PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631632

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631632

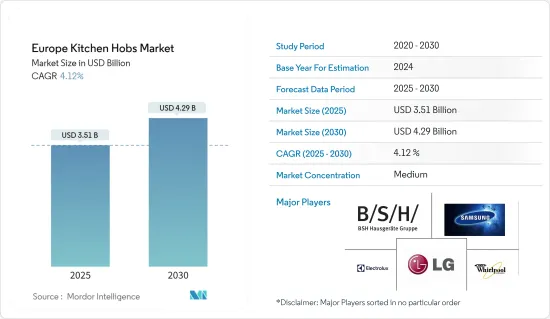

Europe Kitchen Hobs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Europe Kitchen Hobs Market size is estimated at USD 3.51 billion in 2025, and is expected to reach USD 4.29 billion by 2030, at a CAGR of 4.12% during the forecast period (2025-2030).

Kitchen appliances in Europe are evolving to become more connected and intelligent thanks to advancements in smart home technology. Features like Wi-Fi connectivity, remote control through smartphone apps, and compatibility with virtual assistants such as Amazon or Google Assistant are gaining popularity among consumers. These smart functions enable users to remotely monitor and control their hobs, adjust cooking settings using voice commands, and receive alerts and notifications for added convenience.

The rising popularity of induction technology is a key trend in the European kitchen hobs market. Induction hobs are favored by consumers for their sustainability, convenience, rapid heating, precise temperature control, and energy efficiency. European consumers are increasingly opting for kitchen appliances with sleek, modern designs that complement contemporary cooking styles.

The rapid growth of e-commerce has emerged as a significant competitor to traditional sellers, offering highly competitive discounts and promotions. This segment has become the fastest-growing distribution channel in the current year, especially after the prolonged closure of physical stores during the COVID-19 pandemic. Increased competition and consumer demand for innovative products are expected to boost the kitchen hobs market in Europe. The growth is fueled by advancements in product technology, performance, features, and design. The demand for kitchen hobs in Europe is further fueled by rising purchasing power, growing disposable income, and evolving style trends in kitchen appliances. Distribution channels are shifting toward outlets with substantial discounts, including private label stores and large markets offering tax rebates and partnerships with manufacturers.

Europe Kitchen Hobs Market Trends

Rising Urbanization Propelling Market Expansion

The rising trend of urbanization and the improved safety features of kitchen hobs are playing a significant role in the increasing adoption of kitchen hobs in Europe. European consumers are opting for energy-efficient kitchen products to minimize their utility bills, as they are relatively cost-effective. The growing working population and the rising consumption of quick food have given rise to an increased awareness among customers about health. Recently, there has been a surge in demand for induction cooktops, which cook food easily with less oil. This trend is expected to have a positive impact on the induction cooktop market during the forecast period.

Induction hobs are considered safer than gas hobs due to the absence of open flames. Hobs like induction hobs and electric plate hobs are preferred because they require less time and energy to cook and can even be used at low temperatures. The increase in gas prices has become a constraint for the growth of gas and gas-on-glass hobs, leading people to explore alternatives such as energy-efficient hobs.

Surging Construction Projects Fueling Growth in the UK Market

Kitchen hobs have become a staple in both homes and businesses across the United Kingdom. While they can be integrated into kitchen designs or used as standalone units, they are predominantly installed as permanent fixtures.

The UK kitchen hob market is poised for steady growth in the coming years, fueled by a surge in construction activities in both residential and commercial sectors, a trend driven by rapid industrialization and urbanization. This uptick in construction projects, spurred by heightened investments, stands as the primary catalyst for the market's expansion. Furthermore, the allure of advanced hob features boasting enhanced reliability, sustainability, and energy efficiency is steering consumers away from traditional gas stoves and toward modern hobs.

Europe Kitchen Hobs Industry Overview

The European kitchen hobs market is moderately consolidated in terms of market share. Some of the major international players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. The major players in the market are Samsung, Whirlpool, Arcelik, BSH Hausgerate GmbH, and Electrolux.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Urbanization Leads to Increased Demand for Kitchen Appliances

- 4.2.2 Growing Construction Sector

- 4.3 Market Restraints

- 4.3.1 High Power Consumption From Smart Home Appliances

- 4.4 Market Opportunities

- 4.4.1 Energy Efficiency Norms Leads to Increased Demand for Kitchen Appliances

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into Latest Technologies Used in the Industry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Ceramic Hobs

- 5.1.2 Induction Hobs

- 5.1.3 Electric Plate Hobs

- 5.1.4 Gas Hobs

- 5.1.5 Other Products (Stainless Steel, Domino Hobs, and Gas on Glass Hobs)

- 5.2 By Distribution Channel

- 5.2.1 Multi-brand Stores

- 5.2.2 Specialty Stores

- 5.2.3 Online Stores

- 5.2.4 Other Distribution Channels (Manufacture Retailers, Warehouse Clubs, Discount Retailers, and Direct Selling Companies)

- 5.3 By Geography

- 5.3.1 France

- 5.3.2 United Kingdom

- 5.3.3 Germany

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Samsung

- 6.2.2 Whirlpool

- 6.2.3 Arcelik AS (Beko)

- 6.2.4 BSH Hausgerate GmbH

- 6.2.5 Electrolux

- 6.2.6 Daikin Industries Ltd

- 6.2.7 Miele & Cie. Kg

- 6.2.8 FABER SpA

- 6.2.9 Elica SpA

- 6.2.10 LG Electronics*

7 FUTURE MARKET TRENDS

8 DISCLAIMER AND ABOUT US