Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1632110

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1632110

China Mobile Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

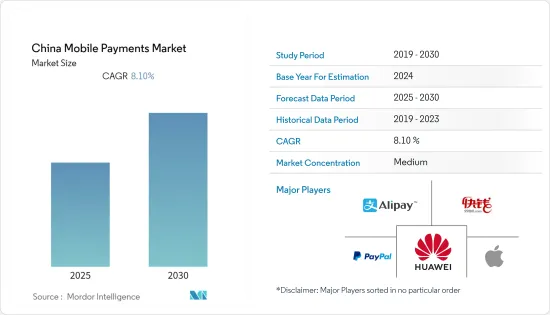

The China Mobile Payments Market is expected to register a CAGR of 8.1% during the forecast period.

Key Highlights

- The mobile payment landscape across China is changing rapidly, owing to digital transformation. The technological advancement in the smartphone has enabled on-the-go fund transfer and POS at retail terminals, which are fueling the global market growth.

- The growth of China's mobile payment business is attributed to three factors, a friendly regulatory environment, a supply shortage of payment services, and recent technological developments. With substantial access, low cost, and reliable transactions, commercial business models and people's daily lives have been changed significantly.

- China's two largest mobile payment service operators, Alibaba and Tencent, ventured into the payment industry with already massive customer bases from their e-commerce and messaging businesses, respectively. On top of this inherent advantage, Chinese consumers generally seem to place more value on the benefits of convenience, speed, and the ability to access financial means brought by mobile payments.

- Limited credit card use and the centralized nature of China's e-commerce market have facilitated the rapid expansion of mobile payments in China. This is also accentuated by the fact that making payments using QR codes in China is a lot easier as compared to other countries, as the codes are readily available everywhere, thereby, proliferating mobile payments even in rural areas.

- With the increasing number of mobile users, the number of security concerns associated with mobile payments is on the rise, too hindering the market growth. For example, malicious app clones are a major problem when it comes to android phones as such apps are either published on alternate, less regulated app stores or distributed as standalone.apk packages. In the case of iOS fraudsters target via jail-broken devices.

China Mobile Payments Market Trends

Proximity Payment Expected to Drive the Market Growth

- The scope for proximity-based Mobile Payments in the market studied encompasses NFC and QR code-based payments. This type of payment requires the mobile phone to make contact with a payment hardware in the immediate vicinity.

- Proximity payment makes use of Near Field Communication (NFC) technology for such payment facilitation. It consists of a small antenna within a smartphone that allows bi-directional communication with NFC readers (contactless POS) to perform contactless payment transactions. Its adoption is favored by the growing NFC-enabled smartphone base and by the already established underlying POS infrastructure, the same that supports contactless credit/debit cards.

- Proximity mobile based payment is dependent on the vast majority of new smartphones are equipped with a NFC chip along with increasing number of outlets. The mainstream usage of such technology will enable consumers to purchase goods and service directly at the point-of-sale using their mobile phone.

- Retailers, in addition, are required to decide on the mobile payment solution to adopt and support based on the relative ease of adoption and use for customers and the ease of implementation for the retailer. The overall retail industry additionally observes that the global population with the younger generation of smartphone-enabled consumers are among the prime drivers of demanding the shopping convenience in-store and proximity payments.

- The COVID-19 impact observes as a potential way for NFC-based contactless payments as it will reduce the need to physically touch a payment terminal.

Retail Industry Expected to Drive the Market Growth

- The e-commerce sector in China is expected to register high growth due to the proliferation of mobile payments and the presence of key players, such as Alibaba, JD.com, and Tmall. The use of online payment methods is rising due to the convenience of mobile shopping and increased spending by consumers, specifically in smaller cities and rural areas. According to CNNIC, as of December 2021, around 81.6% of internet users in China had shopped online, increasing from around 79.1% by the end of 2020.

- Online retail or e-commerce came to a significant halt in China due to the global COVID-19 outbreak, leading to a worldwide lockdown. However, online groceries have significantly increased their market presence, as Chinese citizens are urged to stay at home and are increasingly buying groceries online. Also, online grocery retailers are stimulating online buyers to engage in cashless payments as a measure of safety, which is further expected to increase the traction of mobile payments.

- The evolution of mobile-based POS (mPOS) includes a card reader connected to a basic ePOS app running on a tablet or smartphone. Merchant onboarding is simple and the service is delivered on a 'pay-as-you-go' model. With initial target being the micromerchants, it has observed a quick adoption by large enterprises as well, for its convenience, competitive pricing, and value to the business and adding a new store concepts. Such POS terminals accept payments through mobile wallets while scanning the QR code generated through the terminal.

- The online retail or e-commerce witnessed a major boom in China, as a result of the COVID-19 outbreak. The online groceries have significantly increased their market presence, as the Chinese citizens are urged to stay at home and are increasingly buying groceries online. Also, the online grocery retailers are stimulating the online buyers to make cashless payments, as a measure of safety, which is further expected to boost the mobile payments market.

China Mobile Payments Industry Overview

The China Mobile Payments Market is moderately competitive, with a considerable number of regional and global players. Key players include WeChat (Tencent Holdings Limited), Paupal Inc., AliPay, Huawei Device Co., and 99bill

- October 2021 - Alipay and WeChat Pay are giving state-owned bank card clearinghouse UnionPay even more access to their mobile payment ecosystems. Ant Group-owned Alipay announced payment QR codes through UnionPay's Cloud QuickPass app for offline payments in every city across China. In Beijing, Guangzhou, Shenzhen, Tianjin, Chengdu, Chongqing, Xi'an, and other important Chinese cities, the QR code feature is available.

- January 2021 - PayPal Holdings Inc has become the first foreign company in China to have complete control of a payment platform. According to shareholder data from the National Enterprise Credit Information Publicity System, PayPal purchased the remaining 30% ownership in China's GoPay, formally known as Guofubao Information Technology Co., on December 2020.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 91359

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Internet Penetration and Growing M-Commerce Market

- 5.1.2 Increasing Number of Loyalty Benefits in Mobile Environment

- 5.2 Market Challenges

- 5.2.1 Security Issues Associated with Mobile Payments

- 5.3 Market Opportunities

- 5.4 Key Regulations and Standards in the Mobile Payments Industry

- 5.5 Analysis of Business Models in the Industry

- 5.6 Analysis on Enabling Technologies (Coverage to include NFC, QR, etc.)

- 5.7 Commentary on the growth of Mobile Commerce and its influence on the Market

6 MARKET SEGMENTATION

- 6.1 By Type (Market share in percentage based on relative adoption)

- 6.1.1 Proximity Payment

- 6.1.2 Remote Payment

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AliPay

- 7.1.2 99bill

- 7.1.3 Google LLC (Alphabet Inc.)

- 7.1.4 Samsung Group

- 7.1.5 Apple Inc

- 7.1.6 WeChat (Tencent Holdings Limited)

- 7.1.7 Visa Inc.

- 7.1.8 PAYPAL INC.

- 7.1.9 Huawei Device Co.,

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.