PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631637

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631637

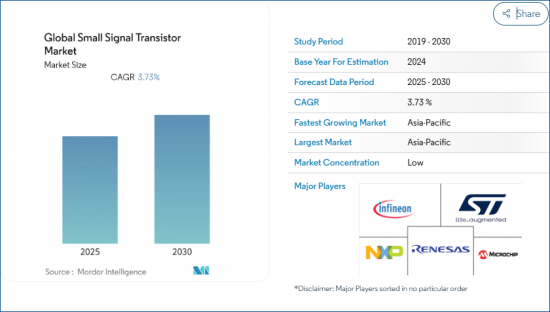

Global Small Signal Transistor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Small Signal Transistor Market is expected to register a CAGR of 3.73% during the forecast period.

Key Highlights

- Transistors have always played a central role in many electronic circuits, where they usually function either as a switch or an amplifier. Small Signal Transistors are transistors that can be used to both amplify and switch low-level signals.

- For small-signal transistors, typical hFE values range from 10 to 500, with maximum Ic ratings ranging from 80 to 600mA. The maximum operational frequencies are between 1 and 300 MHz. Small signal transistors are widely used in all segments and for applications in almost all equipment.

- On/off switches for general use, bias supply circuits, LED diode driver, infrared diode amplifier, relay driver, timer circuits, audio mute function, and so on. Sensors, microcontrollers, and memory devices are in more demand as IoT devices become more prevalent. Growing demand for power electronics is a major trend driving market expansion. Small signal transistors are becoming more popular as the demand for power electronics grows in end-user sectors.

Small Signal Transistor Market Trends

The significant growth in the consumer electronics sector is analyzed to boost the demand for small signal transistors

- Transistors represent one of the significant innovations in the electronics industry. This can be accredited to their high electron mobility, wide temperature limits, and low energy consumption. According to the Semiconductor Industry Association (SIA), Global semiconductor sales reached USD 137.7 billion during the first quarter of 2024, an increase of 15.2% compared to the first quarter of 2023.

- Consumer electronics (CE) forms a multibillion-dollar industry, steadily progressing and developing with the technology and adding new product lines toward changing lifestyles. With the advent of IoT, various end-user industries are increasingly adopting the advanced solution to enhance their operations.

- Small-signal transistors are mostly used to enhance small signals, such as a few volts, and only when mill amperes of current are used. Modern electronic devices make use of these transistors. During the forecast period, a surge in demand for the manufacturing of consumer electronics and smartphones is analyzed to boost demand for these transistors globally.

- The smartphone is the major consumer of semiconductors in this segment. The smartphone market has been very competitive in recent years. The increasing usage of mobile phones is further anticipated to drive the global market. For instance, according to Ericsson, the monthly smartphone data traffic per smartphone in North America is forecasted to amount to 18.52 exabytes (GB) per active device by 2028. In 2023, the average data traffic per smartphone amounted to 9.78 EB per month.

Asia Pacific is Expected to Register the Fastest Growth Rate

- The Chinese government's Made in China 2025 national strategic plan has also been a significant factor in the publications' rise. The central aim of the plan is the growth of the semiconductor industry. Also, China's National Intellectual Property Administration (CNIP) 2021 budget anticipates 2 million filings per year till 2023.

- In May 2024, Infineon Technologies AG has unveiled two advanced generations of CoolGaN devices designed for high-voltage (HV) and medium-voltage (MV) applications. These advancements empower customers to harness Gallium Nitride (GaN) technology across a wider voltage spectrum, spanning from 40 V to 700 V. This expanded range of applications bolsters digitalization efforts and plays a pivotal role in advancing decarbonization initiatives. Notably, both product lines are meticulously crafted using 8-inch in-house foundry processes, with manufacturing hubs in Kulim (Malaysia) and Villach (Austria).

- The semiconductor market in Taiwan is also growing due to support from the government. In October 2023, Toshiba Electronics Europe GmbH ("Toshiba") has introduced the TLP3475W, a photorelay designed to minimize insertion loss and power attenuation in high-frequency signals. This device is aimed at semiconductor testing applications, including high-speed memory testers, logic testers, and probe cards. The TLP3475W features an optimized package design that reduces parasitic capacitance and inductance, thereby decreasing signal insertion loss in the 20GHz frequency range (typical). This improvement represents a 1.5x enhancement in performance over the previous TLP3475S model.

- Moreover, China is witnessing multiple investments from companies such as TSMC, as well as local companies such as Huawei are entering into producing their chips as the US embargo has made it significantly difficult for Huawei to buy chips, so it has no other alternative but to develop the capability to manufacture for itself.

Small Signal Transistor Industry Overview

The market for small signal transistors is highly competitive. The semiconductor industry is undergoing a specialization period. Historically, the industry has focused on manufacturing computer chips that can perform various jobs. These chips were somewhat connected. However, today's semiconductor applications are more complex and varied, resulting in the emergence of several niche businesses with specialized knowledge across many verticals. Furthermore, apart from a few significant firms like Intel, which design, fabricate, and manufacture semiconductor goods, many players in this market outsource their operations. This has made the sector highly competitive and deeply collaborative, as it is tightly integrated into global supply chains. The factors mentioned above make the next-generation transistors market a fragmented market with the presence of many players.

In April 2022, Linear Integrated Systems, Inc., a designer and manufacturer of precision, high-performance, small-signal discrete semiconductors, announced the release of its 2022 Small Signal Discrete Data Book.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Forces of Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Consumer Electronics and Increased Use of Electronics in the Industrial Sector will Drive the Demand

- 5.1.2 Growing demand for IoT

- 5.2 Market Restraints

- 5.2.1 Adoption of power transistors is analyzed pose a challenge for the market

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 PNP

- 6.1.2 NPN

- 6.2 By Application

- 6.2.1 Manufacturing

- 6.2.2 Automotive applications

- 6.2.3 Communication

- 6.2.4 Consumer electronics

- 6.2.5 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NXP Seminconductors N.V

- 7.1.2 ST Microelectronics

- 7.1.3 Renesas Electronics Corporation

- 7.1.4 Infenion Technologies AG

- 7.1.5 Semiconductor Components Industries, LLC(Onsemi)

- 7.1.6 WEE Technology Company Limited

- 7.1.7 Nexperia

- 7.1.8 Microchip Technology Inc.

- 7.1.9 Diodes Inc.

- 7.1.10 Central Semiconductors Corporation

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS