Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630439

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630439

Europe Aviation Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 100 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

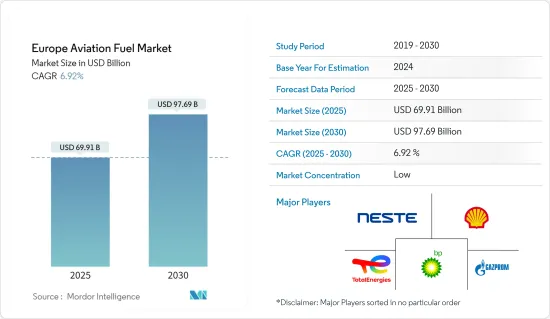

The Europe Aviation Fuel Market size is estimated at USD 69.91 billion in 2025, and is expected to reach USD 97.69 billion by 2030, at a CAGR of 6.92% during the forecast period (2025-2030).

Key Highlights

- In the medium term, several factors are driving the demand for jet fuel in Europe. These include a rise in air passengers due to recent reductions in airfare and the expansion of flight routes.

- However, the growing adoption of electric and hybrid aircraft poses a challenge to this market growth.

- Despite these challenges, the European Commission is pushing for increased mandates on sustainable aviation fuel (SAF) to curb greenhouse gas emissions. Such initiatives are poised to unlock substantial opportunities in the aviation fuel market.

- Europe boasts the largest market size for aviation fuel, with the United Kingdom at the forefront. Given its current leadership, the UK is set to maintain its dominance in the coming years.

Europe Aviation Fuel Market Trends

Commercial Sector to Dominate the Market

- Commercial aviation includes operating scheduled and non-scheduled aircraft, which involves commercial air transportation of passengers or cargo. The commercial segment is one of the largest consumers of aviation fuel, accounting for a quarter of an airline operator's total operating expenditure.

- In 2023, commercial aviation dominated the skies, accounting for 91.9 percent of total flights, reflecting its critical role in European air travel. General aviation contributed 6.5 percent, serving niche markets and private travel needs. While minor, defense aviation still played a vital role, with 1.6 percent of total flights.

- The European commercial aviation fuel market is witnessing robust growth, fueled by a resurgence in air travel and a strong emphasis on sustainable aviation solutions. Major European countries, including Spain, the United Kingdom, and France, are witnessing a tourism boom, leading the commercial sector to capitalize on rising passenger numbers.

- Post-COVID-19, global travel and tourism have rebounded, driven by affordable airfares and improved economic conditions, leading to a surge in air travel demand. This uptick in flight demand has, in turn, increased fuel consumption in the commercial aviation sector.

- Eurostat Data highlights that in Q1 2024, EU air carriers transported 198 million passengers, an 11.5% increase from Q1 2023. February 2024 was particularly notable, with passenger numbers exceeding February 2019 figures for the first time since the pandemic, marking a 1.0% uptick. In Q1 2024, international extra-EU transport made up 50.1% of all passengers within the EU. Given the nationwide tourism surge, the region's aviation fuel demand is poised for significant growth in the coming years.

- Moreover, Europe's tourism upswing, especially in hotspots like Italy and Spain, signals a sustained growth trajectory for fuel demand. As the aviation sector rebounds and new flight routes emerge, this growth is set to accelerate.

- In September 2024, Delta Air Lines announced the addition of seven new European routes, expanding its transatlantic schedule for summer 2025. This expansion includes four new services to Italy, alongside routes from Boston to Barcelona, Detroit to Dublin, and Atlanta to Brussels. With such an expansion in tourism and aviation networks, the demand for aviation fuels is anticipated to rise.

- Therefore, based on the above mentioned points, the commercial sector is expected to dominate the market.

The United Kingdom to Dominate the Market

- The United Kingdom's aviation sector is a cornerstone of its economy, ranking among the largest in Europe. Substantial investments in airport infrastructure and a strong tourism industry support the aviation market in the United Kingdom, contributing to its robust performance.

- In 2023, the United Kingdom had the highest average number of daily flights, at 5290, a 13 percent increase from 2022. Spain was the second busiest, with 4616 flights per day, up 9 percent, followed by Germany, with 4532 flights per day, up 7 percent. Due to this, the demand for aviation fuel in the UK is substantial, driving growth in the European aviation fuel market.

- The country's aviation fuel market is expected to grow significantly during the forecast period, mainly driven by increasing tourism, global geopolitical conditions, domestic air traffic, and mainly by government policies.

- For instance, in April 2024, the United Kingdom government announced that by 2030, 10 percent of all jet fuel must come from sustainable sources. This move aims to cut greenhouse gas emissions and boost the sustainable aviation fuel (SAF) industry, potentially adding over 1.8 billion British Pounds to the economy and creating more than 10,000 jobs.

- Furthermore, the United Kingdom government allocated 135 million British Pounds through the Advanced Fuels Fund to support 13 groundbreaking SAF projects nationwide. This funding aims to accelerate the development and production of sustainable aviation fuels.

- Therefore, due to the factors above, the United Kingdom is expected to dominate the market in the aviation fuel sector during the forecast period.

Europe Aviation Fuel Industry Overview

The Europe aviation fuel market is semi-fragmented. Some of the major companies (in no particular order)include PJSC Gazprom, BP PLC, Shell PLC, TotalEnergies SE, Neste Oyj, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71499

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Air Passenger Traffic

- 4.5.1.2 Sustainable Aviation Fuel (SAF) Mandates

- 4.5.2 Restraints

- 4.5.2.1 High Volatile Fuel Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Air Turbine Fuel (ATF)

- 5.1.2 Aviation Biofuel

- 5.1.3 Avgas

- 5.2 Application

- 5.2.1 Commercial

- 5.2.2 Defense

- 5.2.3 General Aviation

- 5.3 Geography

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Spain

- 5.3.6 Nordic

- 5.3.7 Turkey

- 5.3.8 Russia

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Repsol SA

- 6.3.2 BP PLC

- 6.3.3 Royal Dutch Shell PLC

- 6.3.4 Total SA

- 6.3.5 Exxon Mobil Corporation

- 6.3.6 Gazprom Neft PJSC

- 6.3.7 Neste Oyj

- 6.4 List of Other Prominent Countries

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Aim to increase sustainable aviation fuel (SAF) use to reduce greenhouse gas emissions

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.