PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631612

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631612

Asia Pacific Smartphone Camera Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

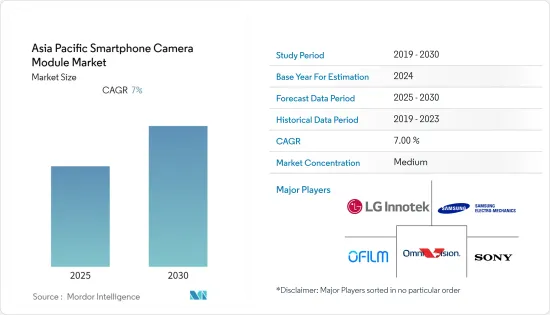

The Asia Pacific Smartphone Camera Module Market is expected to register a CAGR of 7% during the forecast period.

Key Highlights

- The smartphone camera modules have disrupted the digital still camera (DSC) market. The performance and complexity of camera modules have increased considerably, which explains the decline in compact camera sales. Dual and 3D sensing cameras are new ways to implement existing compact (or CMOS) camera module (CCM) technology and sustain growth by having more cameras per system.

- One factor driving the Asia-Pacific smartphone camera module market is the growing number of cameras per smartphone (in units). To improve the functionality and quality of images produced by smartphones and rising trends of front cameras, OEMs are shifting from single rear cameras to dual, triple, and quad-camera designs, resulting in increasing adoption of an average number of camera modules per smartphone.

- For instance, according to the statistics by photonicsViews, the introduction of dual-front and back cameras would increase the number of cameras per smartphone that is expected to be 2.7 cameras per phone on average by 2022.

- Smartphone cameras are expected to offer high image quality even in indoor and nighttime, high-resolution photography and video, optical image stabilization, zoom ability, and high-speed autofocus. Moreover, Sensor size is a crucial determinant of image quality in traditional cameras, and the same is true in smartphones. With the current trends, smartphone companies are now aggressively developing specific image sensors with unique features.

- A shift in consumer spending behavior due to the COVID-19 pandemic, coupled with the smartphone market nearing a point of saturation, witnessed the slowdown of smartphone sales in 2020.

APAC Smartphone Camera Module Market Trends

Introduction of Advanced Camera Technologies is Expected to Drive the Market

- Consumer demands have evolved in tandem with the evolution of phones. This has pushed for technological advancement and research, resulting in developments such as artificial intelligence, ultra-fast charging, bezel-less displays, and motorized cameras, etc.

- The progress of the smartphone camera did not stop at increasing the number of cameras or the megapixel count. Smartphone manufacturers continue to innovate, introducing a periscope-based system as the most recent example of breakthrough technology in this field. It enables a smartphone camera to provide a sophisticated 10x optical zoom with motorized internal optics without sacrificing image quality. Innovations like these will be the differentiating element for consumers' purchase considerations in the following years. For instance the Oppo Find X2 Pro in 2020, the Samsung Galaxy S20 Ultra, and the Realme X3 SuperZoom all included periscope zoom. It remains a popular feature, with Samsung rearranging the cameras in the S21 Ultra for 2021 to include two zooms, one periscope and one conventional, in an effort to improve zoom quality.

- Along with advancements in camera sensors, the demand for the integration of a dedicated image signal processor in smartphones is growing. In terms of image quality and helpful functionality, this has opened up a world of possibilities in smartphone camera technology. Dedicated image signal processors aren't simply for high-speed picture processing, contrary to popular opinion. It improves image quality, reduces noise, and enhances features such as HDR, auto exposure, autofocus, and auto white balance, among others.

- For instance, Qualcomm's new Snapdragon platforms with the Spectra 580 CV-ISP feature triple image signal processors (Triple ISP) capable of processing 2.7 gigapixels per second, allowing devices to use up to three separate cameras at the same time. This functionality opens up several intriguing possibilities, including seamless zooming between three different cameras, triple simultaneous image captures (each up to 28MP), multi-capture HDR composites, and even putting front-facing video footage atop rear-facing video footage, to name a few. On Qualcomm's Triple ISP-enabled devices, the customers may even capture up to three 4K HDR films at the same time.

- The function of smartphones cameras is evolving. The initial surge came as more people began to use smartphones to take photos rather than investing in professional cameras. The next boost will be built around developments in video capturing capabilities, given the prevalence of social media platforms and video content.

