PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1632064

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1632064

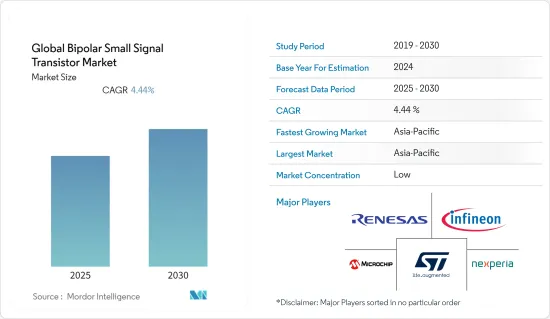

Global Bipolar Small Signal Transistor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Bipolar Small Signal Transistor Market is expected to register a CAGR of 4.44% during the forecast period.

During the production of electric vehicles, many types of transistors are employed. The recent growth of the automotive industry is significantly driving the growth of the studied market. For instance, according to the International Energy Agency (IEA), Electric car sales doubled in 2021 compared to 2020 and reached 6.6 million. In 2021, electric automobiles accounted for approximately 9% of the worldwide car market, more than doubling their market share from two years earlier.

Considering the potential, the automotive industry is contributing significantly to the studied market's growth. The vendors are increasingly focusing on developing products that can have applications in the automotive sector. For instance, Onsemi's MMBT6521L is an NPN bipolar small signal transistor designed for linear and switching applications.

Similarly, to cover the market extensively, ROHM, a leading provider of electronic components and semiconductor devices, offers automotive bipolar transistors in various packages with the nature of small-signal, thin, and high-power.

The major challenge for market participants is keeping up with the growing trend of downsizing electronic devices and shrinking transistor sizes while maintaining high component performance efficiency. To attain full functioning, new technologies such as electron beam or x-ray technology will be required to be implemented in production processes. Advanced fabrication factories must be set up, which will be quite expensive for the producers.

The Covid-19 pandemic has negatively impacted the bipolar small signal transistor market by reducing the total global consumption of electronic devices. Due to supply chain disruptions, the pandemic has severely affected the global manufacturing sector. It has affected various end-users of bipolar small signal transistors by downsizing their businesses.

Bipolar Small Signal Transistor Market Trends

Increasing Consumption of Consumer Electronic Goods to Drive the Market Growth

The demand for consumer electronic products and the usage of electronics across industries has been increasing, directly or indirectly impacting the bipolar small signal transistor market to growth. Bipolar small-signal transistors are used throughout consumer electronics applications such as smartphones, tablets, portable consumer products, linear and switching, etc.

The smartphone is the major consumer of semiconductors in this segment as these transistors are used primarily for the amplification of signals the smartphone sends to the base station. Hence, with the number of mobile subscriptions growing, the increasing usage of mobile phones is anticipated to drive the global market. For instance, according to Ericsson, By the end of 2027, 5G mobile subscriptions are expected to reach 4.4 billion.

Such trends are encouraging the vendors to develop products that can fulfill the requirements of the consumer electronic sector. For instance, Toshiba offers an extensive lineup of bipolar transistors ranging from small-signal, surface-mounted, ultra-small transistors to power transistors with lead-type packages, including high current, low-saturation, and ultra-high-speed types.

Since the outbreak of COVID-19, many institutions have started implementing virtual learning methods and offering online courses. The surge in digitization in educational institutions is one of the key factors driving the increase in devices such as computers, laptops, and tablets. As a result, the increased demand for computers and peripherals in the education sector is expected to positively influence the growth of the studied market.

Asia-Pacific Region is Expected To Witness Significant Growth

Asia-Pacific is the fastest-growing transistor market because of the region's growing economy. China, Japan, South Korea, and India are among the major countries wherein the end-user sectors such as manufacturing, consumer electronics, and automotive have grown significantly over the past few decades.

For instance, the Chinese government has launched "Made in China 2025," a state-led industrial program to make China the world's leading manufacturer of high-tech goods. The program aims to leverage government subsidies, mobilize state-owned firms, and seek intellectual property acquisition to catch up to and eventually surpass Western technological superiority in sophisticated sectors.

Additionally, robotic solutions are increasingly being used, as factories across the region are fast becoming automated. For instance, in March 2021, Fanuc, a Japanese industrial robot manufacturer, invested JPY 26 billion in its Shanghai facility. The investment was made through a joint venture with Shanghai Electric Group, a local company. As these transistors are used inside robots primarily as electronic switches, the demand is expected to increase during the forecast period.

Furthermore, to bring the cost of electric vehicles at par with petrol vehicles, the government, under the Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles in India scheme, supports electric vehicles and demand incentives. For instance, under Phase II of the FAME India Scheme, the Ministry of Heavy Industries has sanctioned 2877 charging stations in 68 cities across 25 states/UTs. Such trends are expected to positively impact the bipolar small signal transistor, owing to the need for electronic devices in the infrastructural development for EV service stations.

Bipolar Small Signal Transistor Industry Overview

The bipolar small signal transistor market is competitive, with various global key market players. For instance, the majority of vendors such as STMicroelectronics, Renesas Electronics Corporation, Infineon Technologies AG, Microchip Technology Inc. WEE Technology Company Limited provide Bipolar small-signal transistors and are having significant global presence. To achieve market differentiation, the vendors focus on new product launches that deal with a specific application.

April 2022 - Linear Integrated Systems, Inc., a designer and manufacturer of precision, high-performance, small-signal discrete semiconductors, announced the release of its 2022 Small Signal Discrete Data Book. Bipolar Single and Dual NPN and PNP Transistors Products included in the 2022 Linear Systems Data Book.

July 2021 - Nexperia announced nine new power bipolar transistors. These recent announcements will extend the company's portfolio of products in the thermally and electrically advantageous DPAK package to cover applications from 2 A to 8 A and from 45 V up to 100 V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Consumer Electronics and Increased Use of Electronics in the Industrial Sector

- 5.1.2 Growth of the Automotive Sector

- 5.2 Market Restraints

- 5.2.1 Scaling Down the Size of Transistors and Simultaneously maintaining High Performance

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PNP

- 6.1.2 NPN

- 6.2 By End-user Industry

- 6.2.1 Manufacturing

- 6.2.2 Automotive Applications

- 6.2.3 Communication

- 6.2.4 Consumer Electronics

- 6.2.5 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 Infineon Technologies AG

- 7.1.4 Microchip Technology Inc.

- 7.1.5 WEE Technology Company Limited

- 7.1.6 Nexperia B.V

- 7.1.7 Semiconductor Components Industries, LLC

- 7.1.8 Diodes Incorporated

- 7.1.9 Central Semiconductor Corp

- 7.1.10 National Instruments Corp

8 INVESTMENTS ANALYSIS

9 FUTURE OF THE MARKET