Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1629797

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1629797

APAC Smart Office - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

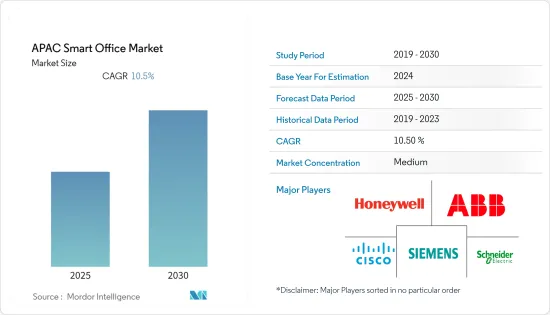

The APAC Smart Office Market is expected to register a CAGR of 10.5% during the forecast period.

Key Highlights

- Several progressions have accelerated smart office demand, driven by digital transformation and changing needs of all stakeholders. One of the drivers is the pandemic's impact on the future of work and the increased adoption of the hybrid work model. However, several existing drivers have grown in importance in the region, with dedicated, intelligent IoT solutions for various use cases.

- The market is witnessing various innovations catering to access cards, data security, and AI capabilities. For instance, in December 2020, SHARP Business Systems (India) Pvt. Ltd. launched an integrated package of workplace solutions designed to meet the needs of working professionals operating remotely in the COVID-19. Sharp offers high-end Digital Multifunctional Printers (MFPs) in both color and mono as part of the integrated deal, with contactless printing through access cards, data security, and AI capabilities such as voice assist and high-speed scanning to digitize documents.

- Also, various collaborations are witnessed in the region to ensure adherence to critical safety protocols such as capacity thresholds, mask-wearing, social distancing, and air quality. For instance, in May 2021, Infosys and RXR Realty partnered to create and deploy a comprehensive Smart Officeform solution that runs on Microsoft Azure. RxWell, a public-health-based, data-driven framework, offers health and wellness insights and management tools for property managers, tenant administrators, and office workers to aid in a safe return to work after a medical emergency.

- The market vendors are combining several data-driven and digitally-enabled services and solutions to improve work expertise and efficiency, realize the cost and energy savings, and add value to the office through apps for various stakeholders.

APAC Smart Office Market Trends

Security and Access Control to Witness Significant Growth

- The region is witnessing significant cloud adoption, and various market vendors are offering security and access control systems through cloud offerings. According to DSCI, In 2020, approximately 33% of cyber security companies surveyed with Indian founders used cloud-based integration models.

- Furthermore, the initiation of technically sophisticated smart card cards for various applications fuels security and access systems demand by providing a user-friendly and reliable service. Aside from that, various commercial establishments such as IT companies, enterprises, data centers are implementing access control systems to protect personnel and data breaches, to record employee's entry and exit timings.

- Over the forecast period, the demand and enterprise interest in Secure Access Service Edge (SASE) is expected to increase as the technology enables fast and secure cloud adoption and ensures that users and devices have access to data, applications, and services anywhere at any time.

- Also, Over the coming years, a significant share of enterprises are expected to adopt zero trust security to ensure the safety of the data over the company network, the numbers are expected to increase in post-pandemic scenarios where the enterprises invest in securing large number of remote workers. For instance, in April 2020, Google launched its Beyond Corp Remote Access product based on the Zero Trust approach.

China to Witness Significant Growth

- China is one of the fastest-growing countries in the Asia Pacific in terms of deployment of smart offices, primarily due to a rise in 5G penetration and robust internet infrastructure. Moreover, the growing working population is driving the demand for sustainable living, which can be achieved by smart office solutions.

- Furthermore, growth in cloud, industrial IoT is poised to drive the market's growth. As per GSMA, the number of industrial IoT devices is expected to be account for 13.8 billion by 2025, and China accounts for approximately 4.1 billion of these connections. Moreover, the initiatives are taken by the Chinese government, such as Made in China 2025, are expected to boost the demand for smart office solutions over the forecasted period.

- Smart fire and safety control systems are witnessing high demand to identify security leaks and leverage next-generation intelligent security solutions. Also, a seminar organized by Chubb Beijing and the Security Professionals Alliance of China witnessed the latest trends and breakthroughs in fire safety solutions. Moreover, companies are focusing on developing advanced integrated security management platforms. For instance, China Entropy offers an intensive converged fire-fighting platform for offices, which provides real-time information sharing.

- The exponential business growth is driving the demand for comfortable working solutions. This, in turn, is driving the development of innovative and diversified HVAC solutions. The Chinese government's electricity policies are driving the launch of smart HVAC products. The annual SH Shanghai & CIHE - Shanghai International Trade Fair for Heating, Ventilation, Air-conditioning, and Home Comfort System allows companies to display their latest heating innovations.

APAC Smart Office Industry Overview

The Asia Pacific Smart Office is moderately competitive in nature. Product launches, high expense on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition.

- May 2021 - Honeywell launched a cloud-based solution for building owners and managers that simplifies and combines operational and business data to back up better decision-making, drive greater efficiencies, and achieve sustainability goals.

- July 2020 - Siemens announced a smart office app, Comfy, to help employees return to work safely during the pandemic. Siemens also stated that the deployment would target approximately 600 company locations and lay the groundwork for future-proof digital workplaces and future-oriented working environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 56856

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Energy Efficient Solutions

- 5.1.2 Growing Need for Automation of Security Systems

- 5.2 Market Challenges

- 5.2.1 High Installation and Replacement Costs Along With Privacy Concerns

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Smart Office Lighting

- 6.1.2 Security and Access Control System

- 6.1.3 Energy Management System

- 6.1.4 Smart HVAC Control System

- 6.1.5 Audio-video Conferencing System

- 6.1.6 Fire and Safety Control System

- 6.2 By Building Type

- 6.2.1 Retrofits

- 6.2.2 New Buildings

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Australia

- 6.3.4 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Koninklijke Philips NV

- 7.1.2 Honeywell International Inc.

- 7.1.3 ABB Ltd

- 7.1.4 Schneider Electric SE

- 7.1.5 Siemens AG

- 7.1.6 United Technologies Corporation

- 7.1.7 Johnson Controls International PLC

- 7.1.8 Cisco Systems Inc.

- 7.1.9 Crestron Electronics Inc.

- 7.1.10 Lutron Electronics Co. Inc.

- 7.1.11 FogHorn Systems Inc.

- 7.1.12 Enlighted Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.