Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628768

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628768

Asia Pacific Retail Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 120 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

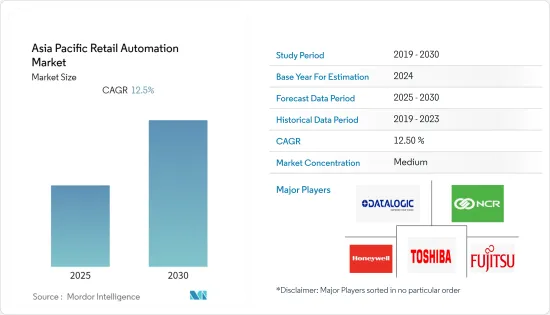

The Asia Pacific Retail Automation Market is expected to register a CAGR of 12.5% during the forecast period.

Key Highlights

- In developing countries across the Asia Pacific, the number of physical stores is gradually expanding. The majority of people choose to buy daily-basis items from stores since they are convenient. As a result, despite the expansion of e-commerce, some visitors still prefer to shop in physical stores. The retail industry's increasing technologies will have an impact on bringing more people into physical locations. The advantages of automated technologies have prompted businesses to incorporate them into physical storefronts. As a result, the retail automation market for in-stores is expected to develop in the future years.

- Automation has become more common in the retail sector as a result of technological improvements. The advantages of automated retail have raised awareness of the benefits of automation in retail operations, such as purchase/sales services, inventory optimization, inventory optimization, and others, all of which are projected to fuel market growth. For instance, automated guided vehicles are used in warehouses to conduct heavy-lifting duties because they can operate continuously and complete repetitive tasks with the same efficiency and accuracy. As a result, the rise of autonomous guided vehicles (AGV) and other technologies in the retail business has encouraged automation adoption in the Asia Pacific.

- The food and non-food segment are considered an essential industry vertical in the retail automation market. This is due to tremendous improvement in the food and beverage business, increasing the number of restaurants, cafeterias, and franchisees. Non-food services, on the other hand, are progressing as many retail suppliers seek solutions for logistics, in-store support, product inspections, and promotional planning, which is positively impacting the retail automation market.

- COVID-19 pushed retailers to invest in automation technology (such as automated inventory management, robotic picking, analytics reporting, and so on) to improve operational efficiency and lower labor expenses. For instance, when compared to manually picking things off store shelves, the application of deep learning and robots provides significant time and cost savings. Now that the COVID-19 pandemic has sparked a surge in demand for online shopping, supermarket stores want to protect their employees while meeting customers' continuous desire for quick delivery.

APAC Retail Automation Market Trends

Significant Upsurge in E-commerce Sector

- The rise of e-commerce and the need for quick distribution of goods to obtain a competitive advantage has resulted in a tremendous demand for retail automation products such as Barcode Reader, Card Reader, Kiosks, Self-Checkout Systems, etc. As a result, prominent retail automation providers have a significant chance to develop digital solutions to improve old operations.

- For instance, Datalogic S.p.A. has decided to invest in "AWM Smart Shelf," a computer vision and artificial intelligence firm situated in California. This initiative intends to keep up with developing trends in cashierless/autonomous checkout, consumer demographics and behavior tracking, automated inventory intelligence, and a Retail Analytics Engine (RAE) for in-store analytics and reporting. The focus is more especially on Frictionless Shopping along with Automated Inventory Solutions, two increasingly crucial areas for improving customer convenience on the one hand and store efficiency on the other.

- Moreover, as an alternative to in-house fulfillment, many retail businesses have turned to third-party logistics providers (3PLs) to meet their online needs. As real-time tracking and tracing become the new standard, retail automation products are projected to expand in popularity in the logistics business.

Increasing Demand for Handheld Barcode Readers

- Increasing demand for handheld barcode readers/ scanners across various industry verticals includes transportation and logistics, warehouse, healthcare, hospitality, oil and gas, etc., is one of the key trends in the retail automation market in the Asia Pacific. For instance, Inventory management and asset tracking are made easier using handheld barcode readers/scanners. Handheld barcode readers/scanners are often small and lightweight, making them ideal for covering large areas at end-users like warehouses.

- Moreover, handheld barcode readers are less expensive than fixed barcode readers/ scanners. Various retailing companies like Wal-Mart Stores, Tesco, Carrefour, and Metro have embraced handheld barcode readers/ scanners. Handheld barcode readers/scanners are versatile, reading and scanning both one-dimensional and two-dimensional barcodes. Businesses can save money on upkeep because of the device. Due to the device's low cost, even small companies may readily adopt and upgrade to a current asset and inventory management system.

- Handheld barcode readers/scanners can now be readily connected to iOS or Android-based mobile devices such as tablets, smartphones, and laptops. This makes data handling easier for the device by allowing it to scan and store real-time data.

APAC Retail Automation Industry Overview

Asia Pacific Retail Automation Market is partially fragmented. Some of the major players in the market are Fujitsu Ltd., Toshiba Corporation, Seiko Epson Corporation, Honeywell International Inc., NCR Corporation, Datalogic S.P.A. Recent Developments made in this sector are:

- In July 2021, Epson introduced the "OmniLink TM-T88VII" fastest POS receipt printer, which offers lightning-fast print speeds and flexible connectivity between multiple devices to help merchants - especially in high-volume industries like retail, hospitality, and grocery - deliver the best customer experience in virtually any environment.

- In August 2020, Toshiba Corporation released "ScanSure," a new barcode solution for manufacturers in various industries that allows them to assess the readability and accuracy of printed barcodes. The new product, ScanSure, was created expressly to answer client demands for a dependable label validation solution that is also simple and intuitive to use.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 53614

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of COVID-19 impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing retail stores

- 5.1.2 Increase in the adoption of digitization across retail sector

- 5.2 Market Restraints

- 5.2.1 At unattended terminals, there is a risk of theft

6 MARKET SEGMENTATION

- 6.1 Product Type

- 6.1.1 Point-of-Sale Systems Requiring Manual Intervention

- 6.1.2 Unattended Terminals

- 6.2 Product

- 6.2.1 Barcode reader

- 6.2.2 Weighing scale

- 6.2.3 Currency Counter

- 6.2.4 Bill Printer

- 6.2.5 Cash Register

- 6.2.6 Card Reader

- 6.2.7 Kiosks

- 6.2.8 Self-Checkout Systems

- 6.2.9 Others

- 6.3 End-user Application

- 6.3.1 Food/Non-Food

- 6.3.2 Oil and Gas

- 6.3.3 Transportation and Logistics

- 6.3.4 Health and Personal Care

- 6.3.5 Hospitality

- 6.3.6 Others

- 6.4 Country

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Datalogic S.p.A.

- 7.1.2 Diebold Nixdorf

- 7.1.3 Fiserv, Inc.

- 7.1.4 Fujitsu Limited

- 7.1.5 Honeywell International Inc.

- 7.1.6 KUKA AG

- 7.1.7 NCR Corporation

- 7.1.8 Seiko Epson Corporation

- 7.1.9 Toshiba Global Commerce Solutions

- 7.1.10 Zebra Technologies

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.