PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631595

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631595

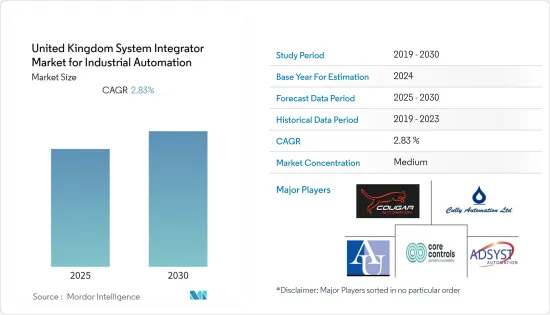

United Kingdom System Integrator for Industrial Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United Kingdom System Integrator Market for Industrial Automation Industry is expected to register a CAGR of 2.83% during the forecast period.

The COVID-19 pandemic temporarily slowed the market's supply chain, thus, eventually increasing the demand for industrial automation in the market.

Key Highlights

- System integration assimilates all these systems in the industry to achieve smart factory utilization. It is responsible for contracting product development, sourcing hardware and software resources from OEMs, and integrating them for end users (manufacturers).

- Recent trends have shown that smaller PLCs introduced in the micro- and nano-classes, providing features, were previously found only in the larger systems. In response to market demands, many functions and features are now offered by lower-end PLCs. It is expected that small PLCs may continue to evolve to include many of the features associated with higher-level PLCs.

- Furthermore, the rising demand for improved control, secured connectivity, and enhanced performance has pushed PLC manufacturers to bank on IIoT technologies, such as machine-to-machine communication, smart sensors, industrial cloud, and cybersecurity. Moreover, to accommodate advanced features, cost-effectiveness, and interoperability, PLC manufacturers have been involved in innovating and integrating conventional PLC systems with modern and contemporary technologies.

- SCADA systems are at the crux of industrial processes as they help organizations manage modern demands. For instance, Yokogawa zeros in on the evolution of SCADA to deliver high performance, high availability, broad scalability, and platform independence in its SCADA applications. Therefore, organizations also benefit from the power and flexibility of Yokogawa's SCADA software (FAST/TOOLS), a comprehensive, fully integrated SCADA application suite.

- Similarly, Mitsubishi Electric, a world-leading equipment supplier, offers the SCADA software, MC Works64, which is a modern solution for next-generation integrated monitoring for the Internet of Things (IoT). With IoT accelerating digital transformation initiatives, solutions like these have the potential to create significant demand for themselves. Furthermore, Mitsubishi solutions come with a wide range of factory automation products to catalyze visualization, analysis, and improvement.

UK Industrial Automation System Integrator Market Trends

Digital Transformation and Industry 4.0 Initiatives to Drive Market Growth

- Digitization and the Industry 4.0 revolution significantly stimulated the growth of automation among manufacturing industries by necessitating smart and automated solutions, such as robotics and control systems, to improve production processes.

- According to a government-commissioned review, the country's manufacturing sector could unlock GBP 455 billion over the next decade, creating thousands of jobs, if the country can successfully adopt the fourth industrial revolution and carve out a successful post-Brexit future.

- In comparison with other developed countries, it is observed that the country's manufacturing sector has underinvested in robotics and other forms of automation. Generally, it invests around 1.7% of its GDP into manufacturing innovation, well behind the OECD average of 2.4%.

- The major trend observed in the market is the adoption of integrated solutions/devices, such as the embedding of PLCs with various other industrial controls (such as HMIs or SCADA). These integrations have offered higher efficacy and visibility in factory operations and allowed the workload on central controllers to be lowered.

- Further, the British Automation & Robot Association (BARA) announced the UK's first robot integrator certification scheme. By launching a certification scheme for robot integrators, BARA is hoping to improve the technical capabilities of integrators and ultimately enhance the UK manufacturing sector.

Market Witnessed Fast Recovery from the Impact of COVID-19

- The COVID-19 outbreak and lockdown restrictions affected industrial activities across the country. Some of the effects of the lockdown include supply chain disruptions, the lack of availability of raw materials used in the manufacturing process, fluctuating prices that could cause the production of the final product to inflate and go beyond budget, and shipping problems.

- Following the global economic recession due to COVID-19, the UK system integrator market for industrial automation witnessed a positive impact from the demand side and mixed impact from the supply side in 1st half of 2020.

- Smart factory initiatives have helped manufacturers overcome COVID-19 challenges and address issues, such as workforce reductions, drops in sales for some specific products, social distancing, and extreme pressure to cut operational costs since most enterprises operating in the end-user industries (majorly manufacturing, automotive) had to shut down their production sites due to lockdown restrictions.

- Mitsubishi Electric, one of the leading global companies in industrial automation, has seen decreased revenue since the second quarter of 2020 due to the supply restrictions imposed as a result of the pandemic. However, automation is considered to be on the front lines in the battle against the pandemic. For example, automated workstations are speeding up the work of pharmaceutical companies striving to play an important part in the pandemic.

- Further, players in the market are providing remote monitoring solutions to help enterprises in the end-user industries withstand the impact of the pandemic.

UK Industrial Automation System Integrator Industry Overview

The UK system integrator market for industrial automation is moderately competitive, with new firms trying to enter the existing market. The firms keep on innovating their solutions and entering strategic partnerships to retain their market shares. Key players in the market include Adsyst Automation Ltd and Cougar Automation Ltd, among others.

- January 2021 - Cougar Automation became an "Approved Solution Partner" for Mitsubishi Electric, as it reached an exceptional standard of expertise in the integration of products and services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital Transformation and Industry 4.0 initiatives

- 4.3 Market Restraints

- 4.3.1 Requirement of High Investments for Automation Implementation and Maintenance

- 4.4 Assessment of the COVID-19 Impact on the Market

- 4.5 Key Use-cases Across Different Verticals

5 COMPETITIVE LANDSCAPE

- 5.1 Company Profiles

- 5.1.1 Au Automation

- 5.1.2 Adsyst Automation Ltd

- 5.1.3 Core Control Solutions

- 5.1.4 Cougar Automation Ltd

- 5.1.5 Cully Automation

- 5.1.6 Automated Control Solutions Ltd

- 5.1.7 Wood PLC

- 5.1.8 Altec Engineering Ltd

- 5.1.9 Applied Automation

- 5.1.10 Adelphi Automation