PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630287

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630287

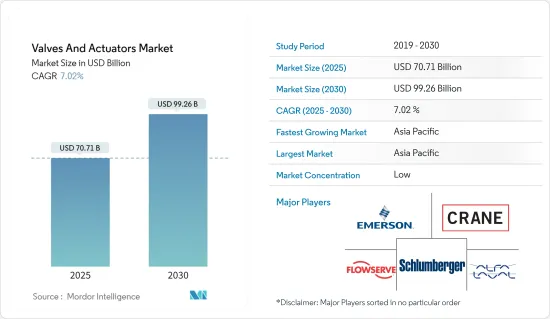

Valves And Actuators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Valves And Actuators Market size is estimated at USD 70.71 billion in 2025, and is expected to reach USD 99.26 billion by 2030, at a CAGR of 7.02% during the forecast period (2025-2030).

The valves and actuators market encompasses various valves and actuators supplied by vendors catering to oil and gas and power generation industries. Market size is determined by the revenue generated by these vendors across industries.

Control valves see heightened demand from oil and gas exploration projects, transportation pipeline initiatives, and ongoing maintenance activities. The market is witnessing a surge, fueled by the push for advanced technologies, paving the way for the development of smart actuators. These smart actuators integrate sensors, motors, communication modules, and controllers seamlessly. Their adaptability allows for easy adjustments, setups, or dismantling, making them a staple in robots across various industries.

As valve and actuator technology advances, engineers prioritize solutions that deliver precise performance, consume less power, and minimize the environmental carbon footprint. This commitment to address the challenges of traditional valve technologies is fueling market growth.

Desalination, which is the process of removing salts and minerals from salty water, is essential for various industries. Industries such as manufacturing, food processing, and agriculture rely more on clean water, leading to a growing demand for desalination as a key solution to increasing water scarcity.

Valves and actuators are pivotal in water treatment plants, power generation, refineries, mining, and food production. Yet, demand for these components has stagnated, particularly in developed nations, due to sluggish industrial growth.

Overall, the valve and actuators market, integral to many industries, is growing, owing to rising demand from the power and chemical industries, the need for desalination activities, and the adoption of advanced technologies.

Valves And Actuators Market Trends

The Oil and Gas Segment Holds Major Market Share

- The oil and gas segment is an important contributor to the actuators market because actuators are essential for regulating the flow of gas and oil through pipelines, maintaining safety systems, and automating a number of tasks in both upstream and downstream operations. Actuators have become widely used in the industry due to the necessity for dependable, long-lasting, and accurate control systems. This is especially true in the increasingly complicated extraction and refining processes. To ensure the safe and effective functioning of oil and gas facilities, actuators in this category are utilized in applications such as valve automation blowout preventers and control of other essential equipment.

- The oil and gas segment increased exploration and production activities in deeper oceans, which has resulted in a major increase in demand for subsea actuators. Extreme underwater environments require subsea actuators to operate equipment. Recent advancements aim to make these actuators more dependable and durable, allowing them to resist corrosive environments, high pressures, and low temperatures. For example, in order to meet the requirements of deep-water projects, Rotork, an actuator manufacturer, has developed advanced subsea electric actuators that offer improved performance and longevity.

- To improve operational efficiency and safety, the oil and gas segment is embracing digital and smart actuation systems at an increasing rate. These smart actuators' sensors and communication capabilities enable real-time monitoring, diagnostics, and control. The Bettis RTS intelligent electric actuators, manufactured by the major industry player Emerson Electric, offer advanced diagnostic features and remote-control capabilities. This allows for more effective administration of oil and gas operations.

- Industrial valves are available in numerous shapes and sizes, including gate, globe, ball, butterfly, check, pressure, and diaphragm valves, each serving distinct functions. As commercial construction and automation projects increasingly rely on them, the demand for industrial gas valves is projected to rise in the coming years. This surge is fueled by technological advancements, heightened industrialization and urbanization, and the expansion of existing facilities.

- In February 2024, 3,000 households in Salem City were registered for domestic piped natural gas (D-PNG) under the city gas distribution (CGD) network. Indian Oil Corporation Limited (IOCL) has installed meters at 1,550 households.

- According to Baker Hughes, North America hosts oil and gas rigs globally. As of May 2024, the region boasted 700 land and 22 offshore rigs. In 2023, the global count of oil rigs surpassed 1,800 units on average.

