Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631621

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631621

Spain Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 95 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

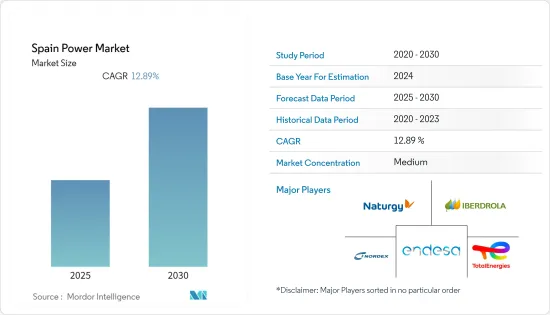

The Spain Power Market is expected to register a CAGR of 12.89% during the forecast period.

Key Highlights

- Over the medium term, favorable government policies and increasing penetration of renewable energy in power generation will likely support Spain's Power Market growth during the forecast period.

- On the other hand, factors such as high initial capital investments for power-generating equipment are likely to hinder market growth during the study period.

- Nevertheless, an increase in the adoption of renewable energy sources coupled with energy storage systems is expected to create several opportunities for the market in the future.

Spain Electricity Market Trends

Renewable Expected to be a Significant Sector

- Spain is a quickly growing country adopting renewable energy sources like solar and wind energy. In Spain, renewable energy sources are primarily solar, wind, hydropower, and bioenergy power generation sources.

- According to International Renewable Energy Agency, in 2022, Spain's total installed renewable energy capacity was around 67.9 GW 2022. It increased by over 9.5% compared to the previous year's installed capacity.

- Furthermore, the government of Spain contains an ambitious renewable energy installation target. In July 2022, the government announced its plans to install more than 160 GW of renewable energy sources by 2030. It will comprise 74% of electricity generation through renewable energy sources and 100% through 2050.

- Due to the ambitious renewable energy targets, various companies entered the renewable energy market in the country. For instance, in May 2023, Siemens Gamesa announced that it had signed agreements with renewable energy company Repsol. It is to deliver its 40 SG 5.0-145 onshore wind turbine products for 6 wind farms in Palencia in, Spain, with a total wind generating capacity of 200 MW.

- Furthermore, the Government of Spain announced plans for decommissioning coal power plants by 2025, oil power plants by 2030, and nuclear power plants by the end of 2035. With the decommissioning of these energy sources, the demand for renewable energy is expected to increase significantly to make up for the decommissioned power-generating sources while matching the increasing demand for electricity in the country.

- Therefore, according to the above points, renewable energy sources will likely dominate the Spain power market during the forecasted period.

Supportive Government Policies to Drive the Market

- The supportive government policies are expected to drive the power market for Spain during the forecasted period. The country's electricity demand constantly rose due to the increasing population and infrastructure development activities.

- According to the Red Electrica de Espana, Spain's electricity transmission company, the country's electricity production capacity in 2022 increased by more than 6% compared to 2021. In 2022 the total power production was 276.31 Terra-Watthours. It signifies the increasing power demand in the country.

- The country's power generating capacity derives most power through hydraulic and combined cycle power generating sources. However, the renewable energy capacity increased significantly in recent years, and in 2022, they comprised almost 43% of the total electricity generation in the country.

- Additionally, in April 2023, the country announced they are preparing a proposal to present to the European Commission. It will look to reform its electricity market, which is looking to decrease the electricity prices for the consumer. It is at an all-time high in 2022 due to the Russia-Ukraine conflict, which affected the gas supply throughout Europe.

- The country is also working on further expanding its electricity generation capacity to gain energy independence from importing electricity through neighboring countries and importing natural gas for electricity generation.

- For instance, in March 2023, the Spanish power ministry, the Ministry of Energy Transition and Autonomous Communities, announced the approval of its 3 GWp solar energy project proposed by the French energy company TotalEnergies SA. The solar energy project will be developed in Madrid Murcia, Andalusia, and various other locations in Spain. The project is expected to reduce dependency on imported oil and gas products for power generation.

- Therefore, according to the above points, favorable government policies are expected to drive the market during the forecasted period.

Spain Electricity Industry Overview

The Spain power market is moderately consolidated. The key players in the market (in no particular order) include Endesa SA, Iberdrola SA, Naturgy Energy Group SA, Total Energies SE, Nordex SE, and EDP Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 72374

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Integration of Renewable Energy

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High infrastructure costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Power Generation Source

- 5.1.1 Thermal

- 5.1.2 Hydroelectric

- 5.1.3 Nuclear

- 5.1.4 Renewable

- 5.2 Power Transmission and Distribution

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Endesa S.A

- 6.3.2 Iberdrola SA

- 6.3.3 Naturgy Energy Group S.A

- 6.3.4 Total Energies SE

- 6.3.5 Nordex SE

- 6.3.6 EDP Group

- 6.3.7 Grupo Red Electrica

- 6.3.8 ABO Wind AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Coupling of Renewable Energy Sources with Energy Storage Systems

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.