PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850347

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850347

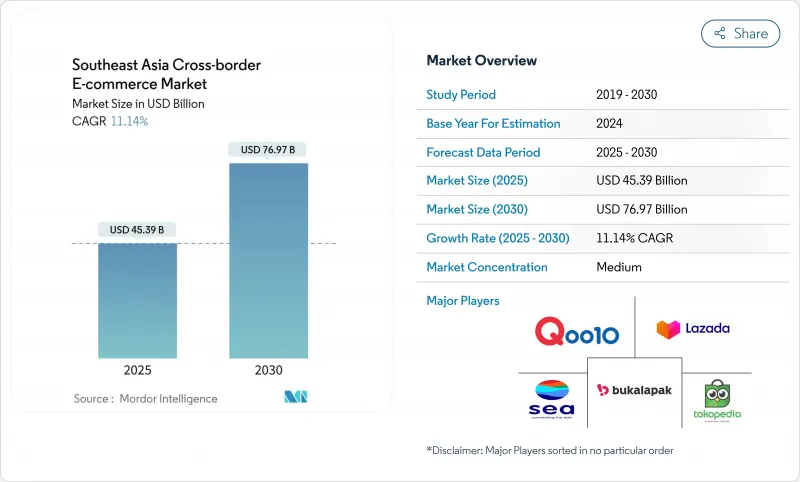

Southeast Asia Cross-border E-commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Southeast Asia cross-border e-commerce market size stands at USD 45.39 billion in 2025 and is forecast to reach USD 76.97 billion by 2030, reflecting an 11.14% CAGR.

Rising disposable incomes, a growing base of 402 million digital consumers, and a rapid pivot toward mobile-first shopping continue to underpin demand. Tariff concessions under the Regional Comprehensive Economic Partnership (RCEP) are lowering average landed costs for Chinese and Korean goods, intensifying competition in electronics and beauty lines. Domestic e-wallet super-apps now power 70% of checkout value, streamlining payments across borders and stimulating higher ticket sizes. Bonded-warehouse logistics, supported by ASEAN customs transit protocols, are cutting intra-regional delivery times to under three days, reinforcing buyer confidence and repeat purchase rates.

Southeast Asia Cross-border E-commerce Market Trends and Insights

Rapid Adoption of Domestic E-wallet Super-apps Driving Cross-border Payments

The proliferation of GrabPay, GCash, and MoMo is redefining checkout preferences across the Southeast Asia cross-border e-commerce market. Regional mobile-wallet users are projected to reach 2.6 billion by 2025, with transaction values climbing to USD 636 billion. Platform interoperability and QR-code standardization are lowering foreign-exchange friction, encouraging first-time cross-border purchases among the unbanked. In the Philippines, GCash has converted more than half of its active users into international shoppers, while Vietnam's MoMo continues to embed buy-now-pay-later micro-credit for higher-value imports. Elevated wallet penetration is closing the trust gap that once hindered regional sellers.

RCEP Tariff Reductions Reshaping Regional Trade Flows

Since 2024, average tariffs on Chinese and Korean origin goods have fallen by 4-8%, lifting trade volumes for electronics and beauty lines in the Southeast Asia cross-border e-commerce market. Merchants are funneling inventory through specialized hubs in Malaysia and Thailand, leveraging duty suspension zones to pre-position stock. Electronics brands report double-digit improvements in price competitiveness, and beauty labels are launching region-wide campaigns timed to tariff milestones. Customs harmonization remains uneven, yet collaborative frameworks under RCEP are gradually aligning documentation procedures to accelerate throughput.

Fragmented De Minimis Rules Creating Landed-Cost Opacity

In Southeast Asia's cross-border e-commerce market, varying thresholds muddle price transparency. Merchants grapple with multiple tax engines, leading to inflated operating costs and checkout confusion for shoppers. Indonesia's import VAT on low-value parcels dampens impulse purchases. While negotiations on the ASEAN Digital Economy Framework seek to standardize small-parcel rules, a consensus before 2026 seems improbable. Meanwhile, sellers are turning to landed-cost calculators and tailored promotions to navigate these regulatory challenges.

Other drivers and restraints analyzed in the detailed report include:

- Video-commerce Revolutionizing Consumer Engagement

- B2B2C Bonded-warehouse Model Transforming Regional Logistics

- High Reverse-Logistics Costs Hampering Profitability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The B2C segment continued leadership in the Southeast Asia cross-border e-commerce market. Familiar marketplace storefronts, localized language support, and integrated parcel-tracking sustain traffic growth, particularly among first-time buyers in Indonesia and Thailand. Cross-border order frequency has risen as younger demographics seek niche international labels unavailable offline.