- The necessity for dependable control systems in exploration and production activities, the growing LNG infrastructure, and the world's need for energy all contribute to the oil and gas segment's continued growth as a key growth area for actuators. Recent subsea and smart actuator technology developments and a strong emphasis on environmental compliance and safety have strengthened the segment's resilience in a challenging market.

Asia-Pacific to Register Major Growth

- China is investing significantly in industrial automation to enhance manufacturing efficiency and reduce labor costs. As factories transition to advanced automated processes, there is an increasing need for actuators, which are essential components in these systems.

- China's government initiatives, like the "Made in China 2025" plan, underscore its focus on automation, technology R&D, and investment. Given the reliance on imports from Germany and Japan for automation equipment, the "Made in China" initiative aims to strengthen domestic production and boost the market's growth.

- India is gradually progressing on the road to Industry 4.0 through the Government of India's initiatives like the National Manufacturing Policy, which aims to increase the share of manufacturing in GDP to 25% by 2025, and the PLI scheme for manufacturing, which was launched in 2022 to develop the core manufacturing industry at par with global manufacturing standards. The manufacturing industry in India is gradually shifting to more automated and process-driven manufacturing, which is expected to increase efficiency and boost production in the manufacturing industry, thereby driving market growth.

- Moreover, the Ministry of Trade, Industry, and Energy is strengthening its efforts by supporting SMEs in adopting and expanding smart factory technologies. They have established the Smart Manufacturing Innovation Office through the Korea Technology and Information Promotion Agency. Also, 10 significant industries are targeted to boast 4,500 smart factories by 2025. Such proactive government measures are poised to stimulate the market's growth.

- The increase in gas exploration activities in Southeast Asia to meet rising demand is expected to drive the need for various types of valves among oil and gas companies in the region. Malaysia and Indonesia have reported successful upstream discoveries, including a significant find by Mubadala Energy in the South Andaman Block.

Valves And Actuators Industry Overview

The valves and actuators market is moderately fragmented, featuring local and international vendors with decades of experience. Vendors are adopting robust competitive strategies, heavily investing in advertising to maintain their market presence.

Leading vendors are actively introducing innovative technologies. Other prominent players in the market are emphasizing integrated solutions to captivate consumers. In contrast, smaller and emerging vendors prioritize cost-benefit advantages, heightening the competitive landscape. With the public sector nearing maturity, a substantial focus is shifting toward the private sector.

Key factors like quality certification, diverse product offerings, competitive pricing, and technical expertise are pivotal in securing new contracts. The competitive rivalry remains high and is projected to persist during the forecast period.

Some of the major players in the market are Emerson Electric Co., Schlumberger Limited, Alfa Laval Corporate AB, Flowserve Corporation, and Crane Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements Propelling Application of Smart Valves and Actuators

- 5.1.2 Increase in Demand for Desalination Activities

- 5.2 Market Restraints

- 5.2.1 Stagnant Industrial Growth in Developed Countries

6 MARKET SEGMENTATION - ACTUATORS

- 6.1 By Type

- 6.1.1 Hydraulic

- 6.1.2 Pneumatic

- 6.1.3 Electric

- 6.1.4 Mechanical

- 6.1.5 Other Types

- 6.2 By End-user Vertical

- 6.2.1 Oil and Gas

- 6.2.2 Power Generation

- 6.2.3 Chemical

- 6.2.4 Water and Wastewater

- 6.2.5 Mining

- 6.2.6 Other End User Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East Africa

- 6.3.1 North America

7 MARKET SEGMENTATION - VALVES

- 7.1 By Type

- 7.1.1 Ball

- 7.1.2 Butterfly

- 7.1.3 Gate/Globe/Check

- 7.1.4 Plug

- 7.1.5 Control

- 7.1.6 Other Types

- 7.2 By End-user Vertical

- 7.2.1 Oil and Gas

- 7.2.2 Power Generation

- 7.2.3 Chemical

- 7.2.4 Water and Wastewater

- 7.2.5 Mining

- 7.2.6 Other End User Verticals

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Emerson Electric Co.

- 8.1.2 Schlumberger Limited

- 8.1.3 Alfa Laval Corporate AB

- 8.1.4 Flowserve Corporation

- 8.1.5 Crane Co.

- 8.1.6 Rotork PLC

- 8.1.7 Metso Oyj

- 8.1.8 KITZ Corporation

- 8.1.9 IMI Critical Engineering

- 8.1.10 Samson Controls Inc.

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS