Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630372

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630372

South Europe Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 110 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

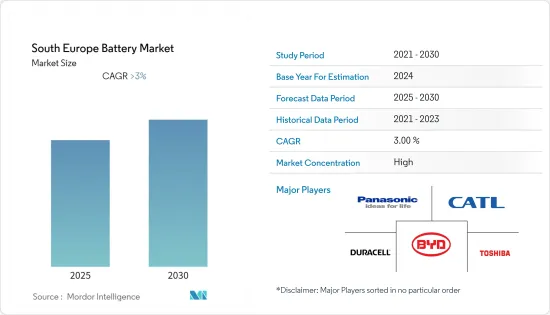

The South Europe Battery Market is expected to register a CAGR of greater than 3% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the medium term, the reduction in the cost of lithium-ion batteries and the adaptation of energy storage systems are expected to drive the market's growth.

- On the other hand, the increasing prices of raw materials and minerals used for manufacturing batteries are expected to hamper the South Europe Battery Market growth during the forecast period.

- Nevertheless, new-generation batteries such as lithium-sulfur and solid-state are likely to create lucrative growth opportunities for the South Europe battery market in the forecast period.

- Italy dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing dependency on renewable energy power generation.

South Europe Battery Market Trends

Lithium-ion Batteries Expected to Dominate the Market

- Lithium-ion batteries are a rechargeable type of battery usually used in digital gadgets and power cars. These batteries also store energy from renewable energy resources, including solar and wind.

- Europe's demand for lithium-ion batteries for electric vehicles is expected to amount to 325 gigawatt-hours in 2030. This represents almost the major of the global demand for electric vehicle lithium-ion batteries. Many European countries committed to combustion engine phase-out will substantially increase battery demand in this time frame.

- Many countries, such as Italy and Greece, have targeted installing solar energy of 50 gigawatts (GW) and 5 gigawatts (GW), respectively, by the end of 2030. Such installation is expected to be a driver for the South Europe battery market, as the extra energy produced by renewable energy can be stored in batteries for later use.

- Portugal is already the largest lithium producer in Europe, though most of the country's lithium is used for making ceramics and glassware. For instance, in December 2021, the Swedish battery cell manufacturer Northvolt announced setting up a 50:50 joint venture with Portugal's energy company Galp. Under the direction of the joint venture Aurora, a lithium conversion plant is expected to be built in Portugal. The plant will have an annual production capacity of up to 35,000 tonnes of battery-grade lithium hydroxide and is expected to commence commercial operation in 2026.

- Hence, owing to the above points, the lithium-ion segment is expected to dominate in the South Europe Battery Market during the forecast period.

Italy Expected to Dominate the Market

- Italy has targeted to phase out coal power by the end of 2025 and rely more on cleaner energy sources such as gas, wind, solar, etc. Such a transition in energy generation is expected to drive the country's battery market as batteries can be used to store extra energy generated from renewable for later use. In 2021 the total renewable energy installation was 56,987 megawatts (MW).

- Moreover, the country is witnessing rapid growth in the telecommunication sector, and increasing demand for batteries in the data centers will likely positively impact the country's battery market.

- The automotive industry of Italy is witnessing rapid growth in the electric vehicles market, thus driving the country's battery market. Different types of initiatives and measures are taken by the government in the country to support electric vehicle (EV) usage in the country. Most of these initiatives regarding EV exhibits create a positive impact and are likely going to drive the country's battery market.

- In August 2022, Italvolt announced plans to build an Italian EV battery plant in spring 2023. The EV battery plant is a 45 GWh battery cell factory in the northwestern Italian region of Piedmont. The company expects to receive the building permit in spring 2023. The new factory will make MNC (nickel, manganese, cobalt) lithium-ion battery cells with silicon anodes for car makers to assemble into packs.

- Hence, owing to the above points, Italy is expected to dominate the South Europe battery market during the forecast period.

South Europe Battery Industry Overview

The South Europe Battery Market is fragmented in nature. Some of the major players in the market (not in particular order) include Toshiba Corp, Contemporary Amperex Technology Co. Limited, BYD Company Ltd, Panasonic Corporation, and Duracell Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 70251

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lithium-ion Battery

- 5.2.2 Lead-acid Battery

- 5.2.3 Flow Battery

- 5.2.4 Others

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Industrial

- 5.3.3 Portable

- 5.3.4 Others

- 5.4 Geography

- 5.4.1 Italy

- 5.4.2 Greece

- 5.4.3 Portugal

- 5.4.4 Spain

- 5.4.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Sovema Group S.p.A.

- 6.3.2 SIA Industria Accumulatori SpA

- 6.3.3 Toshiba Corp

- 6.3.4 Posharp

- 6.3.5 Manz Italy S.R.L.

- 6.3.6 Recor Batteries

- 6.3.7 STEELMAXenergy

- 6.3.8 MONBAT Group

- 6.3.9 Panasonic Corporation

- 6.3.10 Duracell Inc

- 6.3.11 Hitachi Chemical Co Ltd

- 6.3.12 BYD Company Ltd

- 6.3.13 Contemporary Amperex Technology Co Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.