PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851090

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851090

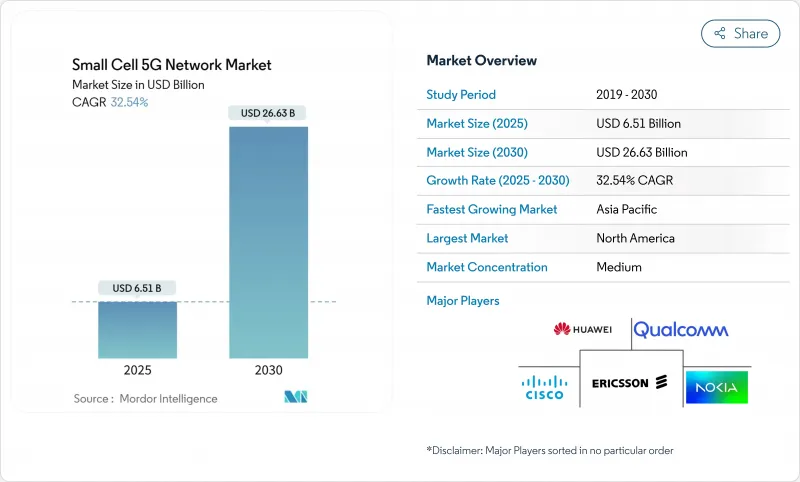

Small Cell 5G Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Small Cell 5G Network Market size is estimated at USD 6.51 billion in 2025, and is expected to reach USD 26.63 billion by 2030, at a CAGR of 32.54% during the forecast period (2025-2030).

Ongoing densification in urban corridors, enterprise digitalization, and the roll-out of AI-native network management systems are accelerating uptake across telecom operators and private-network deployments. Picocells, neutral-host models, and Release-17 NR-U capabilities are expanding addressable use cases by easing spectrum and site constraints. Asia Pacific commands attention through infrastructure scale, yet North America converts infrastructure into premium revenue more efficiently, while Europe's regulatory clarity promises a delayed but sizable second wave of growth. Competitive dynamics feature established radio vendors pivoting toward software-defined architectures even as AI-enabled chipmakers and Open RAN specialists carve out niches.

Global Small Cell 5G Network Market Trends and Insights

Rapid densification needs in urban 5G rollouts

Operators have confirmed that macro cells alone cannot satisfy 5G service-level agreements in dense cities. EE has activated more than 1,000 small cells across the United Kingdom, with 25 London sites moving 7.5 TB of data each week, easing congestion in traditional sectors. Virgin Media O2 introduced the first UK 5G standalone small cells, unlocking network slicing and lower latency that macro sites cannot match. Fractional frequency reuse within small cells improves spectrum utilization, which is critical as uplink-heavy applications such as AR and industrial IoT become mainstream. Municipalities are cutting red tape, and more than 100 neutral-host installations are now live worldwide. Combined, these factors reinforce the densification imperative over the medium term.

Enterprise private-network demand (manufacturing, logistics)

Government policy and Industry 4.0 roadmaps are pushing factories and logistics sites toward deterministic wireless connectivity. China already hosts roughly 4,000 5G factory networks and targets 10,000 by 2027. Nokia counted 850 private 5G customers by Q4 2024, adding 55 in a single quarter. Operational outcomes are compelling: a Thai appliance plant reported 15-20% productivity gains after 5G-enabled automation. Seven European states now license the 26 GHz band locally, and six allocate 100 MHz in the 3.4-3.8 GHz range, making spectrum procurement easier for enterprises. Small cells remain the preferred radio layer because they enforce tight coverage boundaries, integrate edge compute, and support concurrent network slices.

Challenging fiber/backhaul economics in suburban and rural zones

Aerial fiber construction costs between USD 60,000 and USD 170,000 per mile in suburbs, depressing returns where population density is low. Crown Castle shelved 7,000 U.S. small-cell sites, preserving USD 800 million in future capital spending, after recognizing unfavorable backhaul math. Microwave and satellite backhaul trim capex but cannot yet meet 5G capacity or latency targets. Federal Highway Administration data show that using micro-trenching still leaves a six-to-eight-year breakeven in suburban settings. Consequently, operators hesitate to densify beyond profitable metros until next-generation wireless backhaul proves commercially viable.

Other drivers and restraints analyzed in the detailed report include:

- Release-17 5G NR-U enabling unlicensed small-cell spectrum

- AI-driven self-optimizing networks cutting OpEx

- Persistent security concerns around Open RAN small cells

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Picocells contributed 41% of 2024 revenue, confirming their suitability for 100-200 m coverage zones in crowded downtown corridors. The Small Cell 5G Network market size for picocells is on course to expand sharply as mid-band spectrum and multi-user MIMO raise per-site capacity. mmWave picocells show the sharpest 36.51% CAGR, propelled by private networks and fixed wireless access that exploit 28 GHz and 39 GHz to deliver multi-gigabit throughput. Silicon innovation, such as EdgeQ's base-station-on-a-chip, brings integrated AI that shrinks power, cost, and footprint.

Femtocells hold niche residential and small-office positions but face pressure from Wi-Fi 7, while microcells support wider suburban blocks where picocell density is cost-prohibitive. ORAN-compliant micro-radio units from Comba Telecom reflect a drift toward standardized multi-vendor ecosystems. As AI-enabled optimization narrows performance gaps between form factors, operators gain flexibility to match each site's capacity requirements without sacrificing operating efficiency.

