Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631623

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631623

Southeast Asia Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 125 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

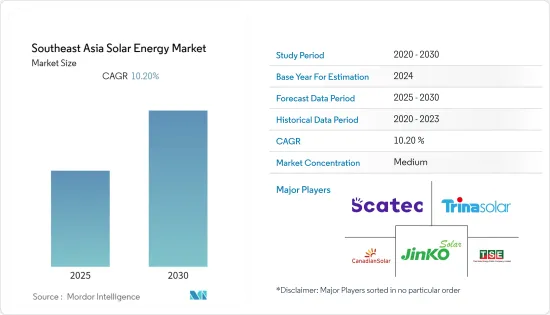

The Southeast Asia Solar Energy Market is expected to register a CAGR of 10.2% during the forecast period.

Key Highlights

- Over the medium term, factors such as increasing renewable energy installation to reduce carbon emissions and the decreasing price of solar PV modules drive the market for solar Energy.

- On the other hand, the increasing adoption of alternative renewable technologies like hydropower is expected to hinder market growth during the study period.

- Nevertheless, supportive government policies towards renewable Energy and technological advancements in solar energy equipment are expected to increase the opportunity for solar energy companies to install solar PV plants in the region during the upcoming years.

- Vietnam is expected to be the largest market in Southeast Asia due to its increasing demand for electricity and the rising number of renewable energy installations, and their connection to the country's grid.

Southeast Asia Solar Energy Market Trends

Solar Photovoltaic Expected to Dominate the Market

- Southeast Asia is one of the lucrative solar energy markets with the fastest growth and one of the most promising places for the solar photovoltaic industry to grow worldwide.

- In July 2022, Solarvest Holdings Berhad, a Southeast Asia clean energy company and turnkey engineering, procurement, construction, and commissioning (EPCC) service provider, ordered 93 MW of advanced thin-film photovoltaic (PV) solar panels from First Solar for use in their four projects in Malaysia's Large Scale Solar Program (LSS).

- Some things that have helped the solar power industry grow in the region are the rising need for electricity, the many solar resources in the area, and the policies supporting renewable energy.

- Also, policymakers in different countries in the region have been working harder to make sure the energy sector has a safe, affordable, and long-term path. This includes making things easier for people to invest in solar power generation and infrastructure.

- According to the International Renewable Energy Agency, the total solar PV installed capacity accounted for 3060 MW in Thailand in 2022. The solar PV capacity is expected to grow in the forecast period as demand for renewable power and greener energy increases.

- In July 2022, the Ministry of Industry and Trade (MOIT) of Vietnam submitted a report to the Prime Minister on the process for transitional wind and solar power projects. The MOIT presented various recommendations in this study to directly address challenges for outstanding wind and solar power projects and the development of wind and solar power projects.

- Thus, owing to the above factors and upcoming projects are taken into account, solar PV is expected to be a significant part of the market during the study period.

Vietnam to Dominate the Market

- The energy demand in Vietnam is projected to increase by more than 10% annually through 2030 and requires power capacity to double; the Vietnamese government is moving quickly to diversify its energy mix, including plans to generate more power from renewable sources.

- Based on its favorable geographical conditions, Vietnam has a high potential for solar energy production, with 1,600-2,700 sunlight hours per year and an average direct normal irradiance of 4-5 kWh per sqm per day. The country also has a well-developed grid infrastructure, government incentives, and a standardized power purchase agreement (PPA) for solar power projects.

- In 2022, Vietnam's total installed solar photovoltaic (PV) capacity reached 18.5 GW, representing an increase of 9.8% compared to 2021. This huge rush in the Vietnamese solar PV market can be attributed to the attractive feed-in-tariff (FIT) rates introduced in 2017 and a few large-scale solar projects commissioned in 2020.

- In June 2023, GreenYellow Vietnam, a subsidiary of French energy management company GreenYellow, announced to completion of a 750 KWp rooftop solar power project for Dong Anh Chainsaw. This project is the largest rooftop solar power project for GreenYellow Vietnam. The solar panels were installed on the roof of Dong Anh C&F's factory in Dong Anh District, Hanoi, Vietnam, and they will generate over 1,000,0000 KWh of electricity per year.

- Therefore, commissioning these projects is likely to boost the sector in Vietnam during the study period.

Southeast Asia Solar Energy Industry Overview

The Southeast Asia Solar Energy Market is moderately fragmented. Some of the major players in the market (in no particular order) include Canadian Solar Inc., JinkoSolar Holding Co. Ltd., Trina Solar Limited, Thai Solar Energy Public Company Limited, and Scatec ASA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 72378

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Southeast Asia Solar Energy Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Renewable Energy Installation to Reduce the Carbon Emission

- 4.5.1.2 The Decreasing Price of Solar PV Modules

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adoption of Alternative Renewable Technologies like Hydropower

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solar Photovoltaic

- 5.1.2 Concentrated Solar Power

- 5.2 Geography

- 5.2.1 Vietnam

- 5.2.2 Indonesia

- 5.2.3 Philippines

- 5.2.4 Thailand

- 5.2.5 Malaysia

- 5.2.6 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Canadian Solar Inc.

- 6.3.2 JinkoSolar Holding Co. Ltd.

- 6.3.3 Trina Solar Limited

- 6.3.4 Thai Solar Energy Public Company Limited

- 6.3.5 Scatec ASA

- 6.3.6 Vena Energy Solar Pte Ltd.

- 6.3.7 Blue Solar Co., Ltd.

- 6.3.8 Johnsolar Energy Co. Ltd.

- 6.3.9 LONGi Green Energy Technology Co Ltd.

- 6.3.10 Solarie Energy

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Supportive Government Policies Towards Renewable Energy and Technological Advancements in Solar Energy Equipment

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.