China to Hold a Major Market Share

- The boom of smartphone market has been one of the notable trends in China. This incraese in demand has been a result of various factors including rising disposable income, cheaper internet, innovations and advancements in technology. For example, the introduction of the mirror or prism in the smartphone camera module, which lies in the centre of the lens to reflect light in a folding zoom camera mechanism. It operates similarly to periscope technology, but instead of using the phone's thickness and camera bump for the increased zoom capability, it allows the camera to leverage the phone's length and width.

- For Instance, several smartphone manufacturers, like Huawei and OPPO, have already used this technology in their flagship models. Huawei's Huawei Mate XS is equipped with a folding zoom module.

- In May 2021, Xiaomi, a Chinese smartphone manufacturer, has patented a smartphone design with an under-screen flip camera that can function as both a primary and a selfie camera. The phone's camera system will feature flip technology, which will allow the camera to spin 180 degrees and act as both a selfie and a rear-facing camera. However, as evidenced by a new patent obtained by the World Intellectual Property Organization, the company is making significant progress in the development of a rotating under-display camera module.

- In August 2021, A Chinese smartphone manufacturer, Vivo has received a patent from the World Intellectual Property Organization (WIPO) for an innovative design that features a smartphone with a removable under-display selfie camera module. The smartphone maker's patent, according to GizmoChina, describes an in-display camera module that can remove from the handset's body.

- Despite dedicated tele lenses being the standard on high-end smartphones these days, smartphone zoom capability has improved substantially in the last couple of years, but it still trails behind traditional cameras. O-Film, a Chinese camera module manufacturer, has demonstrated a smartphone lens with an 85-170mm (35mm equivalent) optical zoom range. In principle, this should deliver better image quality throughout the zoom range than existing models.

APAC Smartphone Camera Module Industry Overview

The Asia-Pacific Smartphone Camera Module Market is a competitive market that consists of significant players. However, in terms of market share, few major players such as LG Innotek Co., Ltd, Samsung Group, Sunny Optical Technology Company Limited, Foxconn Technology Group (Sharp), OmniVision Technologies Inc., etc., currently dominate the market. The mid-size and the smaller companies can increase their market presence by securing new contracts and tapping new markets with the help of technological advancements, product innovations, and partnerships. Some of the latest developments include :-

- September 2021 - Valens Semiconductor and Sunny Optical Technology Group Company Limited have partnered to develop MIPI A-PHY-compliant chipsets for next-generation camera modules. For multi-gigabit vehicle communication, A-PHY is a long-reach serializer-deserializer (SerDes) physical layer interface. The MIPI Alliance launched it in September 2020 as a standard for integrating cameras, sensors, and displays in automobiles while also incorporating functional safety and security. Engineering samples of the Valens VA7000 chipset family, the first A-PHY compliant chipset, will be available in the fourth quarter of 2021.

- May 2021 - The OV60A, a 0.61 micron (m) pixel high-resolution CMOS image sensor for mobile phone cameras, was unveiled by OmniVision Technologies, Inc., a developer of sophisticated digital imaging systems. The OV60A can be used in either a 3:4 or 16:9 aspect ratio 1/2.8 inch optical format. The OV60A's 4-cell color filter array uses near-pixel binning to produce up to 15MP photos with 4X the sensitivity for preview and native 4K video with additional pixels for electronic image stabilization, with 1.22m equivalent performance (EIS).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Average Number of Cameras per End-products-Smartphones

- 4.5 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Multiple Camera Approaches and Introduction of Advanced Camera Technologies

- 5.2 Market Challenges

- 5.2.1 Increasing Pricing Competition

6 MARKET SEGMENTATION

- 6.1 By Country

- 6.1.1 China

- 6.1.2 India

- 6.1.3 Rest of Asia-Pacific

7 VENDOR RANKING ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 LG Innotek Co., Ltd.

- 8.1.2 Samsung Electro-Mechanics Co., Ltd. and Samsung Group

- 8.1.3 Sunny Optical Technology Company Limited

- 8.1.4 JiangXi Holitech Technology Co., Ltd

- 8.1.5 Q Technology (Group) Company Limited

- 8.1.6 O-Film Tech Co. Ltd.

- 8.1.7 Foxconn Technology Group (Sharp)

- 8.1.8 Luxvisions Innovation Limited

- 8.1.9 Sony Corporation

- 8.1.10 Largan Precision Co Ltd.

- 8.1.11 OmniVision Technologies Inc.

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET