Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630376

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630376

East Europe Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

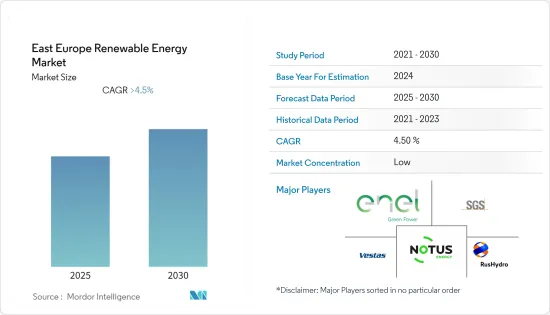

The East Europe Renewable Energy Market is expected to register a CAGR of greater than 4.5% during the forecast period.

COVID-19 marginally impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as increased environmental awareness and regulations and decreased cost per kilowatt of electricity generated are expected to boost the market.

- On the other hand, the high price of solar and wind energy storage is expected to restrain the market.

- Nevertheless, new models of solar cells made of a thin film technology that uses thin coatings of cadmium telluride in solar cells, which have higher efficiency and lower cost, may prove to be an opportunity in the sector.

- Russia is expected to dominate the renewable energy market during the forecast period in the region. Due to a significant rise in investment in renewable energy projects.

East Europe Renewable Energy Market Trends

Hydropower Segment to Dominate the Market

- The hydropower segment is expected to dominate the market as a vast reservoir of dams has been built across east Europe due to its history with U.S.S.R. It is expected to remain the largest renewable energy segment in the forecast period. Most of the dams have been constructed in Russia.

- The hydropower Segment includes different-sized reservoir dams that can be used to provide renewable energy. Hydropower is the most used renewable energy in East Europe.

- In January 2022, the Polish government announced that work would be resumed on the country's largest hydroelectric plant 50 years after construction began and 33 years after the project was abandoned. The plant will have a capacity of 750 MW and will be located in the village of Mloty, southwestern Poland.

- Hydropower (including mixed plants) constitute almost 72.7%of the total renewable energy generated in the region, with nearly 74,101 MW of energy being produced, in 2021.

- Therefore, vast reservoirs of dams providing renewable energy are expected to dominate the market due to their large size relative to other renewable energy, a continuation of maintenance, and little increase in investments.

Russia to Dominate the Market

- In 2021, more than 18% of Russia's electricity is produced by Russia's hydroelectric power plants, with the country holding a wealth of untapped resources to increase its output significantly.

- Most of the renewable energy in the country is produced by hydropower projects. In 2021, the country's renewable energy capacity stood at 56.2 GW. New projects in the solar energy sector are expected to be added to the total renewable energy market.

- The biggest hydropower plant in Russia, the Sayano-Shushenskaya hydroelectric power plant, is located on the Yenisei River in Sayanogorsk, Khakassia. The power station's 242m-high arch-gravity dam has an installed capacity of 6.4GW. The hydro project provides plentiful electricity supply in the Central and East regions of the country.

- Hence, Russia is expected to dominate the market due to its large size and increased renewable energy installed capacity in the forecast period.

- However, after the outbreak of the Russia-Ukraine conflict, Russia is not expected to witness any significant growth in its renewable energy portfolio as almost all of the foreign companies have exited the country.

East Europe Renewable Energy Industry Overview

East Europe Renewable Energy Market is partially fragmented. Some of the key players in this market are (not in particular order) PJSC RusHydro, Vestas Wind Systems A/S, Enel Green Power S.p.A., NOTUS Energy GmbH, and SGS SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 70279

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Installed Capacity Forecast in GW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hydropower

- 5.1.2 Solar

- 5.1.3 Others

- 5.2 Geography

- 5.2.1 Russia

- 5.2.2 Poland

- 5.2.3 Ukraine

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems A/S

- 6.3.2 Enel Green Power S.p.A.

- 6.3.3 NOTUS Energy GmbH

- 6.3.4 SGS SA

- 6.3.5 Wartsila Oyj Abp

- 6.3.6 Hanwha Q Cells Co., Ltd.

- 6.3.7 Schneider Electric SE

- 6.3.8 C&C Energy SRL

- 6.3.9 Federal Hydro-Generating Co RusHydro PAO

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.