PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631587

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1631587

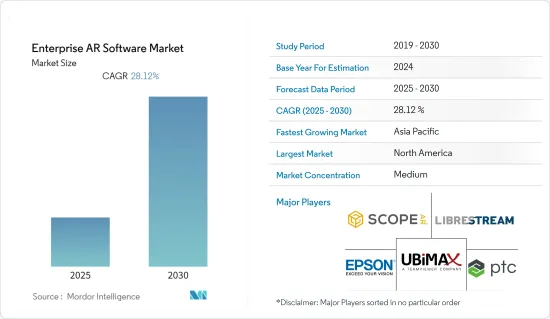

Enterprise AR Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Enterprise AR Software Market is expected to register a CAGR of 28.12% during the forecast period.

Key Highlights

- AR has become a powerful tool for a variety of employee-oriented enterprise scenarios as the application of Enterprise AR is expanding, and almost every industry, including manufacturing, education, entertainment, healthcare, field service, and marketing, has found ways to apply AR technology to improve the process and productivity.

- Augmented Reality (AR) is an overlay of computer-generated digital content over the real-world environment and has emerged as one of the biggest technology trends currently and is on the verge of becoming a part of everyday life. Companies are leveraging augmented reality to streamline their workflow, cut down on logistics and operational costs, and improve efficiency.

- Furthermore, the current market scenario has observed a greater focus on creating content and tools with more smartphone compatibility. This is expected to be driven by photorealistic AR, enabled by the combination of software and hardware advances, one of the most significant launches of dedicated AR frameworks in the smartphone operating systems.

- The COVID-19 pandemic has created an unprecedented impact across the global business landscape with widespread lockdowns, brick-and-mortar retail closures, essential ecommerce delivery limitations, and supply chain disruption. However, from a positive perspective, the pandemic has caused an acceleration of remote working and has increased the adoption of cloud infrastructure services and spending on specialized software. As the hybrid working model is expected to stay even in the post-pandemic age, the enterprise AR software market is expected to gain traction.

- AR software works with devices such as tablets, phones, headsets, and more and supports features such as analytics, remote assistance, content management, etc. This is expected to encourage companies to have their facilities located at different geographical locations towards AR software as this can help them manage a large setup using a small group of people.

Enterprise AR Software Market Trends

Retail Segment would grow at a higher pace

- AR has witnessed an increasing implementation in existing applications and platforms, including gamification for customer engagement, AR applications, social media-based marketing, and enterprise collaboration for unified workplace communications (such as Microsoft HoloLens, for assessing insurance risks). In addition, game developers are anticipated to use AR as a differentiator that could encourage new downloads.

- While AR is still over a decade away from achieving its full market potential, technological advancements in the space industry have accelerated the market studied over the past two years. The increasing availability of content and the launch of developer tools, such as ARKit, are driving the growth of this segment. The rising adoption and availability of the cloud have been major drivers for the AR market. It provides the platform and infrastructure to address the scalability limitation of on-premise AR experiences.

- For example, the WorkLink platform offered by ScopeAR is an augmented reality application suite that supports smartphones, tablets, and wearables. It is designed to ingest any CAD model format, making it easy for leading organizations to augment curated procedures over real-world objects to guide users. It also enables them to alert the user to avoid non-compliance or a safety incident if they deviate from the prescribed procedure.

- Furthermore, the precision of indoor location services has grown significantly, enabling AR location features for vehicles, campus, and in-building navigation and identification. Image recognition capabilities have allowed enterprises to use AR for object identification and display by assisting real-time decision-making.

- The future of the AR market is expected to be augmented by the amalgamation of the virtual and physical worlds to generate new, engaging, interactive, and personalized experiences that benefit both customers and the business.

Asia Pacific to Dominate Enterprise AR Market

- Asia-Pacific is one of the most important markets for Enterprise AR technology and is supposed to record the largest growth over the forecast period. The region offers one of the largest enterprise applications markets for AR software. Moreover, the increasing government programs favoring the development of AR technologies are also motivating local vendors to invest in the studied market.

- South Korea is also emerging as one of the significant markets for enterprise AR technologies, owing to the increasing government investments in the market studied and the rising adoption of AR technologies amongst the country's end-user applications. For instance, LG Uplus Corp., a major South Korean telecom firm, unveiled the world's first 5G-based augmented reality (AR) glass. The product was developed in partnership with Chinese mixed-reality product developer Nreal and chipmaker Qualcomm.

- Furthermore, as a result of the COVID-19 pandemic, there has been a big push for more adoption of enterprise AR technology in the region. The sudden need for virtual meetings, remote collaboration, more efficient workflows, and reduced IT costs favors AR technology in the enterprise. For instance, VeativeLabs, headquartered in India, offers employees in the power, oil, and gas industry a safe training atmosphere wherein they can learn in a simulated world without being exposed to hazards.

- Although China has emerged as a major player in the gaming sector, Japan is the third-largest market. The country's gaming companies are some of the major adopters of advanced AR technologies at a global level. According to the Computer Entertainment Supplier's Association, the Japanese gaming market is expected to reach approximately JPY 1.59 trillion by 2025. Some notable Japanese players in the AR software space include names such as GrapeCity, Cluster, and HADO (Meleap Inc.).

- Furthermore, the healthcare sector in the Asia-Pacific region is on the rise and has emerged as one of the key markets for AR technology. AR is revolutionizing telehealth, and AR tech is also expected to be incorporated into rehabilitation, treatment methods, and chronic care routines.

Enterprise AR Software Industry Overview

The Enterprise AR software market is moderately competitive and consists of several players. The increasing use cases across various industries are expected to attract new players, resulting in increased competition among the players operating in the market during the forecast period. Many companies are increasing their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions. Some key players operating in the market include Seiko Epson Corporation, Librestream, Scope AR, and PTC, among others.

In September 2023, Supernova Academy Inc., an augmented reality (AR) technology company serving the educational and business community, announced a new strategic partnership with Domain-U, an education technology platform. As a result of the collaboration between the two organizations, Supernova Academy will be offering its suite of medical educational courses through Domain-U's leading online training e-platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the market

- 4.5 Market Drivers

- 4.5.1 Increased demand for 3D visualization software across various industries.

- 4.5.2 Increasing acceptance of AR across industry verticals

- 4.6 Market Challenges

- 4.6.1 Technical and Regulatory Issues

5 MARKET SEGMENTATION

- 5.1 Category

- 5.1.1 Education

- 5.1.2 Healthcare

- 5.1.3 Retail

- 5.1.4 Manufacturing

- 5.1.5 Other End-user Verticals

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ubimax GmbH

- 6.1.2 Atheer, Inc

- 6.1.3 Scope AR

- 6.1.4 RE'FLEKT GmbH

- 6.1.5 Vuforia (PTC Inc.)

- 6.1.6 Blippar Ltd

- 6.1.7 Upskill

- 6.1.8 Librestream

- 6.1.9 Fieldbit

- 6.1.10 XMReality

- 6.1.11 Third Eye Gen Inc

- 6.1.12 Seiko Epson Corporation

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET