PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1632092

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1632092

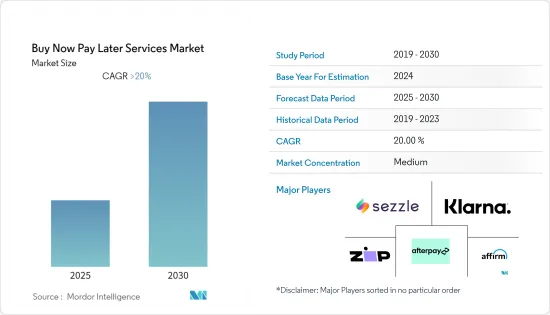

Buy Now Pay Later Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Buy Now Pay Later Services Market is expected to register a CAGR of greater than 20% during the forecast period.

Due to an increase in customers purchasing items through online channels to limit the transmission of the coronavirus during the COVID-19 pandemic, the buy now pay later payment platform has seen a large surge. Furthermore, major payment solution providers like Visa and Mastercard have established partnerships to offer reasonable insinstallmentnancing options, which will help the industry thrive throughout the epidemic. Furthermore, during the COVID-19 pandemic, consumer spending on health care, the cost of luxury electronic devices, and the usage of online payment services are all major elements that boosted the expansion of the purchase now pay later market.

Retailers are increasingly offering buy now, pay later options, allowing customers to acquire everyday necessities by selecting an affordable financing plan and paying in installments rather than paying the whole pricinstallmentsce. Several business owners across Canada have been utilizing the buy now pay later payment platform to finance significant equipment, purchase raw materials, and pay staff salaries, fueling the buy now pay later market's expansion. Furthermore, as a result of the increased adoption of buy now pay later payment technology among the youth, which provides several benefits such as purchasing high-cost smartphones and laptops, paying tuition fees and stationery products, and paying the canteen bill, the buy now pay later market is expected to grow.

Canada Buy Now Pay Later Market Trends

People are Increasingly Using Online Payment Methods

The use of online payment methods by consumers in emerging countries such as Canada is speeding up the expansion of the buy now pay later payment business. The primary digital payment technologies include mobile payment, debit cards, and credit cards, which provide individuals with several benefits such as lower transaction costs, faster cash transfers, and increased payment security, all of which contribute to the expansion of the buy now pay later industry. The availability of high-speed internet access, a boom in smartphone use, and increased knowledge of digital payment services are all essential elements that encourage individuals to use online payment technologies.

Buy Now Pay Later Platforms Offer an Affordable and Convenient Payment Service

The buy now pay later payment method provides individuals with several benefits, including economical and convenient payment services, fast credit card money transfer service at the point of sale platform, and increased personal information security, all of which contribute to the market's growth. Furthermore, the buy now pay later platform supports a QR-code option, which allows individuals to make payments using a scan code and to conduct transactions using UPI techniques, further propelling the market's growth. Furthermore, the buy now pay later platform enables consumers to make safe payments without swiping their debit card, boosting market development across Canada.

Canada Buy Now Pay Later Industry Overview

The report covers major players operating in the Canada Buy Now Pay later Services Market, their product portfolio, key financials, and developments. The market is transforming with many technological advancements through product innovation and process automation. The key market players are focusing on improving their production capacity, which will help them to increase exports.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Insights on Various Regulatory Trends

- 4.5 Insights on impact of technology and innovation

- 4.6 Industry Attractiveness - Porters' Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Channel

- 5.1.1 Online

- 5.1.2 POS

- 5.2 By Enterprise Size

- 5.2.1 Large

- 5.2.2 SME

- 5.3 By End Use

- 5.3.1 Consumer Electronics

- 5.3.2 Fashion & Garment

- 5.3.3 BFSI

- 5.3.4 HealthCare

- 5.3.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Afterpay

- 6.2.2 Sezzle

- 6.2.3 ZIP

- 6.2.4 Klarna

- 6.2.5 Affirm

- 6.2.6 PayPal Holdings Inc.

- 6.2.7 Laybuy Group Holdings Limited

- 6.2.8 Prepay

- 6.2.9 Interac

- 6.2.10 Neteller*

7 MARKET OPPORTUNTIES AND FUTURE TRENDS

8 DISCLAIMER AND ABOUT US