Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630381

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630381

Southeast Asia Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

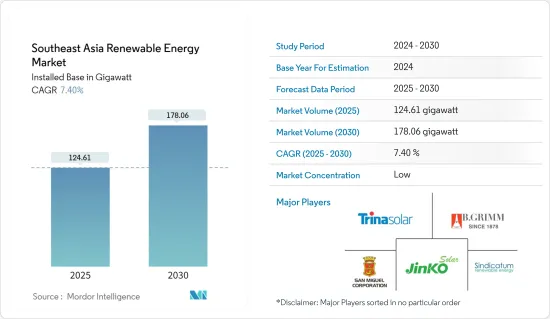

The Southeast Asia Renewable Energy Market size in terms of installed base is expected to grow from 124.61 gigawatt in 2025 to 178.06 gigawatt by 2030, at a CAGR of 7.4% during the forecast period (2025-2030).

Key Highlights

- Coal-fired power generation is the dominant form of power generation in Southeast Asia. However, renewable power generation and battery costs registered a significant decline in recent years, combined with the drying up of the finances for coal-fired power plants. This is expected to drive the renewable energy sector in Southeast Asia during the forecast period.

- However, the lack of international companies' investments and the delay in the practical deployment of projects are expected to hinder the market's growth.

- The Southeast Asian region has insufficient indigenous fossil fuel resources to meet its growing energy demand, thus creating significant opportunities for renewable energy installations, which can then solve the region's ever-increasing energy demand.

- Vietnam has a high potential for renewable energy, thus creating its dominance in the region's renewable energy market during the forecast period.

Southeast Asia Renewable Energy Market Trends

Solar Energy Segment to Witness Significant Growth

- Southeast Asia is becoming one of the fastest-growing solar energy markets and one of the most promising regions in the global expansion of the solar energy industry. In 2023, Vietnam and Thailand were at the forefront of this movement, with the region's highest amount of new PV capacity installed. In 2023, Vietnam's installed solar energy capacity stood at 17.07 GW, while Thailand's installed solar capacity stood at 3.18 GW.

- The increasing demand for electricity, the abundance of solar resources in the region, and favorable renewable-related policies are some of the factors that have been favoring the growth of the solar industry in the region.

- In addition, policymakers across different countries in the region have been intensifying their efforts to ensure a secure, affordable, and sustainable pathway for the energy sector, which includes activities to facilitate investment in solar power generation and infrastructure.

- In April 2024, the Philippines Department of Energy (DoE) announced its plans to switch to 2 GW of solar power generation. The government expects at least 4,165 MW of power projects to come online in 2024 in a mix of renewable and conventional sources. This includes the start of commercial operation of 1,985 MW of solar capacities, of which some 495 MW are already in the testing and commissioning stage, and an additional 966.3 MW should come online by June.

- However, Southeast Asia's cumulative solar photovoltaic (PV) capacity could increase to 35.8 gigawatts (GW) by 2024. The high solar power generation targets set by various nations lend support to this. The region is expected to witness the development of floating solar photovoltaic (PV) power plants over the next 5 to 15 years, as countries in the region are looking to substantially increase their share of renewable energy in the power mix. Moreover, development plans are in progress, particularly in Thailand and Vietnam, while smaller utility-scale floating PV developments are being proposed in Indonesia, Singapore, and Myanmar.

- Therefore, owing to the points listed above, solar energy is expected to witness significant growth in the Southeast Asian renewable energy market during the forecast period.

Vietnam to Dominate the Market

- Vietnam has a high potential for renewable energy, including hydro, solar, wind, biomass, and waste. Biomass and hydropower are the two major sources of renewable energy currently used in Vietnam. The government aims to install 11 GW of wind power and 20 GW of solar power capacity by 2025, which is expected to foster the growth of the market.

- The environmental concerns and constraints in financing over the development of coal-fired and large-scale hydropower plants, the slow development of the natural gas industry, and the government's decision to suspend nuclear power projects are expected to provide an opportunity for the growth of solar and wind power in the country. Moreover, the renewable energy sector in the country has witnessed growth in the past, owing to investment from overseas, as there are no foreign ownership restrictions that apply to the development of renewable energy projects in Vietnam.

- Vietnam is one of the fastest-growing economies in Asia, and thus, the power demand in the country is increasing. The nation's demand for electricity, pushed up by its booming industry and a growing population, is expected to outstrip the construction of new power plants in the future, causing severe power shortages. By 2030, the country is expected to install 130 GW of electricity generation facilities, more than double the 54 GW currently installed.

- With Vietnam's energy demand projected to increase by 10% annually in the next five years and the required power capacity to double, the country has been taking initiatives to diversify its energy mix, including plans to generate more power from renewable sources. The rooftop solar market is expected to play a crucial role in helping Vietnam meet its massive energy needs.

- In January 2024, State utility Vietnam Electricity (EVN) entered 19 power purchase agreements for the acquisition of 2,689 MW of electricity from 26 hydropower plants in Laos during the 46th meeting of the Vietnam-Laos Intergovernmental Committee for Bilateral Cooperation in Hanoi. The signing of the agreements demonstrated deeper cooperation in electricity between Vietnam and Laos.

- Thus, owing to the points listed above, Vietnam is expected to dominate the renewable energy market in the region during the forecast period.

Southeast Asia Renewable Energy Industry Overview

The Southeast Asian renewable energy market is moderately fragmented. Some of the major companies in the market (in no particular order) include Sindicatum Renewable Energy Company Pte Ltd, Trina Solar Co. Ltd, Jinko Solar Holding Co. Ltd, B.Grimm Group, and San Miguel Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 70308

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Southeast Asia Renewable Energy Mix, 2023

- 4.3 Renewable Energy Installed Capacity and Forecast in GW, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Government Policies, Targets, and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Investments in Renewable Energy Generation

- 4.6.1.2 Favorable Government Policies

- 4.6.2 Restraints

- 4.6.2.1 Initial Cost of Renewable Energy Is High

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Industry Attractiveness - Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solar

- 5.1.2 Wind

- 5.1.3 Hydro

- 5.1.4 Bioenergy

- 5.1.5 Other Types

- 5.2 By Geography

- 5.2.1 Vietnam

- 5.2.2 Indonesia

- 5.2.3 Philippines

- 5.2.4 Thailand

- 5.2.5 Malaysia

- 5.2.6 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Canadian Solar Inc.

- 6.3.2 JinkoSolar Holding Co. Ltd

- 6.3.3 Sindicatum Renewable Energy Company Pte Ltd

- 6.3.4 Trina Solar Co. Ltd

- 6.3.5 San Miguel Corporation

- 6.3.6 B.Grimm Group

- 6.3.7 Thanh Thanh Cong (TTC) Group

- 6.3.8 BCPG Public Company Limited (BCPG)

- 6.3.9 Gulf Energy Development PCL

- 6.4 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Southeast Asia's Offshore Wind Potential and Projects

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.