Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631615

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631615

India Switchgear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

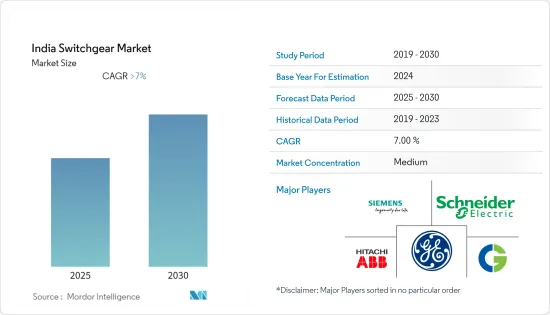

The India Switchgear Market is expected to register a CAGR of greater than 7% during the forecast period.

The outbreak of COVID-19 negatively impacted the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- The Indian switchgear market is already making sustained gains. It is expected to flourish over the forecast period with rapid population growth, urbanization, and industrialization, increasing the electricity demand. The fast improvement in the power distribution sector, owing to the increasing implementation of smart-grid and smart meters, is the fundamental factor driving the growth of the Indian switchgear market. Also, Increasing investments in the renewable energy sector in the country are expected to drive the market during the forecast period.

- However, SF6 gas used in insulating switchgear is a potent greenhouse gas with a global warming potential that may restrain the market.

- Plans to integrate renewable energy with the national grids are expected to create a significant opportunity for the switchgear market players in the near future.

Switchgear in India Market Trends

Gas Insulated Switchgear Hold Significant Market Share

- Gas-insulated switchgear (GIS) is expected to hold the largest share in the Indian switchgear market. It is a switchgear made of high-voltage parts, like circuit breakers and disconnectors, that is covered in metal. Most of the time, a GIS is used in small spaces like city buildings, offices, offshore platforms, additions, roofs, etc.

- Switchgear use is likely to go up because there are more rules to control carbon emissions as a whole and more people are becoming aware of the need to use renewable energy sources like solar.

- Compared to air-insulated switchgear (AIS), they are more environment-friendly, reliable, and flexible. Also, the installation time and maintenance costs required for GIS are less than those of AIS. The major applications of GIS are power transmission, integration of renewable power generation units into the grid, and railways.

- The major factor driving the growth is the rising energy demand and the extension or replacement of old switchgear at substations that can drive the switchgear market's gas-insulated switchgear equipment. Gas-insulated switchgear is expected to become more popular because it saves space, needs little maintenance, and keeps out the elements.

- In 2021, the total installed capacity of renewable energy reached 163 GW, which was an increase of more than 10.8% from the year before.

- Thus, the Indian switchgear market is likely to be driven by the above factors during the forecast period.

Growth in Renewable Energy Sector to Drive the Market

- Coal and lignite-fired power plants predominate in the country's power generation. Renewable and non-renewable hydropower plants also have a significant share in power generation and capacity. As of 2022, hydropower and non-hydro renewables accounted for about 20% of the total power generation.

- The infrastructure development schemes initiated by the Indian government, like Smart Cities, Make in India, Digital India, the Integrated Power Development Scheme, and the Atal Mission for Rejuvenation and Urban Transformation, among others, have significantly contributed to the growth of the switchgear market in India.

- To address the pollution-related problems in India and reduce carbon emissions, the government aims to increase the share of renewable energy.

- India's renewable energy potential is vast and untapped. It is one of the fastest-growing nations in the global renewable energy market. The country's solar potential is more than 750 GW, and its wind potential is around 302 GW. The country's energy security scenario for 2047 shows the possibility of achieving around 410 GW of wind and 479 GW of solar PV installed capacity by that year.

- Therefore, the aforementioned factors are expected to drive the market during the forecast period.

Switchgear in India Industry Overview

The India switchgear market is moderately fragmented. Some of the key players are (in no particular order) Schneider Electric SE, Siemens AG, Hitachi ABB Power Grids Ltd, General Electric Company, and CG Power and Industrial Solutions Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 72349

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Voltage

- 5.1.1 Low Voltage

- 5.1.2 Medium and High Voltage

- 5.2 Insulation

- 5.2.1 Gas Insulated Switchgear(GIS)

- 5.2.2 Air Insulated Switchgear(AIS)

- 5.3 End-User

- 5.3.1 Commercial

- 5.3.2 Residential

- 5.3.3 Industrial

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Kirloskar Electric Company

- 6.3.2 Hitachi ABB Power Grids Ltd.

- 6.3.3 General Electric Company

- 6.3.4 Havells India Ltd.

- 6.3.5 CG Power and Industrial Solutions Limited

- 6.3.6 Schneider Electric SE

- 6.3.7 Bharat Heavy Electricals Limited

- 6.3.8 HPL Electric and Power Limited

- 6.3.9 Siemens AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.