Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631616

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631616

Southeast Asia Air Purifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

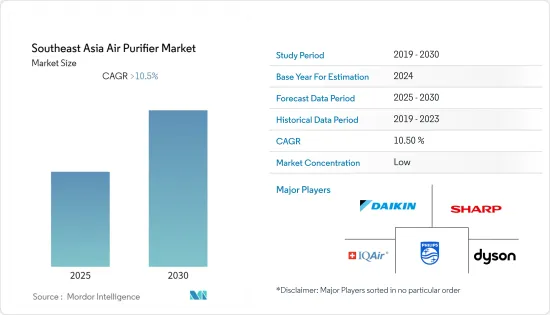

The Southeast Asia Air Purifier Market is expected to register a CAGR of greater than 10.5% during the forecast period.

The outbreak of COVID-19 had a negative effect on the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as increasing airborne diseases and growing health consciousness among consumers are driving the market. Air pollution from industries is constantly emerging as a big threat to the health of individuals as well as the environment. Due to deteriorating air quality and rising concerns about health issues, the demand for air purifiers has increased in recent years.

- Despite the various technological developments, air purifiers have been perceived as a luxury item in both underdeveloped and emerging economies, particularly in the commercial and residential segments, owing to the high installation and maintenance costs. This, in turn, is expected to hinder the growth of the market studied during the forecast period.

- Technological advancements and upgrades in developing air purifier systems are expected to create immense opportunities for the Southeast Asian air purifier market in the coming years.

- With sales of air purifiers increasing by several folds due to the public's increasing adoption of air purifiers, Indonesia is expected to dominate the market during the forecast period.

Southeast Asia Air Purifier Market Trends

High-Efficiency Particulate Air (HEPA) Expected to Dominate the Market

- Mechanical air filters, such as HEPA filters, remove particles by capturing them on filter materials. It captures large airborne particles, such as dust, pollen, mold spores, animal dander, and particles containing dust mite and cockroach allergens.

- HEPA filters are a type of extended-surface filter with a larger surface area and higher efficiencies for removing larger and smaller airborne particles. Moreover, these types of air filters remove respirable particles more efficiently than pleated filters.

- The two most common standards required for HEPA air purifiers include the capability to remove particles, i.e., 99.95% (European Standard) or 99.97% (ASME Standard), which have a size greater than or equal to 0.3 micrometers.

- Furthermore, HEPA filter applications in industrial and commercial spaces have led to high demand for the product across Southeast Asian countries. The advent of newer HEPA filters with advanced integrated technologies, designs, and new concepts is likely to increase demand for the product. The rising air pollution and worsening climatic conditions fuel the need for the work, which may boost the HEPA filter market in the coming years.

- For the last 10 years, HEPA filters have been proven across a wide range of healthcare facilities and life science applications to control the spread of airborne particles and organisms, such as viruses and bacteria. Moreover, many professional engineering organizations recommend HEPA filters in hospitals, infection control clinics, and other healthcare facilities to eliminate microbes and other dangerous particles.

- Therefore, based on the above-mentioned factors, high-efficiency particulate air (HEPA) technology is expected to dominate the market during the forecast period.

Indonesia Expected to Dominate the Market

- As of 2021, Indonesia stood in the seventeenth position in terms of the most polluted country globally, with an average of 34.3 µg/m3 PM2.5 concentration weighted by population. According to the World Air Quality Report, in 2021, Indonesia was the most polluted country in Southeast Asia.

- Moreover, as of 2021, Surabaya, Bandung, and Jakarta were the three most polluted cities in the country, with the highest annual average of PM2.5 concentrations coming from Jakarta (39.2 µg/m3 PM2.5 concentration).

- Seasonal agricultural burning practices, seasonal forest fires, rapid urban development, open burning of household waste, and reliance on coal-based energy are the primary sources of particulate pollution in Indonesia.

- Although the COVID-19 pandemic led to an improvement in global air quality, cities such as Jakarta, Indonesia, consistently recorded high PM2.5 levels, which were exacerbated by coal-fired plants working in the vicinity of the city. Moreover, Indonesia is set to build more coal-fired power plants in Jakarta, which may lead to more air pollution and increase the adoption of air purifiers.

- Therefore, based on the above-mentioned factors, Indonesia is expected to dominate the air purifier market in the Southeast Asian region during the forecast period.

Southeast Asia Air Purifier Industry Overview

The Southeast Asia air purifier market is fragmented. Some of the major players include (in no particular order) Daikin Industries, Ltd., Sharp Corporation, Koninklijke Philips N.V., IQAir, and Dyson Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 72357

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Filtration Technology

- 5.1.1 High-efficiency Particulate Air (HEPA)

- 5.1.2 Other Filtration Technologies (Electrostatic Precipitators (ESPs), Ionizers and Ozone Generators, etc.)

- 5.2 Type

- 5.2.1 Stand-alone

- 5.2.2 In-duct

- 5.3 End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.4 Geography

- 5.4.1 Indonesia

- 5.4.2 Malaysia

- 5.4.3 Thailand

- 5.4.4 Vietnam

- 5.4.5 Philippines

- 5.4.6 Singapore

- 5.4.7 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Daikin Industries, Ltd.

- 6.3.2 Sharp Corporation

- 6.3.3 LG Electronics Inc.

- 6.3.4 Unilever PLC

- 6.3.5 Dyson Ltd

- 6.3.6 Panasonic Corporation

- 6.3.7 Koninklijke Philips N.V.

- 6.3.8 IQAir

- 6.3.9 Samsung Electronics Co., Ltd.

- 6.3.10 WINIX Inc.

- 6.3.11 Xiaomi Corp.

- 6.3.12 Amway (Malaysia) Holdings Berhad

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.