Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628805

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628805

North America Image Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

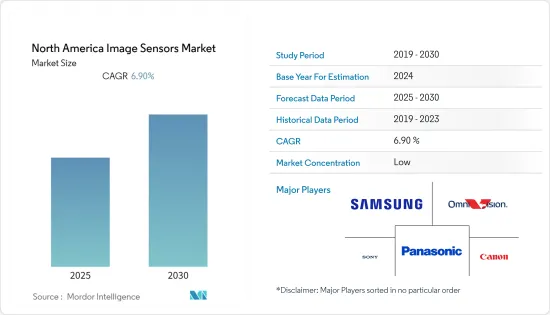

The North America Image Sensors Market is expected to register a CAGR of 6.9% during the forecast period.

Key Highlights

- Due to the growing demand for smartphones, security cameras, high-definition cameras, and camcorders, the image sensors market is expected to record a high growth rate during the forecast period. Manufacturers in the region have been striving to improve major parameters, such as resolution, performance, and pixel size.

- IC technology advancements have allowed the incorporation of previously independent functions by integrating sensors in the same chip. For example, a standard mobile phone has independent features, such as a camera, wireless connectivity, and music-playback capabilities. Now, all these functionalities are made available in a single device and have resulted in popularity, thus increasing the production volumes for image sensors, such as CMOS and CCD.

- In terms of consumer electronics, the smartphone has become the primary camera device, dominating still-cameras and DSLRs. Heavy competition in the smartphone segment has driven manufacturers to provide better cameras to have the edge over the competition, which has resulted in high investments in camera technology innovations in this field.

- Further, manufacturing firms in the region realize the benefits of machine vision systems, particularly in areas where redundant tasks, such as inspection, should be performed precisely. Industry 4.0 fueled the development of technologies, like robots playing a crucial role in industrial automation, with many core operations in industries managed by robots. Machine vision supports new applications, like vision-guided robotics, etc.

- Moreover, drones are widely used in North America to conduct surveys, and manufacturers are constantly looking for cameras that can capture images from altitudes. Cameras with higher megapixel resolution and small sensor sizes can be subject to image diffraction effects. Therefore, such disadvantages provide opportunities for the image sensor vendors in the market to introduce larger sensors that showcase better light-gathering ability at the same resolutions.

North America Image Sensors Market Trends

CMOS Image Sensor in Smartphone and Other Products to Witness Significant Growth

- CMOS image sensor technology, which several vendors are ramping, is sustaining its vigorous move into low-cost camera designs. Although often disparagingly compared to charge-coupled device (CCD) sensors with superior image quality at the same price, CMOS sensors are establishing a foothold at the low-cost end of the consumer market by offering more functions on-chip that simplify camera design.

- In March 2022, SmartSens, an advanced CMOS image sensor supplier, launched its first 50MP ultra-high-resolution 1.0μm pixel size image sensor product - SC550XS. The new product adopts the advanced 22nm HKMG Stack process and SmartSens' multiple proprietary technologies, including SmartClarity-2 technology, SFCPixel technology, and PixGain HDR technology, to enable excellent imaging performance. In addition, it can achieve 100% all pixel all-direction autofocus coverage via AllPix ADAF technology and is equipped with MIPI C-PHY 3.0Gsps high-speed data transmission interface. The product addresses the flagship smartphone's main camera requirements in night vision full-color imaging, high dynamic range, and low power consumption.

- Consumer electronics, automotive, security, and surveillance are all growing markets for CMOS image sensors. The rise of the consumer electronics sector has been spurred by the increasing popularity of smartphones with built-in front and rear cameras.

- Further, the expansion of the automotive application has been spurred by the innovation of self-driving automobiles and advancements in driver safety with the help of ADAS. The capacity of CMOS image sensors to work in various lighting conditions, including dim light, darkness, and low light, has raised the use of CMOS image sensors for security applications, bolstering the CMOS image sensor market for security and surveillance.

United States is Expected to Account for the Largest Market Share

- Image sensors are an integral part of consumer electronic products, such as smartphones, tablets, and wearables. The image sensors that are built in today's consumer electronic devices use either CCD or CMOS technology. With the growing adoption of such devices in the country, the demand for image sensors is expected to increase over the forecast period.

- Most CCD image sensors that have been developed for consumer applications possess the built-in anti-blooming capability, in contrast to most of the CCDs that have been specifically designed for industrial and scientific applications.

- Moreover, ON Semiconductor introduced a new 50-megapixel-resolution CCD image sensor. As the highest-resolution interline transfer CCD image sensor commercially available, the KAI-50140 provides the critical imaging detail and high image uniformity needed not only for the inspection of smartphone displays but also for circuit board and mechanical assembly inspection, as well as aerial surveillance. The KAI-50140 is designed in a 2.18-to-1 aspect ratio to match the format of modern smartphones, reducing the number of images captured to inspect a full display.

- Further, the region has also witnessed continuous consumer electronics sales growth over the past couple of years. The growing inclination towards purchasing various consumer electronics products is positively impacting the market as several products, including smartphones and tablets, are increasingly focusing on enhancing the image-capturing capabilities of these products.

North America Image Sensors Industry Overview

The North America Image Sensors Market is fragmented in nature due to intense competitive rivalry. Due to the high market growth rate, it is a significant investment opportunity, and therefore, new entrants are entering the market. Key players are Canon Inc., Samsung, Sony, etc.

- January 2022 - LUCID Vision Labs, Inc., a designer and manufacturer of unique and innovative industrial vision cameras, announced the launch of the new Atlas SWIR IP67-rated 1.3 MP and 0.3 MP cameras. The Atlas SWIR is a GigE PoE+ camera featuring wide-band and high-sensitivity Sony SenSWIR 1.3 MP IMX990 and 0.3 MP IMX991 InGaAs sensors, capable of capturing images across both visible and invisible light spectrums and boasting a miniaturized pixel size of 5μm.

- May 2021 - OMNIVISION Technologies, Inc., a significant developer of advanced digital imaging solutions, announced in advance of COMPUTEX Virtual the industry's first 1/7-inch, 2-megapixel image sensor, the OV02C, for full high definition (HD) video performance in thin bezel premium notebooks, tablets, and IoT devices. The sensor offers 60 frames per second (fps) and excellent pixel performance in the thinnest 3 mm module Y size for high screen-to-body ratio designs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 54763

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand in Automotive Sector

- 5.1.2 Low-Cost Availability of CMOS Image Sensors Deployed in Electronic Devices

- 5.1.3 Demand for Gesture Recognition/Control in Various Applications

- 5.2 Market Restraints

- 5.2.1 Space and Battery Consumption issues

- 5.2.2 High Manufacturing Costs and Increased Market Competition

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 CMOS

- 6.1.2 CCD

- 6.2 End-User Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Healthcare

- 6.2.3 Industrial

- 6.2.4 Security and Surveillance

- 6.2.5 Automotive and Transportation

- 6.2.6 Aerospace and Defense

- 6.2.7 Other End-user Industries

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Canon Inc.

- 7.1.2 Omnivision Technologies Inc.

- 7.1.3 Panasonic Corporation

- 7.1.4 Samsung Electronics Co. Ltd

- 7.1.5 Sony Corporation

- 7.1.6 STMicroelectronics N.V

- 7.1.7 Teledyne DALSA Inc.

- 7.1.8 Aptina Imaging Corporation

- 7.1.9 CMOSIS N.V.

- 7.1.10 ON Semiconductor Corporation

- 7.1.11 SK Hynix Inc.

8 INVESTMENTS ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.