PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628751

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1628751

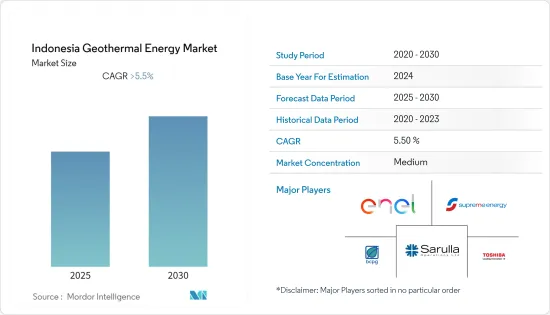

Indonesia Geothermal Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Indonesia Geothermal Energy Market is expected to register a CAGR of greater than 5.5% during the forecast period.

COVID-19 had a detrimental effect on the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, the primary driver for the market will be the government's efforts to reduce the country's dependency on fossil fuels and thereby reduce CO2 emissions. Increasing electricity demand is likely to drive the market during the forecast period.

- On the other hand, geothermal energy is more expensive than power from fossil fuels, and there is more competition from other renewable energy sources, like solar and wind, which is expected to slow market growth during the forecast period.

Nevertheless, with an estimated population of 296 million and an increased urbanization rate of 71% by 2030, electricity demand is expected to grow. The Indonesian government wants to cut CO2 emissions by 29% by 2030. This is most likely to be done by increasing the use of renewable energy to meet the growing electricity demand. This is likely to give the geothermal market a chance to grow in the near future.

Indonesia Geothermal Energy Market Trends

Increasing Demand for Electricity is Likely to Drive the Market

- Indonesia's need for electricity has grown over the years as the country's population and cities have grown. In 2021, the electricity consumption in Indonesia accounted for 168.38 million BOE (barrel oil equivalent).

- In 2021, the total electricity consumption of the household sector in Indonesia was nearly 70,289 thousand BOE. Households consumed the highest percentage of electricity, with almost 41.7% of the total electricity consumed.

- It is estimated that the household electricity demand in Indonesia is likely to increase to 350 TWh. In contrast, demand in the industrial and commercial sectors is expected to rise to about 80 TWh and 70 TWh, respectively.

- The use of electronic appliances in the household sector is expected to be the primary driver of the increase in electricity consumption. In contrast, the metal, chemical, food, and textile industries are expected to be the major drivers for industrial electricity consumption.

With a growing population, Indonesian households will likely grow to almost 80 million by 2050. This will likely increase the amount of electricity used in the coming years. Geothermal energy as a possible source of electricity is expected to grow over the next few years because the government is trying to increase the amount of electricity made from renewable energy.

Upcoming Coal Fired Power Plant is Likely to Restrict the Market Growth

- In 2021, Indonesia's power plant installed capacity increased to nearly 74,532.94 MW, which was around 72,750.73 MW compared to the capacity in 2020. With a total installed capacity of about 51.8%, steam power plants dominated the power plant industry in 2021.

- In 2021, primary energy consumption by fuel accounted for 8.31 exajoules, which were generated from 39% coal, 16% natural gas, 34% oil, and 7.5% renewables.

- The country has a high reliance on coal-based power plants; thus, there are plans to build new coal power plants with existing coal power plants in operation. In 2021, energy consumption from coal accounted for 87.82 million BOE (barrel oil equivalent).

- In November 2022, the Indonesian government permitted the building new coal plants that had already been bid out and had a total capacity of 13 gigawatts. The country's 10-year energy plan for 2021-2030 lays out the strategy. Notably, President Joko Widodo signed legislation into law in 2022, allowing the development of "captive coal plants."

- Increasing the capacity of coal-fired power plants is expected to make up a big part of how electricity is made. It will likely meet most of the growing demand for electricity over the next few years. This is expected to slow the growth of the country's geothermal energy and other renewable sources.

Indonesia Geothermal Energy Industry Overview

The Indonesia geothermal energy market is moderately consolidated. Some of the key players in the market ( not in particular order ) include Enal SpA, Toshiba Energy Systems & Solutions Corporation, BCPG Public Company Limited, PT Supreme Energy, and Sarulla Operations Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in MW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 COMPETITIVE LANDSCAPE

- 5.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 5.2 Strategies Adopted by Leading Players

- 5.3 Company Profiles

- 5.3.1 Enal SpA

- 5.3.2 Toshiba Energy Systems & Solutions Corporation

- 5.3.3 BCPG Public Company Limited

- 5.3.4 PT Supreme Energy

- 5.3.5 Sarulla Operations Ltd.

6 MARKET OPPORTUNITIES AND FUTURE TRENDS