Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628786

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628786

LA Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

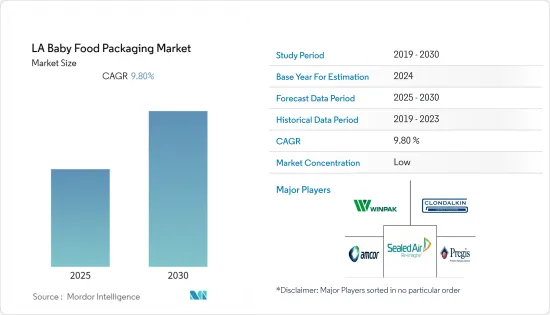

The LA Baby Food Packaging Market is expected to register a CAGR of 9.8% during the forecast period.

Key Highlights

- Glass jars remained the most common pack type in prepared baby food, dominating volume sales in the category once more in 2020 by a long way. The most popular pack sizes in 2020 remained 120g and 170g glass jars, as consumers still tend to prefer to purchase smaller pack sizes and to refresh their stocks regularly for their children, rather than keeping larger presentations for a longer time.

- Metal tins remain the main pack type to convey a premium image and for better storage, unlike dried baby food, which is increasingly being sold in flexible aluminum/plastic stand-up pouches, thus reducing unit prices.

- Dried baby food is projected to continue its decline in Latin America as consumers increasingly opt for other baby food products. Despite a brief revival expected in 2022, when the effects of the COVID-19 pandemic are expected to subside in Latin America, the already declining category will continue to register declining volume sales as other categories gain share.

Latin America Baby Food Packaging Market Trends

Plastic is Expected to Hold the Largest Market Share

- Plastics are a more efficient material for food packaging than other alternatives because plastics are energy efficient to manufacture, and they are also lighter than alternative materials.

- For instance, just two pounds of plastic can deliver 10 gallons of Liquid, i.e., milk, whereas three pounds of aluminum, eight pounds of steel, or over 40 pounds of glass are needed to deliver the same amount of Liquid.

- In the powder milk formula segment, the busy life of working parents has led to the launch of single-serve plastic sachets by various brands. Thus, this increases the importance of ready nutrition products and further boosts the market growth.

- With the expanding infant nutrition market, it is evident that nutritional product demand, such as milk, is increasing, and it is directly driving the baby food packaging market. It is also durable, and parents can carry them without hassle. Moreover, plastics are airtight, so the chances of getting stale are unlikely.

Brazil to Hold the Largest Market Share

- Brazil is the major market for these solutions in the region, followed by Mexico and Argentina in the Latin America region. Increasing consumer awareness and higher disposable income are the factors driving the demand for baby food packaging solutions.

- Latin America is one of the growing regions expected to capture a significant share of the global baby food packaging market during the forecast period. The Brazilian public is famous for searching product reviews on different platforms; furthermore, they are heavy users of social networks.

- As per the Brazilian Institute of Geography and Statistics, it is expected that the revenue of packaging manufacturing in Brazil will amount to approximately USD 6.9 billion by 2023. Further, there is a trend supporting premiumization in this market. Despite being price-sensitive, it follows eco-friendliness.

- Furthermore, newer acquisitions and contracts might add value to the market growth. Recently, Armor Protective Packaging announced that they welcomed the Orvic Brasil to the ARMOR global 'family.' ARMOR and Orvic have joined forces in a strategic partnership.

Latin America Baby Food Packaging Industry Overview

The baby food packaging market is highly fragmented, owing to the presence of many domestic and international players. The market is fragmented, with the players competing in terms of price, product design, product innovation, etc. Some of the major players in the market are Amcor Ltd, Pregis LLC, Sealed Air Corporation, Huhtamaki OYJ, Clondalkin Group Holdings BV, Winpak, among others.

- October 2021 - Gualapack Spa announced its plans for expansion in Brazil as part of the Group's continued efforts for sustainable, global growth through vertical integration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 54226

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Assessment of Impact of COVID-19 on the Industry

- 4.3 Market Drivers

- 4.3.1 Growing Demand of Packaged Baby Food and Infant Formula

- 4.3.2 Increasing Working Women in Urban Areas residing Population

- 4.4 Market Restraints

- 4.4.1 Stringent Government Regulations over Single-Use Plastic-based Packaging

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Metal Cans

- 5.2.3 Cartons

- 5.2.4 Jars

- 5.2.5 Pouches

- 5.2.6 Other Packaging Type

- 5.3 By Product

- 5.3.1 Liquid Milk Formula

- 5.3.2 Dried Baby Food

- 5.3.3 Powder Milk Formula

- 5.3.4 Prepared Baby Food

- 5.4 By Country

- 5.4.1 Brazil

- 5.4.2 Mexico

- 5.4.3 Argentina

- 5.4.4 Rest of Latin America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Ltd.

- 6.1.2 Sonoco Products Company

- 6.1.3 Mondi Group

- 6.1.4 Berry Global Inc.

- 6.1.5 Rexam PLC

- 6.1.6 Winpak Ltd.

- 6.1.7 AptarGroup

- 6.1.8 Silghan Holding Inc.

- 6.1.9 CAN-PACK S.A.

- 6.1.10 Tetra Laval

- 6.1.11 DS Smith Plc

- 6.1.12 Coldalkin Group Holdings BV

- 6.1.13 Pregis LLC

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.