Commercial procurement is gathering momentum. The B2B segment, though smaller, is on track for a 9.13% CAGR to 2030 as manufacturers in Vietnam and Thailand digitize sourcing. Simplified customs corridors under the ASEAN Customs Transit System now cut documentation by up to 50%, accelerating just-in-time inventory moves. Platform providers are layering trade-finance tools and verified supplier badges to raise trust levels. Collective purchasing among micro-enterprises further signals that the Southeast Asia cross-border e-commerce market is evolving beyond purely consumer transactions.

The Southeast Asia Cross-Border E-Commerce Market Report is Segmented by Business Model (B2C and B2B), by Product Category (Fashion and Apparel, Consumer Electronics and More), by Sales Channel (Online Marketplaces, Direct-To-Consumer and More) and by Country (Indonesia, Thailand, Vietnam, Philippines, Malaysia, Singapore and Rest of Southeast Asia). The Market Forecasts are Provided in Terms of Value (USD)

List of Companies Covered in this Report:

- Shopee (Sea Ltd)

- Lazada Group (Alibaba)

- Tokopedia (GoTo)

- Bukalapak

- Qoo10 Pte Ltd

- JD.com Inc (JD.ID)

- eBay Inc

- AliExpress

- Shopify Inc

- Blibli (PT Global Digital Niaga)

- Tiki Corp

- Zalora (Global Fashion Group)

- Carousell Pte Ltd

- Sendo Joint Stock Co

- SHEIN

- Temu (PDD Holdings)

- ezbuy (LightInTheBox)

- Wish (ContextLogic Inc)

- Global-e Online Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of domestic e-wallet super-apps across ASEAN (GrabPay, GCash, MoMo) fueling cross-border checkout

- 4.2.2 RCEP tariff phase-downs lowering average landed costs by 4-8 % for Chinese and Korean origin goods

- 4.2.3 Rise of video-commerce and live-streaming converting 15 % of social media GMV to cross-border sales

- 4.2.4 B2B2C bonded-warehouse model (e.g., Lazada's Malaysia Fulfilment Hub) cutting delivery lead-time to <3 days

- 4.2.5 Proliferation of BNPL providers (Kredivo, Atome) expanding ticket sizes among Gen-Z shoppers

- 4.2.6 ASEAN Customs Transit System (ACTS) enabling duty-suspended truck moves across CLMV corridor

- 4.3 Market Restraints

- 4.3.1 Fragmented de-minimis rules (USD 75-150) creating landed-cost opacity for merchants

- 4.3.2 High reverse-logistics costs; return rates more than 22 % in fashion cross-border flows

- 4.3.3 Patchy FX controls in Indonesia and Vietnam delaying seller payouts by up to 5 days

- 4.3.4 Social-commerce fraud incidents eroding trust in Tier-2/3 cities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook (AI personalisation, cross-border tax engines)

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact of Geo-Political Events on Cross-border Sales

5 Market Size and Growth Forecasts

- 5.1 By Business Model

- 5.1.1 B2C

- 5.1.2 B2B

- 5.2 By Product Category

- 5.2.1 Fashion and Apparel

- 5.2.2 Consumer Electronics

- 5.2.3 Home Appliances

- 5.2.4 Furniture

- 5.2.5 Beauty and Personal Care

- 5.2.6 Toys, Food and Others

- 5.2.7 Others

- 5.3 By Sales Channel

- 5.3.1 Online Marketplaces

- 5.3.2 Direct-to-Consumer (Webstores)

- 5.3.3 Social Commerce (Live, Chat)

- 5.4 By Country

- 5.4.1 Indonesia

- 5.4.2 Thailand

- 5.4.3 Vietnam

- 5.4.4 Philippines

- 5.4.5 Malaysia

- 5.4.6 Singapore

- 5.4.7 Rest of Southeast Asia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Shopee (Sea Ltd)

- 6.4.2 Lazada Group (Alibaba)

- 6.4.3 Tokopedia (GoTo)

- 6.4.4 Bukalapak

- 6.4.5 Qoo10 Pte Ltd

- 6.4.6 JD.com Inc (JD.ID)

- 6.4.7 eBay Inc

- 6.4.8 AliExpress

- 6.4.9 Shopify Inc

- 6.4.10 Blibli (PT Global Digital Niaga)

- 6.4.11 Tiki Corp

- 6.4.12 Zalora (Global Fashion Group)

- 6.4.13 Carousell Pte Ltd

- 6.4.14 Sendo Joint Stock Co

- 6.4.15 SHEIN

- 6.4.16 Temu (PDD Holdings)

- 6.4.17 ezbuy (LightInTheBox)

- 6.4.18 Wish (ContextLogic Inc)

- 6.4.19 Global-e Online Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment