PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851795

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851795

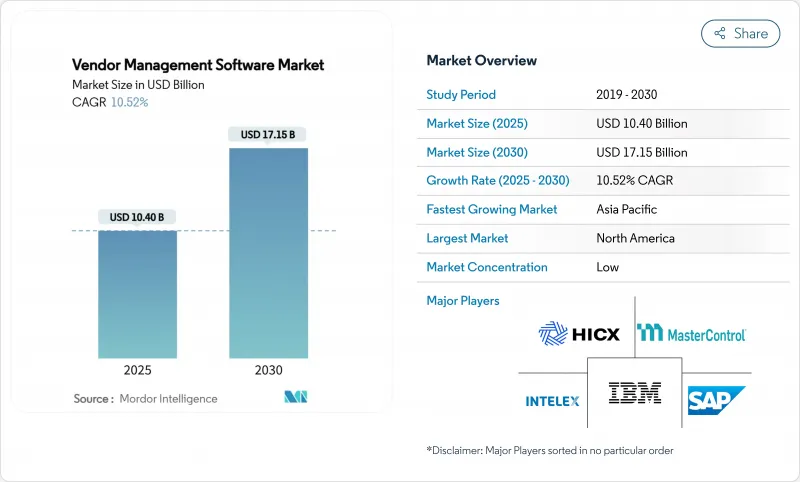

Vendor Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The vendor management software market size reached USD 10.40 billion in 2025 and is forecast to post a 10.52% CAGR, lifting value to USD 17.15 billion by 2030.

Strong momentum reflects enterprises' need to digitize supplier relationships as supply-chain complexity, material-cost inflation, and regulatory scrutiny converge. Cloud-native deployment, AI-driven analytics, and embedded compliance monitoring now set the baseline for new purchases, while integrated source-to-pay suites are steadily replacing point tools. Platform vendors that streamline onboarding, centralize supplier data, and surface predictive insights win preference because manual oversight cannot scale across hundreds of third parties. Competitive conditions remain moderate; established ERP providers, best-of-breed specialists, and AI-native entrants share the field, creating ample scope for niche differentiation without any single firm dominating.

Global Vendor Management Software Market Trends and Insights

Need to Minimize Administrative Costs

Automating repetitive supplier tasks reduces procurement overhead and frees teams for strategic sourcing. Wefunder saved 1,350 hours annually and USD 416,000 in lifetime costs after automating contract renewals through CloudEagle's platform. Similar deployments typically cut processing expenses by 20-30% within year one, a result BetterCloud formalizes through its 3x ROI guarantee. As inflation narrows margins, the cost-take-out motive accelerates adoption across industries.

Rapid Adoption of Cloud Deployment

Cloud-native platforms shorten implementation cycles, lower capital outlay, and offer elastic scalability that aligns fees with transaction volume. Choice Hotels International achieved 98.8% accurate cost allocation soon after going live on Finout's SaaS environment. Real-time collaboration, API-based ERP connectivity, and automatic security patching turn cloud into the default option, especially where IT talent is scarce.

High Implementation and Maintenance Costs

Conexis VMS notes that integration, customization, and data migration can double initial budgets, pushing small firms toward phased rollouts.Annual operational spend covers software development, support, and cybersecurity, yet return on investment typically arrives within 18 months as automated workflows unlock savings.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Emphasis on Third-Party Risk Compliance

- Globalized, Multi-Tier Supply-Chain Complexity

- Integration Complexity with Legacy ERP Suites

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployment captured 63.2% of the vendor management software market in 2024 and is forecast to expand at a 12.9% CAGR to 2030. Broad acceptance follows lower upfront spend, faster time-to-value, and the ability to push real-time updates that keep security controls current. Finout's success at Choice Hotels illustrates the quick wins enterprises expect. In contrast, on-premises models now appeal mainly to organizations with sensitive sovereignty mandates. Integration workloads and AI compute requirements tip the cost-benefit equation further toward cloud. Hybrid paths persist, letting firms retain critical data in-house while exploiting SaaS collaboration and analytics layers. The vendor management software market continues to shift budgets accordingly, a dynamic reinforced by subscription pricing that scales with transaction throughput.

Second-generation SaaS suites also bundle AI engines that predict supplier risk, recommend cost savings, and automate compliance evidence gathering. These capabilities rely on cloud elasticity, encouraging users to sunset bespoke instances. As upgrades arrive automatically, IT teams redirect effort toward strategic data stewardship instead of routine patching. Consequently, cloud remains the anchor as the vendor management software market advances.

Manufacturing held 37.3% of 2024 revenues, reflecting multi-tier supply chains that demand granular visibility into quality, delivery, and ESG metrics. LeanDNA's rollout at Johnson Controls shows how plant networks benefit from synchronized part, supplier, and inventory data. Inflationary raw-material swings and geopolitical events push producers to diversify sourcing, raising onboarding volumes and reinforcing platform necessity. Retail, while smaller, posts the fastest 11.2% CAGR on the back of omnichannel growth, private-label expansion, and the need to align assortments with consumer demand.

Financial-services uptake accelerates as regulators scrutinize fintech collaborations. Ncontracts found 73% of institutions staffing vendor risk functions with two or fewer employees even while managing 300+ vendors. Healthcare providers prioritize HIPAA-aligned oversight; Vanta's deployment at US Med-Equip reduced audit prep by 50%. Governments gradually modernize procurement to heighten transparency and supplier diversity, aided by solutions such as BidNet Direct.

Vendor Management Software Market is Segmented by Deployment (Cloud, On-Premises), End-User Industry (Retail, BFSI, Manufacturing, and More), Organization Size (Large Enterprises, Smes), Component / Module (Vendor Onboarding and Information Management, Vendor Risk and Compliance Management, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 27.9% share in 2024 owing to early digital procurement maturity, deep cloud infrastructure, and stringent banking and healthcare regulations that institutionalize vendor-risk workflows. Financial services, in particular, adopt platforms to navigate OCC and CFPB guidance. Continuous innovation from domestic SaaS vendors sustains refresh cycles, further anchoring the region's lead.

Asia-Pacific rises as the growth engine with a 13.2% CAGR through 2030. Government-backed digitization programs, burgeoning manufacturing exports, and increasing cyber incidents push organisations to professionalize third-party oversight. Singaporean firms reported over 70% supply-chain cyber breaches, spurring 90% of them to raise risk-management budgets. India's MSMEs contribute 48% of national exports and rely on modern vendor portals to compete globally. China's forced-labor compliance drives demand for screening tools that trace sub-tier suppliers.

Europe maintains steady growth as ESG and due-diligence directives necessitate automated disclosures. Firms deploy platforms to capture Scope-3 emissions and ethical-sourcing attestations across supply chains. Middle East and Africa along with South America trail in absolute value but display rising adoption as cloud connectivity improves and public-sector modernization funds flow. Across regions, the vendor management software market demonstrates strong correlation to e-procurement maturity and regulatory mandates, setting a clear roadmap for future penetration.

- IBM Corporation

- SAP SE

- Coupa Software Inc.

- MasterControl, Inc.

- Intelex Technologies Inc.

- HICX Solutions

- Gatekeeper

- MetricStream Inc.

- Ncontracts LLC

- LogicManager Inc.

- SalesWarp

- Quantivate LLC

- Ivalua

- Jaggaer

- GEP Worldwide

- Oracle Corporation

- Workday Inc.

- Beeline

- Precoro

- Zycus

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need to minimize administrative costs

- 4.2.2 Rapid adoption of cloud deployment

- 4.2.3 Regulatory emphasis on third-party risk compliance

- 4.2.4 Globalized, multi-tier supply chains complexity

- 4.2.5 AI-driven predictive vendor risk scoring

- 4.2.6 ESG and Scope-3 transparency mandates

- 4.3 Market Restraints

- 4.3.1 High implementation and maintenance costs

- 4.3.2 Data-security and privacy concerns

- 4.3.3 Integration complexity with legacy ERP suites

- 4.3.4 Shortage of vendor-risk talent

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By End-user Industry

- 5.2.1 Retail

- 5.2.2 BFSI

- 5.2.3 Manufacturing

- 5.2.4 IT and Telecommunications

- 5.2.5 Healthcare

- 5.2.6 Government and Public Sector

- 5.2.7 Other Industries

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Component / Module

- 5.4.1 Vendor Onboarding and Information Management

- 5.4.2 Vendor Risk and Compliance Management

- 5.4.3 Contract and Performance Management

- 5.4.4 Invoice and Payment Management

- 5.4.5 Analytics and Reporting

- 5.4.6 Other Modules

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Southeast Asia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 SAP SE

- 6.4.3 Coupa Software Inc.

- 6.4.4 MasterControl, Inc.

- 6.4.5 Intelex Technologies Inc.

- 6.4.6 HICX Solutions

- 6.4.7 Gatekeeper

- 6.4.8 MetricStream Inc.

- 6.4.9 Ncontracts LLC

- 6.4.10 LogicManager Inc.

- 6.4.11 SalesWarp

- 6.4.12 Quantivate LLC

- 6.4.13 Ivalua

- 6.4.14 Jaggaer

- 6.4.15 GEP Worldwide

- 6.4.16 Oracle Corporation

- 6.4.17 Workday Inc.

- 6.4.18 Beeline

- 6.4.19 Precoro

- 6.4.20 Zycus

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment