Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635339

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1635339

US Pharmaceutical Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

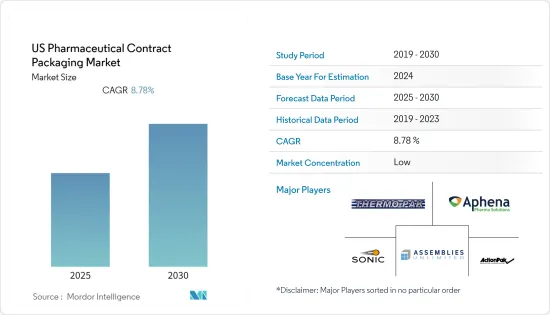

The US Pharmaceutical Contract Packaging Market is expected to register a CAGR of 8.78% during the forecast period.

Key Highlights

- Contract packaging gives pharmaceutical companies a chance to differentiate their product against the competition. Differentiation in pharmaceutical packaging is usually focused on the user's needs and use case. For example, the specific indication requirements section is one such need for contract packaging.

- Further, Serialization continues to be a driving factor for flexible, sterile packaging used for medical equipment, devices, implantable devices, and consumables, such as vials and syringes, among others. Increased demand for administering oral drugs, prescription dose medicines, and over-the-counter (OTC) medicines is expected to increase the use of flexible aluminum foil in the pharmaceutical sector.

- Furthermore, according to IQVIA, a human data science company, pharmaceutical sales worldwide are anticipated to reach USD 1.5 trillion in 2023 from USD 491 billion in 2019. The United States dominates the pharmaceutical sector, both in consumption and development. According to STAT, prescription drug spending in the nation is considered to add up to USD 600 billion by 2023, up from an estimated USD 500 billion in 2019.

- Manufacturers in the sector rushed their resources and pushed for quicker manufacturing and packaging procedures as a result of COVID-19's considerable impact on the demand for vials, medications, and other products. Due to supply chain issues in the Asia-Pacific region, which holds a prominent position when it comes to pharmaceutical raw materials as well as packaging industry raw materials, there was a significant shortage of materials for both CMOs and CPOs in the market during the early months of the pandemic, which caused slower manufacturing and packaging.

US Pharmaceutical Contract Packaging Market Trends

Increasing Outsourcing Volumes by Major Pharmaceutical Companies

- With cost containment a priority, especially in the era of the COVID-19 pandemic and the threat of other previously unimagined business disruptions, the race to contract packaging of life-saving drugs for trusted service providers is accelerating.

- Also, the development and manufacturing of medications is a capital-intensive business. With margins shrinking for generics, manufacturers are reducing the scale of their investments within this category. Outsourcing the packaging mechanism enables companies to work with packaging experts while reducing the packaging expenses of the drugs.

- Owing to the increasing demand in the market, in October 2021, Tjoapack, a Netherlands-based contract packaging organization serving the pharmaceutical industry, acquired US-based Pharma Packaging Solutions ("PPS"), a leading healthcare packaging services business based in Clinton, TN. Tjoapack's acquisition of PPS creates an opportunity to build a new global leader in contract packaging and supply chain services for the pharmaceutical market. The acquisition supports Tjoapack's growth strategy and is indicative of our commitment to customers

Blister Packs to Hold the Highest Market Share

- Blister packaging is mostly used to provide barrier protection from moisture, gas, light, and temperature and longer shelf life. Blister packaging helps retain product integrity as drugs that are pre-packed in blisters are shielded from adverse conditions. Blister packs are mainly used for packaging pharmaceutical products, such as OTC drugs and medicines (capsules), and small medical devices.

- The growing demand for the pharmaceutical industry is one of the primary drivers of the blister packaging demand in the North American region. The implementation of FDA regulations that require that all prescribed pharmaceuticals that are dispensed in hospitals and nursing homes are to be packaged in unit-dose formats, including barcodes to reduce dispensing errors, has also increased the sales of blister packs over the past few years.

- In the United States, blister packaging is used for products that are not behind the prescription counter, such as allergy medication or chewing gum. The US retailers and consumers are catching up with the rest of the world when it comes to packaging prescribed medications. The demand for blister packaging is increasing in the country.

- The US pharmaceutical market is among the world's most important national markets. The United States alone holds over 45% of the global pharmaceutical market. It is expected that almost USD 60 billion is spent annually on pharmaceutical R&D purposes in the country.

- Pharmaceutical companies are stringent about their policies regarding drug safety and effectiveness of drug packaging, and this, in turn, is leading to an increase in pharmaceutical packaging such as blister packs, thereby, driving the market's growth positively.

US Pharmaceutical Contract Packaging Industry Overview

The United States Pharmaceutical Packaging market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. However, with extensive adoption of prescription drugs and vaccines is increasing the demand in the market. Many companies are increasing their market presence by securing new contracts and by tapping new markets.

- December 2021 - KD Pharma Group, an international contract manufacturer for the pharmaceutical and nutraceutical industries, announced recently that it has acquired the manufacturing assets of the former Rohner AG, a chemical manufacturer based in Switzerland.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91407

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the market

- 4.4 Market Drivers

- 4.4.1 Cost-Effectiveness Of The Outsourcing

- 4.4.2 Access to the advanced technologies and expertise

- 4.5 Market Restraints

- 4.5.1 Monitoring issues and lack of standardization

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Primary

- 5.1.1.1 Medical Pouches

- 5.1.1.2 Blister Packs

- 5.1.1.3 Cartridges and Syringes

- 5.1.1.4 Vials

- 5.1.1.5 Ampoules

- 5.1.1.6 Others Product Types

- 5.1.2 Secondary

- 5.1.3 Tertiary

- 5.1.1 Primary

- 5.2 Material Type

- 5.2.1 Plastic

- 5.2.2 Paper & Paperboard

- 5.2.3 Glass

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Thermo-Pak Co., Inc.

- 6.1.2 Aphena Pharma Solutions

- 6.1.3 Sonic Packaging Industries, Inc.

- 6.1.4 Assemblies Unlimited, Inc.

- 6.1.5 Action Pak, Inc.

- 6.1.6 AmeriPac, Inc.

- 6.1.7 MBK Tape Solutions

- 6.1.8 Elitefill, Inc.

- 6.1.9 Tru Body Wellness

- 6.1.10 Deluxe Packaging

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.