PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851729

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851729

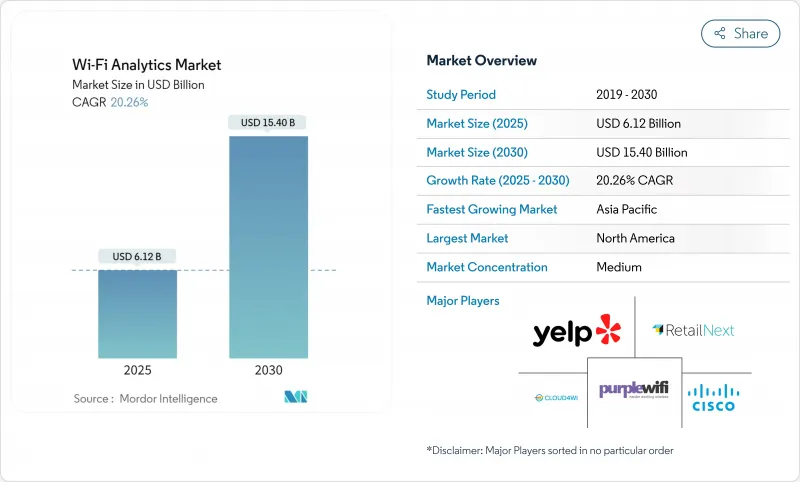

Wi-Fi Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Wi-Fi analytics market generated USD 6.12 billion in 2025 and is on track to reach USD 15.40 billion by 2030, reflecting a 20.26% CAGR.

Enterprises now treat access points as data-collection assets that fuel real-time decision making, rather than as basic connectivity tools. Commercial roll-outs of Wi-Fi 7, wider 6 GHz spectrum access, and the spread of edge AI in access points amplify demand. Hospitality remains the largest user group, while retail's fast climb shows how brick-and-mortar operators are turning location data into a competitive advantage. Cloud deployment rules the landscape as companies favor subscription models that scale without heavy capital expense.

Global Wi-Fi Analytics Market Trends and Insights

Surging Smartphone and Smart-Device Penetration

More than 21.1 billion Wi-Fi devices were active in 2024, with 576.2 million Wi-Fi 6E and 231.4 million Wi-Fi 7 units shipped during the year. Each connected user now carries multiple devices, enabling richer cross-session behavioral profiles. Enterprises that harness this density translate anonymous foot-traffic counts into layered customer-journey maps, improving conversion and dwell time. Retail chains that correlate device classes with in-store heatmaps allocate associates and promotions more precisely, raising basket size and reducing stock-outs. The trend strengthens predictive modeling accuracy as sample sizes grow, feeding AI that anticipates queue build-ups or product interest shifts minutes ahead of time.

Rapid Rollout of Public Wi-Fi in Physical Venues

Stadiums, airports, and malls moved Wi-Fi from cost center to revenue engine. Extreme Networks now supports analytics at 25 NFL stadiums, turning fan movement into real-time engagement cues. TD Garden's guest platform shows how seamless log-in increases opted-in first-party data capture. Transport hubs use dwell metrics to reshape concession placement, while quick-service restaurants upgrade access points to push queue-length alerts to managers. The emerging norm links splash-page consent with loyalty IDs, building persistent profiles that extend beyond venue walls into omnichannel marketing.

Stringent Privacy Regulations (GDPR, CCPA, etc.)

Hefty fines push operators to overhaul consent flows, add data-protection officers, and run routine audits that can add 15-20% to deployment budgets. Firms such as Purple pivoted to explicit user accounts and granular consent logs that meet GDPR demands. Some venues now anonymize probe-request data at the chip level, trading individual paths for aggregated density maps. Vendors that bake privacy first in their design win bids as enterprises seek compliance assurance.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Real-Time Customer Experience Personalisation

- Integration of AI/ML Engines with Wi-Fi Analytics Platforms

- MAC-Address Randomization Impacting Data Accuracy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions continued to dominate, holding 56.5% of the Wi-Fi analytics market share in 2024. However, services are outpacing at 21.4% CAGR, driven by demand for turnkey insight rather than do-it-yourself dashboards. Enterprises outsource analytics interpretation, privacy governance, and cross-system integration to specialists, lowering internal workloads while compressing time-to-value.

The Wi-Fi analytics market size for services is anticipated to more than double between 2025 and 2030 as vendors bundle consulting, managed operations, and outcome-based pricing. RetailNext's fresh funding from Battery Ventures underscores investor belief that analytics-as-a-service will underpin future growth. Cloud4Wi's Fogsense micro-device shows how service firms shrink hardware footprints and shift value upstream to business context.

Cloud platforms controlled 62.9% of the Wi-Fi analytics market share in 2024, and the segment is forecast to advance at a 21.8% CAGR. Subscription models eliminate capex and provide elastic storage plus AI updates on release day. Small and midsize retailers that once lacked internal IT staff now deploy within hours, unlocking network data that previously sat idle.

Edge compute addresses latency and data-sovereignty concerns; Cisco's AI-native Wi-Fi 7 access points process telemetry locally while syncing summaries to the cloud.On-premise remains relevant in defense, healthcare, and financial institutions where sovereign hosting or legacy architectures persist.

Wi-Fi Analytics Market Report is Segmented by Component (Solutions, Services), Deployment (On-Premise, Cloud), Application (Presence Analytics, Marketing Analytics), End-User Vertical (Retail, Hospitality, Sports and Leisure, Transportation, Healthcare and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America accounted for 31.2% of global revenue in 2024, driven by early enterprise adoption and mature regulatory balance between privacy and analytics. Flagship examples include Extreme Networks' deployments across 25 NFL stadiums that demonstrate best practices in high-density Wi-Fi. High smartphone penetration and robust cloud infrastructure sustain continuous platform upgrades.

Asia-Pacific is the fastest expanding region, growing at a 20.5% CAGR through 2030. China hosts about 4,000 private wireless factories that lay groundwork for granular analytics, while India's prospective 6 GHz allocation could unlock USD 4,030 billion in economic value by 2034. Rapid urbanisation and government digital-in-public policies spur deployments across transport hubs, malls, and smart campuses.

Europe presents a privacy-led model where GDPR dictates platform design. Operators that secure user consent and anonymise data gain first-mover advantage. Germany leads with large retail chains linking guest Wi-Fi to loyalty programs under strict compliance, and the United Kingdom's public Wi-Fi initiatives in rail stations illustrate high-traffic analytics at national scale. Edge-enabled deployments lower cloud egress costs and align with the region's sustainability targets.

- Cisco Systems Inc.

- Cloud4Wi Inc.

- Purple WiFi Ltd

- RetailNext Inc.

- Yelp WiFi Inc.

- CommScope Inc. (Ruckus Wireless)

- Fortinet Inc.

- Blix Inc.

- Skyfii Limited

- Singtel Optus Pty Ltd

- MetTel Inc.

- Hewlett Packard Enterprise (Aruba Networks)

- Extreme Networks Inc.

- Cambium Networks Ltd

- Ubiquiti Inc.

- Aislelabs Inc.

- Plume Design Inc.

- Euclid Analytics

- Near Intelligence Holdings

- Mist Systems (Juniper Networks)

- Cloud5 Communications

- Datavalet Technologies Inc.

- GoZone WiFi LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging smartphone and smart-device penetration

- 4.2.2 Rapid rollout of public Wi-Fi in physical venues

- 4.2.3 Demand for real-time CX personalisation in retail and hospitality

- 4.2.4 Integration of AI/ML engines with Wi-Fi analytics platforms

- 4.2.5 Adoption of Wi-Fi RTT for sub-meter indoor positioning

- 4.2.6 Edge-based analytics on access points lowering TCO

- 4.3 Market Restraints

- 4.3.1 Stringent privacy regulations (GDPR, CCPA, etc.)

- 4.3.2 Persistent network-level security vulnerabilities

- 4.3.3 MAC-address randomisation impacting data accuracy

- 4.3.4 Spectrum congestion in high-density locations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Application

- 5.3.1 Presence Analytics

- 5.3.2 Marketing Analytics

- 5.4 By End-user Vertical

- 5.4.1 Retail

- 5.4.2 Hospitality

- 5.4.3 Sports and Leisure

- 5.4.4 Transportation

- 5.4.5 Healthcare

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 Cloud4Wi Inc.

- 6.4.3 Purple WiFi Ltd

- 6.4.4 RetailNext Inc.

- 6.4.5 Yelp WiFi Inc.

- 6.4.6 CommScope Inc. (Ruckus Wireless)

- 6.4.7 Fortinet Inc.

- 6.4.8 Blix Inc.

- 6.4.9 Skyfii Limited

- 6.4.10 Singtel Optus Pty Ltd

- 6.4.11 MetTel Inc.

- 6.4.12 Hewlett Packard Enterprise (Aruba Networks)

- 6.4.13 Extreme Networks Inc.

- 6.4.14 Cambium Networks Ltd

- 6.4.15 Ubiquiti Inc.

- 6.4.16 Aislelabs Inc.

- 6.4.17 Plume Design Inc.

- 6.4.18 Euclid Analytics

- 6.4.19 Near Intelligence Holdings

- 6.4.20 Mist Systems (Juniper Networks)

- 6.4.21 Cloud5 Communications

- 6.4.22 Datavalet Technologies Inc.

- 6.4.23 GoZone WiFi LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment