PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630245

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1630245

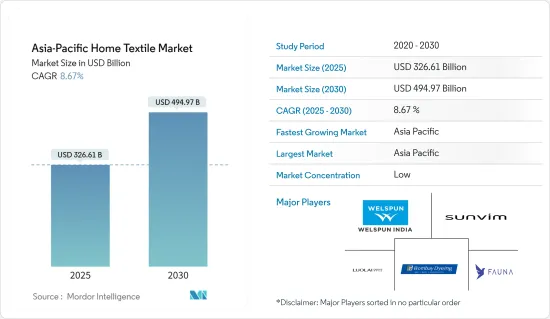

Asia-Pacific Home Textile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Asia-Pacific Home Textile Market size is estimated at USD 326.61 billion in 2025, and is expected to reach USD 494.97 billion by 2030, at a CAGR of 8.67% during the forecast period (2025-2030).

The Asia-Pacific home textile market is experiencing significant expansion, driven by innovations and an increasing consumer preference for aesthetically appealing home decor. Technological advancements are creating numerous opportunities for market players to innovate. A booming housing sector and evolving fashion trends are fueling the growth of home textiles in the region.

Manufacturers are strategically expanding their product lines to meet seasonal demands, offering a variety of bedsheets tailored to specific weather conditions. During the winter months, they introduce bedsheets made from warm, woolen fabrics to provide extra comfort, while in the summer, they shift to lightweight, breathable cotton bedsheets to ensure coolness. This adaptability in product offerings directly responds to consumer needs and preferences. Moreover, the furniture industry's significant growth within the region has provided substantial support to the expansion of the home textile market, indicating a symbiotic relationship between these two sectors.

The integration of cutting-edge technologies in the home textile sector has significantly enhanced performance by improving durability and introducing a wide array of functionalities and applications. This advancement fosters the adoption of innovative trends such as electronic textiles, characterized by their environmentally friendly design, allowing for easy disposability and reusability, thereby meeting the growing consumer demand for sustainable products.

Asia-Pacific Home Textile Market Trends

Rising Demand for Bed Linen Fueling the Market

The hospitality sector's growth, especially in emerging markets, continues to fuel the demand for bedroom linens. China spearheads hotel development, closely trailed by India and Australia, positioning these regions as key consumers of bedroom linens. A surge in home remodeling has seen consumers increasingly investing in home furnishings, with bedroom linens topping the list. A Comscore study revealed that, amidst the COVID-19 pandemic, 74 million consumers took on home improvement projects, with many opting to revamp their living spaces with new bedroom linens for added comfort and style. Regional preferences for bedroom linens exhibit significant diversity. Anki Spets, owner of AREA Home, recommends a minimum of two sheets per person, with higher demand in humid areas for enhanced comfort and hygiene. Sustainability shapes consumer decisions, prompting brands to pivot toward eco-friendly, chemical-free offerings. These products, often crafted from organic cotton, linen, hemp, and Tencel, cater to the environmentally conscious consumer.

India Dominates the Market

The Indian home textiles market is witnessing robust growth, catching the eye of foreign brands. These brands are making their foray into India through direct investments or joint ventures. The surge in India's home textiles sector can be attributed to several factors, such as the rise in household income, a growing population, increasing income levels, a boost in organized retail, and a surge in demand from sectors like housing, hospitality, and healthcare. Notably, India holds a substantial 7% share in the global home textiles trade and is a key exporter to the United States. The Indian textile industry boasts a diverse range of products. With a keen eye for innovation, it is embracing cutting-edge technologies like smart textiles and vegan silk production. These advancements present lucrative avenues for both local and global players, bolstering their prospects in the Indian market. These factors are fueling the growth of the home textiles market in India.

Asia-Pacific Home Textile Industry Overview

The Asia-Pacific home textile market is fragmented in nature. Currently, a handful of major players hold significant market shares. However, consumer income remains the primary driver of demand. The larger corporations leverage their scale to compete on factors like volume purchasing, diverse product portfolios, and robust marketing strategies. Conversely, smaller enterprises carve their niche by emphasizing a narrower market segment, offering a wider range of products, and delivering exceptional customer service. The major players in this market are Welspun Group, Sunvim Group Co. Ltd, Luolai Home Textile Co. Ltd, Bombay Dyeing, and Fuanna.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Crop Yields Drives the Market

- 4.2.2 Vibrant Look of Home Textiles Gives a Positive Mood

- 4.3 Market Restraints

- 4.3.1 High Volume of Waste Material

- 4.4 Market Opportunities

- 4.4.1 Technological Advancements in Home Textile Market

- 4.5 Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Trends Influencing the Asia-Pacific Home Textile Market

- 4.8 Insights into Technological Innovations in the Market

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Bed Linen

- 5.1.2 Bath Linen

- 5.1.3 Kitchen Linen

- 5.1.4 Upholstery

- 5.1.5 Floor

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets & Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 Online

- 5.3 By Country

- 5.3.1 China

- 5.3.2 Japan

- 5.3.3 India

- 5.3.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 COMPANY PROFILES

- 6.1.1 Welspun Group

- 6.1.2 Sunvim Group Co Ltd

- 6.1.3 Luolai Lifestyle Technology Co. Ltd

- 6.1.4 Bombay Dyeing

- 6.1.5 Fuanna

- 6.1.6 Hunan Mendale Hometextile Co. Ltd

- 6.1.7 Shanghai Shuixing Home Textile Co. Ltd

- 6.1.8 Arvind Ltd

- 6.1.9 Raymond Group

- 6.1.10 Trident Limited*

7 FUTURE MARKET TRENDS

8 DISCLAIMER AND ABOUT US