Indoor sites represented 63% of 2024 deployments, since mid-band 5G signals fade through modern building materials. Neutral-host systems and smart-building management keep indoor investments compelling for enterprises seeking quality-of-service across offices, stadiums, and factories. The outdoor category is accelerating at a 33.01% CAGR as faster municipal permitting, Release-17 NR-U, and shared infrastructure lower siting friction. Initiatives such as Virgin Media O2's outdoor cells in central Manchester underline this pivot.

Hybrid solutions are emerging, with Freshwave integrating all four UK carriers into a single outdoor-indoor small cell enclosure, cutting costs by 65% and energy by 60% relative to earlier systems. Indoor providers must now defend against Wi-Fi 7, which advertises 46 Gbps theoretical speeds, by highlighting deterministic latency, security, and slice management that Wi-Fi cannot match.

The Small Cell 5G Network Market Report is Segmented by Cell Type (Femtocell, Picocell, Microcell, and Metrocell), Operating Environment (Indoor and Outdoor), Frequency Band (Sub-6 GHz, Mmwave [More Than 24 GHz], and Sub-1 GHz), End-User (Telecom Operators, Enterprises, and Residential), and Geography.

Geography Analysis

Asia Pacific owns 38% of 2024 revenue and tracks a 32.60% CAGR to 2030, propelled by China's 4.4 million 5G base stations and CNY 3 billion earmarked for 5G-Advanced overlays in 300 cities. China Unicom Beijing and Huawei achieved downlink peaks of 11.2 Gbps across a population of 10 million, setting a reference point for future dense overlays. Japan and South Korea push enterprise mmWave, and India's post-auction build-out supplies scope for densification through public-private partnerships.

North America showcases revenue realization efficiency. Ericsson's regional revenue climbed 55% year over year on the back of AT&T's USD 14 billion contract, underlining robust investment returns. More than 50 U.S. neutral-host projects operate in CBRS, and Canada's TELUS is rolling out the first commercial virtualized Open RAN, positioning the region at the forefront of cloud-native RAN experimentation. Still, Crown Castle's canceled deployments highlight suburban economics as a persistent hurdle.

Europe enjoys a clear spectrum policy yet lags in standalone 5G coverage, reaching only 2% penetration by late 2024. Virgin Media O2 and EE are ramping small-cell footprints, but many operators wait for a business-case inflection once device penetration rises. In the Middle East, the UAE logged record 30.5 Gbps 5G speeds, and du committed AED 2 billion to hyperscale data centers, signaling that Gulf operators will leapfrog directly to 5G-Advanced. Latin America sees Brazil's Brisanet and Uruguay's Antel expanding public 5G, though macroeconomic constraints and spectrum scarcity temper small-cell rollouts.

- Telefonaktiebolaget LM Ericsson

- Nokia Corporation

- Huawei Technologies Co. Ltd

- ZTE Corporation

- Samsung Electronics Co. Ltd

- Qualcomm Technologies Inc.

- Airspan Networks Inc.

- CommScope Inc.

- Cisco Systems Inc.

- NEC Corporation

- Baicells Technologies Co. Ltd

- Qucell Inc.

- JMA Wireless

- Parallel Wireless

- Mavenir Systems

- Casa Systems

- Corning Inc.

- Sercomm Corporation

- Comba Telecom Systems Holdings Ltd

- American Tower Corporation

- Boingo Wireless Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid densification needs in urban 5G roll-outs

- 4.2.2 Enterprise private-network demand (manufacturing, logistics)

- 4.2.3 Release-17 5G NR-U enabling unlicensed small-cell spectrum

- 4.2.4 Neutral-host business models gaining regulatory support

- 4.2.5 AI-driven self-optimizing networks cutting OpEx (under-reported)

- 4.3 Market Restraints

- 4.3.1 Challenging fiber/backhaul economics in suburban and rural zones

- 4.3.2 Municipal site-acquisition delays and fees

- 4.3.3 Persistent security concerns around Open RAN small-cells (under-reported)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Cell Type

- 5.1.1 Femtocell

- 5.1.2 Picocell

- 5.1.3 Microcell

- 5.1.4 Metrocell

- 5.2 By Operating Environment

- 5.2.1 Indoor

- 5.2.2 Outdoor

- 5.3 By Frequency Band

- 5.3.1 Sub-6 GHz

- 5.3.2 mmWave (More than 24 GHz)

- 5.3.3 Sub-1 GHz

- 5.4 By End-User

- 5.4.1 Telecom Operators

- 5.4.2 Enterprises

- 5.4.3 Residential

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 UAE

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Telefonaktiebolaget LM Ericsson

- 6.4.2 Nokia Corporation

- 6.4.3 Huawei Technologies Co. Ltd

- 6.4.4 ZTE Corporation

- 6.4.5 Samsung Electronics Co. Ltd

- 6.4.6 Qualcomm Technologies Inc.

- 6.4.7 Airspan Networks Inc.

- 6.4.8 CommScope Inc.

- 6.4.9 Cisco Systems Inc.

- 6.4.10 NEC Corporation

- 6.4.11 Baicells Technologies Co. Ltd

- 6.4.12 Qucell Inc.

- 6.4.13 JMA Wireless

- 6.4.14 Parallel Wireless

- 6.4.15 Mavenir Systems

- 6.4.16 Casa Systems

- 6.4.17 Corning Inc.

- 6.4.18 Sercomm Corporation

- 6.4.19 Comba Telecom Systems Holdings Ltd

- 6.4.20 American Tower Corporation

- 6.4.21 Boingo Wireless Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment