PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630447

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630447

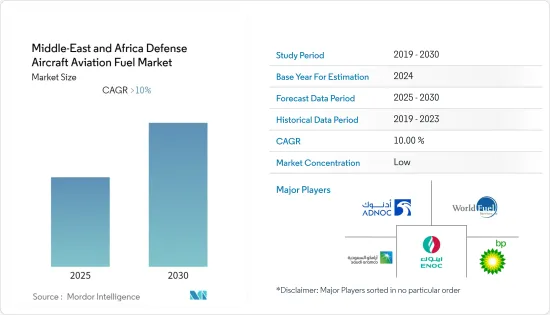

Middle-East and Africa Defense Aircraft Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Middle-East and Africa Defense Aircraft Aviation Fuel Market is expected to register a CAGR of greater than 10% during the forecast period.

The outbreak of COVID-19 had a negative effect on the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as the changing nature of warfare, increasing defense spending, and increasing national security concerns are scaling up the development and investment in unmanned drones and defense aircraft, giving thrust to the demand for aviation fuel.

- However, the high volatility of crude oil prices, stringent government regulations, and increasing awareness of the reduction of carbon emissions are some of the key challenges in the regional aerospace and defense fuel market.

- The government's efforts to decrease pollution and increase awareness towards cleaner fuels in the aviation sector across the region are likely to increase demand for biofuels, which in turn is likely to provide an opportunity in the market.

Saudi Arabia is expected to dominate the Middle East and Africa defense aircraft aviation fuel market over the forecast period.

Middle-East And Africa Defense Aircraft Aviation Fuel Market Trends

Aviation Turbine Fuel (ATF) to Dominate the Market

- Aviation turbine fuel, or jet fuel, is available in various grades and forms, including Jet B, JP-8, JP-5, etc., which are ideal for military aircraft.

- For military jets, the main fuel is JP-8, which is the military equivalent of Jet A-1 with the addition of corrosion inhibitors and anti-icing additives. Jet B is primarily used in military aircraft for cold weather performance, and JP-5 is also a jet fuel that has a higher flash point than JP-8.

- Iran, Qatar, Saudi Arabia, and the United Arab Emirates (UAE) had high levels of military expenditure as a share of their gross domestic product in 2021.

- Qatar placed an order for 34 of the 777X, a sizable, twin-engine aircraft, in January 2022, as well as options for 16 additional aircraft.

- Furthermore, the Republic of Mali Air Force added various military transport aircraft and announced plans to add another 21 fighter jets to increase the military power of the country.

- Therefore, factors such as increasing investment and new aircraft additions in defense applications are expected to create demand for air turbine fuel in the Middle East and Africa defense aircraft aviation fuel market.

Saudi Arabia to Dominate the Market

- The Royal Saudi Air Force (RSAF) is continuously developing and modernizing its air systems and is keen on acquiring modern fighters to provide the flexibility of rapid deployment and the ability to intervene quickly.

- In 2021, Saudi Arabia's military spending amounted to an estimated USD 55.564 billion, down from 64.558 billion in 2020. It was the third-largest military spender globally and by far the largest military spender in the Gulf region.

- In 2021, Saudi Arabia signed a financing agreement worth USD 3 billion to partially finance the requirements for aircraft it ordered. The amount covers the airline's aircraft financing requirements until mid-2024, helping finance the purchases of 73 aircraft previously ordered, it said in a statement. The airline has ordered Airbus A320neo, A321neo, A321XLR, and Boeing 787-10 jets.

- Fighter jets account for a large share of the total Saudi Arabian Air Force fleet-about 54%-followed by trainers and helicopters.

- Furthermore, Saudi Arabia's air defenses are undergoing realignment to provide a 360-degree air defense umbrella that could counter threats emerging from all sides, especially drone attacks.

- Therefore, with the increasing military activities and increasing defense expenditure, the market for defense aircraft aviation fuel in Saudi Arabia is expected to dominate during the forecast period.

Middle-East And Africa Defense Aircraft Aviation Fuel Industry Overview

The Middle-East and Africa defense aircraft aviation fuel market is consolidated. Some of the major players in the market (in no particular order) include Abu Dhabi National Oil Company, World Fuel Services Corp, BP plc, Emirates National Oil Co Ltd LLC, and Saudi Arabian Oil Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Aviation Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.2 Geography

- 5.2.1 United Arab Emirates

- 5.2.2 Saudi Arabia

- 5.2.3 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Abu Dhabi National Oil Company

- 6.3.2 World Fuel Services Corp

- 6.3.3 BP plc

- 6.3.4 Emirates National Oil Co Ltd. LLC

- 6.3.5 Saudi Arabian Oil Co.

- 6.3.6 RNGS Trading

7 MARKET OPPORTUNITIES AND FUTURE TRENDS