PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631603

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631603

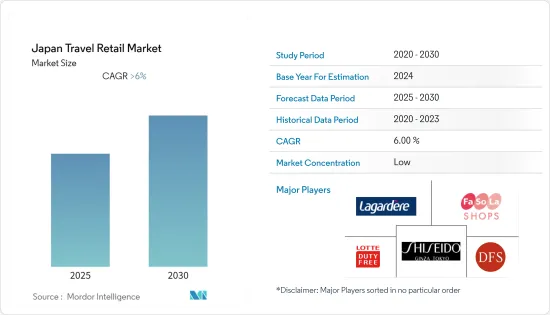

Japan Travel Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Japan Travel Retail Market is expected to register a CAGR of greater than 6% during the forecast period.

As the inbound tourism market grows rapidly in Japan with strong spending among Chinese, Taiwanese, Korean, and Hong Kong visitors, the potential of the travel retail market in the country has not gone unnoticed, especially among the major international travel retailers. Growth in disposable incomes, consumer spending, tourism, and duty-free sales are some of the major factors fuelling the growth of the Japanese Travel Retail Market.

The Japanese travel retail market is evolving due to new business dynamics, changing consumer habits, and a continued surge in visitors from foreign countries. The success of some of the popular product categories, such as Japanese cosmetics, is led by Shiseido group brands, and confectionery is led by brands such as Royce and Tokyo Banana. The change in regulations has benefitted duty-free arrival shop operators who are currently restricted to selling only imported liquor, tobacco, confectionery, and perfumes in their arrival shops.

The COVID-19 pandemic hugely hampered the growth of the travel retail sector in Japan, and the closure of retail stores in travel hubs in the country has contributed to overall losses for many big brands. Players like Shiseido, which is a Japanese beauty giant, witnessed a nearly 18% decline in their travel retail division due to the disruptions caused by COVID-19. Furthermore, during COVID-19, domestic travel and foreign visitors' expenditures to Japan declined significantly due to the impacts of the COVID-19 pandemic. Post-COVID-19, the market activity picked up airport retailers and downtown operators in Japan are braced for the restoration of full duty-free and travel retail services as they tread a cautious path to recovery.

Japan Travel Retail Market Trends

Rising International Tourist Arrivals to Japan is Driving the Market

The majority of international visitors in Japan arrive from East Asian regions, with Korean, Chinese, and Taiwanese visitors in the lead. The increased number of tourists in the country has led to increased infrastructure development in the travel-retail markets, such as larger retail experiences, which include shops, restaurants, bars, and other forms of retail.

The growing number of inbound visitors and the steadily increasing tourism expenditure showed the rising popularity of Japan as a travel destination and tapped into the potential of the vibrant industry.

Growing Number of Tax-Free Shops in Japan is Driving the Market

The travel retail market in Japan is majorly driven by the tourism industry, as many foreign investors visit the country for tax-free shopping. Japan is filled with stores offering tax-free shopping, from airports to chain shops around the country. Duty-free shops in the country are in airports and major cities, where the shoppers meet certain requirements and can be excluded from paying the standard 10% consumer tax on goods in Japan.

The number of tax-free shops in Japan has increased more than tenfold in the last few years as the expansion of the number of tax-free shops was one of the major incentives devised by the government of Japan to attract international tourists.

Japan Travel Retail Industry Overview

The Japanese travel retail market is highly competitive, with several international as well as domestic brands present in the market, which include Lagardere, Shisheido, DFS, Lotte Duty-Free, and TIAT, amongst others. Despite the lack of price competitiveness, Japanese purchasing agents survive because they have access to some Japanese products that are not supplied to foreign duty-free shops.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tourism Growth is Driving the Market

- 4.2.2 Airport Expansions is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Currency Fluctuations is Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Digital Transformation will Create Opportunities to New Entrants

- 4.5 Insights on Technological Innovations in the Market

- 4.6 Insights on Trends in Passenger Traffic by Channels

- 4.7 Insights on Government Regulations and Initiatives in the Market

- 4.8 Industry Attractiveness: Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Buyers

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Fashion and Accessories

- 5.1.2 Wine and Spirits

- 5.1.3 Tobacco

- 5.1.4 Food and Confectionary

- 5.1.5 Fragrances and Cosmetics

- 5.1.6 Other Product Types (Stationery, Electronics, Others)

- 5.2 By Distribution Channel

- 5.2.1 Airports

- 5.2.2 Airlines

- 5.2.3 Ferries

- 5.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Lagardere

- 6.2.2 Shiseido

- 6.2.3 DFS

- 6.2.4 Lotte Duty Free

- 6.2.5 ANA Festa

- 6.2.6 LOFT

- 6.2.7 HIS Group

- 6.2.8 Daiso

- 6.2.9 Jalux

- 6.2.10 Fa-So-La

- 6.2.11 TIAT Duty Free

- 6.2.12 Donki*

7 MARKET FUTURE TRENDS

8 DISCLAIMER AND ABOUT US