Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630412

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630412

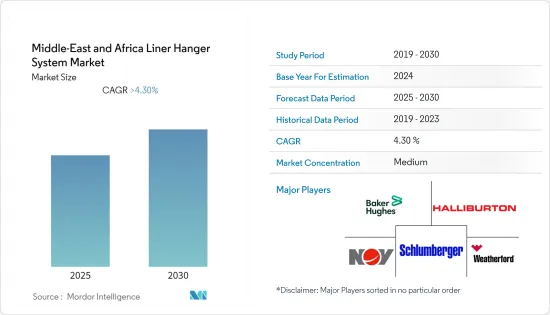

Middle-East and Africa Liner Hanger System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Middle-East and Africa Liner Hanger System Market is expected to register a CAGR of greater than 4.3% during the forecast period.

In 2020, COVID-19 had a detrimental effect on the market.Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, with the world's largest oil reserves, the region is expected to witness significant growth in upstream oil and gas activities in the forecast period. Moreover, the increasing gas production in the Middle East is driving the demand for the liner hanger system.

- On the other hand, the global crude oil price decline in 2020 and 2021 has led to a halt or delay in various oil and gas projects. Also, total crude oil production in the Middle East declined in 2021. If this declining trend continues, it is expected to have a negative impact on further market growth.

- With the largest proven reserves of natural gas and crude oil, the Middle East and Africa have significant potential for exploration and completion activities, which will create substantial opportunities for the liner hanger system market in the near future.

Middle-East And Africa Liner Hanger System Market Trends

Onshore Segment is Expected to Dominate the Market

- A liner hanger system consists of a liner hanger assembly, a releasing tool, a cementing head, a packer, etc. Liner hanger systems can be mechanical or hydraulic, premium or standard, rotating or non-rotating, conventional or expandable, and pocket slip.

- The Liner Hanger System witnessed growth in 2021 as the exploration and drilling activities in the Persian Gulf ramped up. In December 2021, Iranian oil and gas firm Pars Oil and Gas Company (POGC) announced the start of drilling operations at the South Pars gas field in the Persian Gulf as part of its field development strategy.

- In August 2022, the Abu Dhabi National Oil Company gave out five framework agreements worth a total of USD 1.83 billion to increase drilling in the oilfields of the emirate.The growing drilling activities in the onshore region will, in turn, culminate in the growth of the linger hanger systems across the region.

- Moreover, due to ongoing sanctions on Iran by the United States, major companies like Total are withdrawing their investment, which can negatively impact the LHS market. Furthermore, rising crude oil production in the Middle East to 28.15 million barrels per day in 2021 will result in significant growth of the liner hanger system during the forecast period.

- Since several onshore fields produce the most oil and gas and have the most oil and gas reserves, the onshore segment is expected to drive the market a lot.

Saudi Arabia to Dominate the Market

- According to Baker Hughes, Saudi Arabia is estimated to have the world's fifth-largest estimated shale gas reserve. Thus, it has great potential to replicate North America's unconventional reserves' development growth. The country has vast shale reserves, and the increasing exploitation of its unconventional reserves is expected to drive the demand for liner hanger systems in the long run.

- Saudi Aramco is always doing exploration and development to make up for fields that are getting smaller in other places. This opens up new markets for liner-hanger systems. In December 2021, Saudi Aramco awarded USD 100 billion in contracts on the Jafurah project to position itself as the third-largest natural gas producer by 2030. Further, the project's development is expected to help the country incline more towards natural gas as a source of electricity generation, thus supporting the pursuit of its 2060 net-zero target.

- Saudi Arabia's oil production amounted to 10.95 million barrels per day in 2021. By 2022, the country was expected to have more than 100 active onshore rigs. The deployment of these rigs is expected to increase drilling activities, which is further likely to increase the demand for liner hanger systems.

- Aramco also wants to produce 0.65 bcm of natural gas per day by 2028. It plans to do this by going after unconventional gas reserves in North Arabia, South Ghawar, and the Jafurah Basin, which is east of Ghawar.

- Because the onshore fields produced more crude oil and natural gas, more hydraulic and mechanical liner hanger systems were still used in the country. But as more people look for oil and gas reserves offshore, the demand for expandable LHS is likely to rise.

Middle-East And Africa Liner Hanger System Industry Overview

The market for liner hanger systems in the Middle East and Africa is moderately consolidated. Some of the major companies (in no particular order) include National-Oilwell Varco, Inc., Halliburton Company, Weatherford International Plc, Baker Hughes, and Schlumberger Limited Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 71201

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Conventional

- 5.1.2 Expandable

- 5.2 Location of Deployment

- 5.2.1 Offshore

- 5.2.2 Onshore

- 5.3 Geogrpahy

- 5.3.1 The United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Nigeria

- 5.3.4 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 Weatherford International plc

- 6.3.3 National Oilwell Varco Inc.

- 6.3.4 Baker Hughes Ltd

- 6.3.5 National-Oilwell Varco, Inc

- 6.3.6 Well Innovation AS

- 6.3.7 NCS Multistage LLC

- 6.3.8 Schlumberger Limited

- 6.3.9 Drill-Quip Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.