Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1629789

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1629789

South And Central America Oil Field Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 90 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

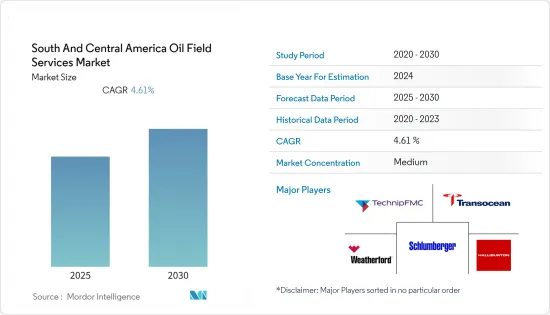

The South And Central America Oil Field Services Market is expected to register a CAGR of 4.61% during the forecast period.

Key Highlights

- Over the long term, factors such increasing number of offshore operations in the region and rising demand from unconventional hydrocarbons, like shale gas, etc, is expected to drive the market in the forecast period.

- On the other hand, as more renewable energy is used, the demand for hydrocarbons like natural gas to make electricity is expected to go down. This will slow the growth of the market during the forecast period.

- Nevertheless, shale oil and gas reserves have been discovered in Mexico and Argentina, and their exploitation is expected to create several opportunities for the South and Central American oil field services market in the future.

- Brazil is likely to see significant growth in the South and Central American oil field services market during the forecast period.

South and Central America Oil Field Services Market Trends

Drilling Services Expected to dominate the market

- Drilling is one of the most cost-intensive parts of the entire exploration and production (E&P) phase, and new wells are being drilled. Most estimates in the industry say that drilling costs more than 70% of the total cost of a well. Because of this, drilling services are expected to bring in a lot of money for the market.

- As the global demand for hydrocarbons has gone up and prices have gone up because of the conflict between Russia and Ukraine, most countries in the region are spending a lot of money drilling new wells to increase oil production and make more money from oil.The rig count in South and Central America increased from just 119 in January 2021 to 181 in February 2023.

- For instance, YPF, Argentina's state-run oil and gas producer, planned to invest USD 30 billion between 2018 and 2022. It wanted to increase hydrocarbon production by 5% per year until it reached 700,000 barrels of oil equivalent per day by 2022. The company planned to develop 29 projects and drill 1,600 wells. In January 2022, it was reported that Argentina's shale gas production witnessed a 42% YoY growth from January 2021, up to 69 million cubic meters per day.

- This is likely to open up new business opportunities for companies that make cooling systems. In September 2021, the government of Argentina passed a bill to encourage investment in hydrocarbons. The goal was to increase oil and gas exports and domestic production in the huge Vaca Muerta shale formation and elsewhere.

- Due to the above, the South and Central American oil field services market is expected to see a lot of growth in drilling services over the next few years.

Brazil Expected to See Significant Market Growth

- Due to its deep-water and ultra-deep-water activities in the Atlantic Ocean, Brazil is likely to have a large share of the market. Exploration and production have grown a lot between 2021 and 2022, which has led to more money being spent on oilfield services.

- The growth during the last year mainly came from the offshore sector. The increased spending on oilfield services can be related to increased drilling and completion practices, which are expected to drive the demand for cooling systems for hydraulic systems.

- Brazil has a number of large-scale offshore upstream projects in the works, and it is expected that by 2025, the country will produce more than 20% of the world's offshore crude oil and condensate. According to the BP Statistical Review of World Energy, Brazil's oil production in 2022 was 3,107 thousand barrels per day.

- The majority of the production is expected to come from the Pao de Acucar in the Campos basin and Carcara fields. With the commencement of production from these two fields, the demand for cooling systems in the upstream industry, as well as the midstream industry, is expected to increase significantly, driving the oilfield services market during the forecast period.

- Hence, owing to the above points, Brazil is likely going to see significant growth in the South and Central American oil field services market during the forecast period.

South and Central America Oil Field Services Industry Overview

The South and Central America oil field services market is moderately fragmented. Some of the key players in this market (in no particular order) include Schlumberger NV, Transocean LTD, Weatherford International plc, Halliburton Company, and TechnipFMC PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 56713

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Number of Offshore Operations

- 4.5.1.2 Demand Coming for Unconventional Energy Sources

- 4.5.2 Restraints

- 4.5.2.1 Demand for Renewable Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Service

- 5.1.1 Drilling Services

- 5.1.2 Completion Services

- 5.1.3 Production Equipment

- 5.1.4 Other Serivices

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 Mexico

- 5.3.2 Brazil

- 5.3.3 Argentina

- 5.3.4 Rest of The South and Central America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Key Companies Profile

- 6.3.1 Schlumberger NV

- 6.3.2 Transocean LTD.

- 6.3.3 Weatherford International plc

- 6.3.4 Halliburton Company

- 6.3.5 TechnipFMC PLC

- 6.3.6 COSL/Shs A Vtg 1.00 (China Oilfield Services Limited)

- 6.3.7 Saipem SpA

- 6.3.8 National-Oilwell Varco, Inc.

- 6.3.9 Superior Energy Services, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shale Oil and Gas Reserves in Mexico and Argentina

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.