PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630294

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630294

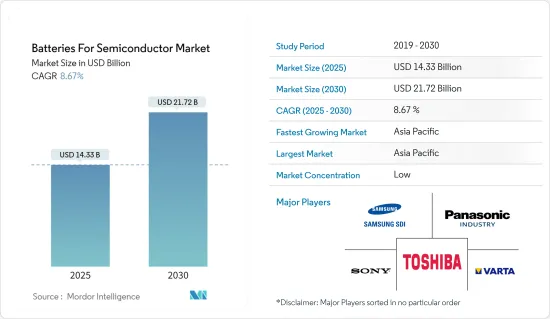

Batteries For Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Batteries For Semiconductor Market size is estimated at USD 14.33 billion in 2025, and is expected to reach USD 21.72 billion by 2030, at a CAGR of 8.67% during the forecast period (2025-2030).

Over the long term, the increasing adoption of electric vehicles and demand for mobile phones are expected to drive the market during the forecasted period.

On the other hand, technological challenges of batteries, like low energy density, lower lifespan, and slower charging capacity, are expected to hinder the growth of the market during the forecasted period.

Nevertheless, the increasing adoption of energy storage systems is expected to create huge opportunities for the Batteries for Semiconductor Market.

Asia-Pacific is expected to be a dominant region for the Consumer Battery Market due to the presence of a large battery manufacturing infrastructure in the region.

Semiconductor Battery Market Trends

The Electric Vehicle Segment is Expected to Witness Significant Demand

- The electric vehicle (EV) market segment has witnessed substantial growth in recent years, and this has had a significant impact on the demand for batteries in the semiconductor market. As EVs continue to gain popularity due to their environmental benefits and technological advancements, the need for efficient and reliable batteries has become paramount. This surge in demand has generated a ripple effect throughout the semiconductor market, creating new opportunities and challenges for stakeholders in the industry.

- According to the International Energy Agency, global electric vehicles are on the rise in 2022; the cumulative plug-in light electric vehicle sales globally were around 10.2 million units, recording a growth rate of 56.9% between 2021 and 2022 and a fivefold increase between 2018 and 2022.

- One of the key drivers behind the growth of the EV market segment is the increasing global awareness of environmental concerns. Governments and consumers are advocating for cleaner and more sustainable modes of transportation, and EVs have emerged as a viable solution. This has led to various incentives, tax breaks, and regulations promoting the adoption of electric vehicles. As a result, automakers are shifting their focus towards EV production, thus bolstering the demand for advanced battery technologies within the semiconductor market.

- For instance, in January 2023, the Government of Canada announced that at least 20% of the vehicles sold in the country will be electric vehicles from 2026, and it will gradually increase to 60% in 2030 and reach 100% by the end of 2035. This announcement was made to increase the adoption of electric vehicles in the country to meet the carbon emission targets set by Canada. The government has also announced offering production incentives to companies manufacturing electric vehicle batteries nationwide.

- The electric vehicle market segment's growth trajectory has a cascading effect on the semiconductor industry, creating a range of opportunities for market players. Semiconductor manufacturers have a chance to develop and supply the cutting-edge components and chips required for EV batteries, battery management systems, and power electronics. This translates to increased revenue potential and the chance to capitalize on the expanding EV market.

- With the increasing sales of electric vehicles and the supportive government policies, the segment is expected to increase further, increasing the research and development activities in the battery for semiconductor segment.

Asia-Pacific Account for Significant Market Growth

- The Asia-Pacific market segment for batteries in the semiconductor market is a pivotal and dynamic region with significant implications for the global semiconductor industry. This vast and diverse region encompasses many countries, each with its unique economic and technological landscape. The demand for batteries in the semiconductor market within the Asia Pacific region has been steadily rising, driven by factors that include rapid industrialization, increasing consumer electronics usage, and the burgeoning electric vehicle market.

- One of the critical drivers for the demand for semiconductor batteries in the Asia-Pacific region is the exponential growth in consumer electronics. This growth is driven by rising disposable incomes and a surging middle-class population, especially in countries like China and India. These consumers are increasingly adopting smartphones, laptops, and other personal electronic devices, which, in turn, fuels the need for advanced semiconductor batteries to power these gadgets. As consumer electronics become an integral part of everyday life, semiconductor manufacturers in the Asia-Pacific region are poised to benefit from this growing market segment.

- Additionally, the Asia-Pacific region has witnessed a substantial uptick in electric vehicle adoption. With an increasing focus on environmental sustainability and government incentives to promote electric vehicles, countries like China have become significant players in the electric vehicle market.

- For instance, according to the China Association of Automobile Manufacturers (AMMA), as of May 2023, China is the largest market for electric vehicles (EV), with an estimated 0.793 million plug-in hybrid Electric vehicles (PHEVs) and 2.146 million battery electric vehicles (BEVs) being sold. In 2022, the country recorded the highest sales of battery electric vehicles, with 5.45 million. It is expected to remain the world's largest electric car market during the forecast period.

- This, in turn, has led to soaring demand for advanced batteries in the semiconductor market, as EVs require efficient and reliable semiconductor components to manage power and battery performance. The growth of the electric vehicle market, therefore, offers substantial opportunities for semiconductor battery manufacturers in the Asia-Pacific region.

- In conclusion, the Asia-Pacific market segment for batteries in the semiconductor market is a dynamic and rapidly evolving landscape. The region's growing demand for semiconductor batteries, driven by consumer electronics and electric vehicles, offers significant opportunities for manufacturers. Therefore, per the above points, the Asia-Pacific region will dominate the battery for semiconductor market during the forecasted period.

Semiconductor Battery Industry Overview

The batteries for semiconductor market are highly fragmented and consolidated. The major companies (in no particular order) include Samsung SDI Co Ltd, Sony Corporation, Panasonic Corporation, Varta AG, and Toshiba Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Mobile Devices

- 4.5.1.2 Rising Adaption of Electric Vehicles

- 4.5.2 Restraints

- 4.5.2.1 Availability of Technical Challenges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Lithium-Ion

- 5.1.2 Nickel-Metal Hydride

- 5.1.3 Lithium-Ion Polymer

- 5.1.4 Sodium-Ion Battery

- 5.2 End-User Application

- 5.2.1 Consumer Electronics

- 5.2.2 Electric Vehicles

- 5.2.3 Energy Storage System

- 5.2.4 Other End-User Applications

- 5.3 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Asia-Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Japan

- 5.3.2.4 South Korea

- 5.3.2.5 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Chile

- 5.3.4.2 Brazil

- 5.3.4.3 Argentina

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Egypt

- 5.3.5.5 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Samsung SDI Co Ltd.

- 6.3.2 Sony Corporation

- 6.3.3 Panasonic Corporation

- 6.3.4 Varta AG

- 6.3.5 Toshiba Corporation

- 6.3.6 EnerSys

- 6.3.7 GS Yuasa Corporation

- 6.3.8 Faradion Limited

- 6.3.9 Routejade

- 6.3.10 TianJin Lishen Battery Joint-Stock Co. Ltd.

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Energy Storage System