensure that it compliments SBS's current air conditioning lineup and successful approach to market while eventually giving the customers additional options.

Europe Air Conditioning Equipment Industry Overview

The Europe Air Conditioning Equipment Market is competitive as it is home to prominent vendors with a major market share in different segments and access to well-established distribution networks. With the advent of smart solutions, it is expected to become another strategic competitive point in the market. The smart building technology incorporation across commercial and industrial sectors is expected to drive connected HVAC systems in Europe and increase the competitive rivalry among the vendors in the market.

- April 2022 - Johnson Controls-Hitachi Air Conditioning introduced the airHome smart household air conditioner series, equipped with several smart and intuitive capabilities that assist consumers in maintaining a comfortable indoor environment while enhancing IAQ and saving energy. Beginning in April in France, the first model in the airtime series is offered throughout Europe before being made available in Asia.

- June 2021- CIAT introduced CLIMACIAT, a new line of air handling units (AHUs). The CLIMACIAT line includes innovative, energy-efficient, and simple-to-install units for various commercial applications. It is offered in three models: Airtech, Airclean, and Air access.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Smart Cities in the Region

- 5.1.2 Replacement of Existing Equipment with Better Performing Ones

- 5.2 Market Restraints

- 5.2.1 High Costs of Equipment

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single Splits/Multi-Splits

- 6.1.2 VRF

- 6.1.3 Air Handling Units

- 6.1.4 Chillers

- 6.1.5 Fans

- 6.1.6 Other Types

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Commercial

- 6.2.3 Industrial

- 6.3 Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daikin Industries Limited

- 7.1.2 Mitsubishi Electric Corporation

- 7.1.3 Carrier Global Corporation

- 7.1.4 Danfoss A/S

- 7.1.5 Johnson Controls-Hitachi Air Conditioning

- 7.1.6 Whirlpool Corp.

- 7.1.7 Luvata Oy

- 7.1.8 ROBERT Bosch GmbH

- 7.1.9 Emerson Electric Co.

- 7.1.10 Lennox International Inc

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS