PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630392

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630392

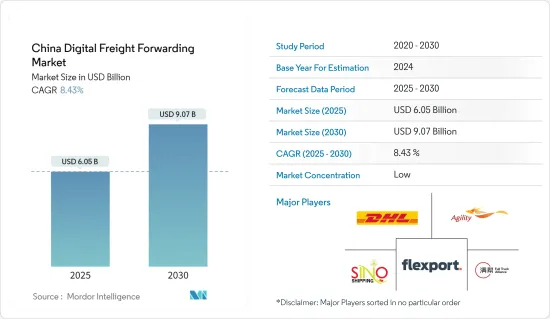

China Digital Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The China Digital Freight Forwarding Market size is estimated at USD 6.05 billion in 2025, and is expected to reach USD 9.07 billion by 2030, at a CAGR of 8.43% during the forecast period (2025-2030).

The China Digital Freight Forwarding Market Analysis focuses on the application of digital technologies to streamline and enhance the traditional freight forwarding process within China. Freight forwarding involves organizing and facilitating the shipment of goods across international borders on behalf of shippers, utilizing ocean, air, rail, or truck transportation modes. By employing online platforms, software, and advanced data analytics, digital freight forwarders in China are modernizing this process, optimizing various facets of shipping.

In recent years, China's digital freight forwarding market has experienced significant growth, driven by e-commerece boom and incresing demand for real-time logistics solutions as mentioned by the Chinese Ministry of Transport in 2023.

According to the Government of China, in 2023, Shanghai, Shenzhen, and Ningbo-Zhoushan led the world as some of the busiest container ports, with Shanghai processing over 36 million TEUs, closely followed by Ningbo-Zhoushan at 35 million TEUs, and Shenzhen surpassing 27 million TEUs. This surge underscores China's economic recovery and its expanding port infrastructure, bolstering both regional and global trade. By September 2023, Chinese ports collectively managed over 230 million TEUs, reflecting a year-on-year uptick of 5.2%. As China's digital freight forwarding market expands, both domestic and international companies are harnessing technology to optimize operations and curtail costs.

China Digital Freight Forwarding Market Trends

Rise in E-Commerce Sector Driving the Market

Several factors have fueled the rapid growth of China's e-commerce industry. The Chinese government has rolled out a series of policies to bolster e-commerce and the digital economy, with a particular focus on enhancing internet infrastructure and promoting entrepreneurship.

With advancements in mobile technology and widespread internet connectivity, e-commerce has become both available and accessible across China, benefiting consumers and business owners alike. Furthermore, residents enjoy the convenience of diverse mobile payment solutions, such as Alipay and WeChat Pay, facilitating seamless online transactions.

According to industry experts, in 2023, China represented 6.0% of the global freight forwarding market in terms of revenue. Looking ahead to 2030, the U.S. is poised to dominate the global market in terms of revenue. Within the Asia Pacific region, China's freight forwarding market is set to take the lead in revenue by 2030. India, recognized as the fastest-growing market in the Asia Pacific, is on track to achieve a valuation of USD 17,732.1 million by 2030.

Increasing Air Cargo Shipments Expected to Drive the Market

The digital freight forwarding market in China is undergoing rapid transformation, driven by technological advancements and the growing need for efficient and cost-effective logistics solutions. The market is expected to achieve significant growth in the coming years, fueled by the increasing adoption of digital platforms and solutions by both shippers and carriers.

According to industrial experts, air transportation is one of the fastest modes of transportation available, making it ideal for transporting time-sensitive products, such as perishable goods and high-value items requiring urgent delivery. The primary advantage of air transport in logistics is the speed of delivery.

In 2023, China's imports and exports of cross-border e-commerce products were worth CNY 2.38 trillion (USD 328.3 billion), up 15.6 percent year-on-year. Products exported for cross-border e-commerce alone reached CNY 1.83 trillion (USD 0.25 trillion), up nearly 20 percent year-on-year, according to the General Administration of Customs.

China Digital Freight Forwarding Industry Overview

The report covers the major players operating in the Chinese digital freight forwarding market. The market is highly competitive, with none of the players occupying the major share. The market is fragmented, and it is expected to grow during the forecast. The major players in the Chinese digital freight forwarding market include DHL, Flexport, Agility Logistics, and Freightos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Insights on Investment Scenarios

- 4.4 Insights on Government Regulations and Initiatives

- 4.5 Brief on Technology Development in Online Freight Forwarding and Digital Platforms

- 4.6 Overview on E-commerce Logistics and Freight Forwarding in China

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Government's Belt and Road Initiative

- 5.1.2 Integration of 5G Technology in Freight Logistics

- 5.2 Restraints

- 5.2.1 Fragmentation in the Logistics Market

- 5.2.2 Geopolitical Trade Barriers

- 5.3 Opportunities

- 5.3.1 Carbon-Neutral Logistics Goals

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Customers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode of Transportation

- 6.1.1 Ocean

- 6.1.2 Air

- 6.1.3 Road

- 6.1.4 Rail

- 6.2 By Firm Type

- 6.2.1 SMEs

- 6.2.2 Large Enterprises and Governments

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Flexport

- 7.2.2 Youtrans

- 7.2.3 Full Truck Alliance (Manbang group)

- 7.2.4 Agility Logistics Pvt. Ltd (Shipa Freight)

- 7.2.5 Twill

- 7.2.6 Freightos

- 7.2.7 DHL Group

- 7.2.8 Kuehne + Nagel International AG

- 7.2.9 FreightBro

- 7.2.10 Cogoport

- 7.2.11 SINO SHIPPING

- 7.2.12 DB Schenker

- 7.2.13 MOOV

- 7.2.14 WICE Logistics*

- 7.3 Other Companies

8 FUTURE OUTLOOK OF THE MARKET

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 9.2 Economic Statistics - Transport and Storage Sector Contribution to Economy